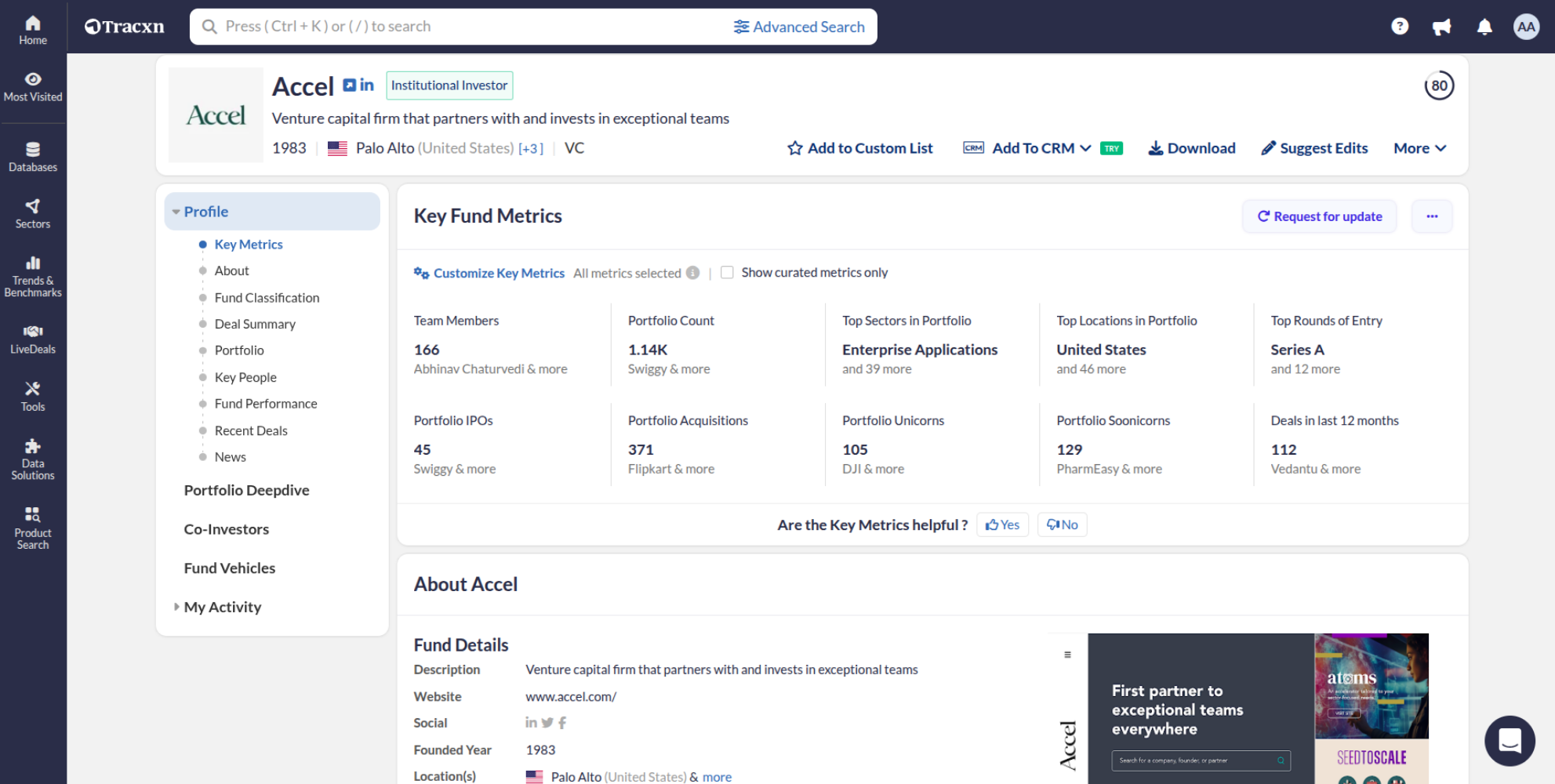

Analyze team leadership and co-investment network

Validate the fund's leadership and identify reliable co-investment partners for future deals.

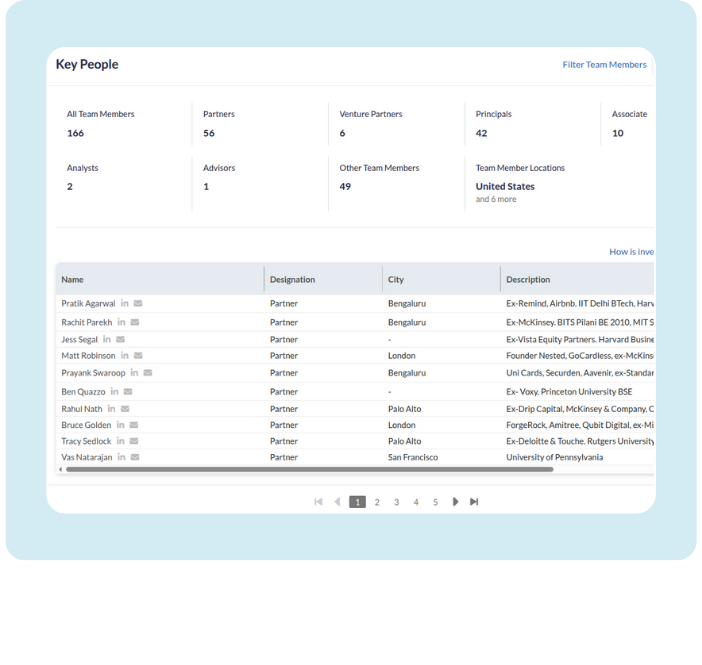

Key personnel deep dive

Assess the fund’s capabilities by reviewing detailed profiles of Partners, Venture Partners, and Principals, including their background.

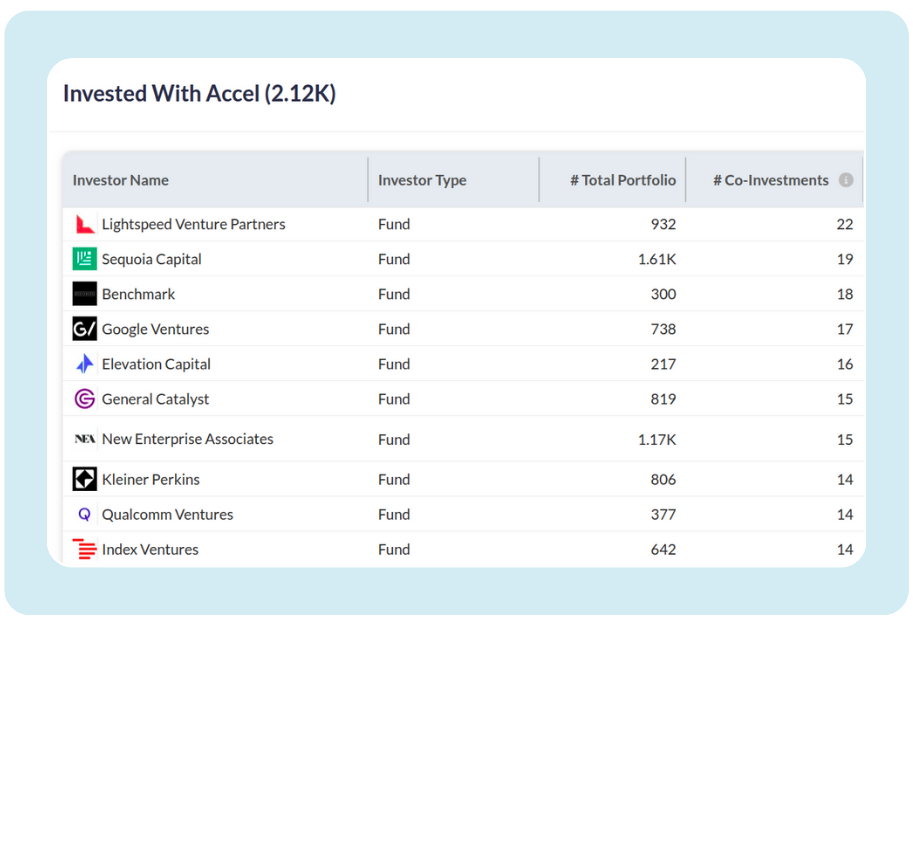

Map current Co-Investors

Identify reliable co-investment partners by seeing which major investors have co-invested with the target fund most frequently.

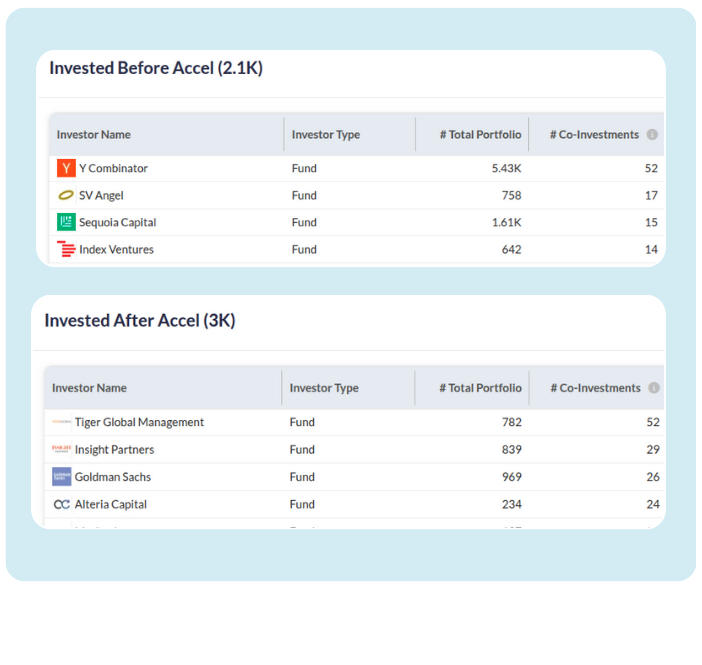

Who invested before & after

Discover investors who joined a company's funding rounds either before or after the target fund, validating deal quality and identifying next-round partners.

Key personnel deep dive

Assess the fund’s capabilities by reviewing detailed profiles of Partners, Venture Partners, and Principals, including their background.

Map current Co-Investors

Identify reliable co-investment partners by seeing which major investors have co-invested with the target fund most frequently.

Who invested before & after

Discover investors who joined a company's funding rounds either before or after the target fund, validating deal quality and identifying next-round partners.

.svg)

.png)