Tracxn has released its Europe Tech ecosystem insights for 2025, outlining funding activity, sector performance, deal-making, and investor participation across the region. The data highlights a shift in capital deployment across stages, strong late-stage momentum, continued mega funding activity, and active exit markets through acquisitions and IPOs within the European technology landscape.

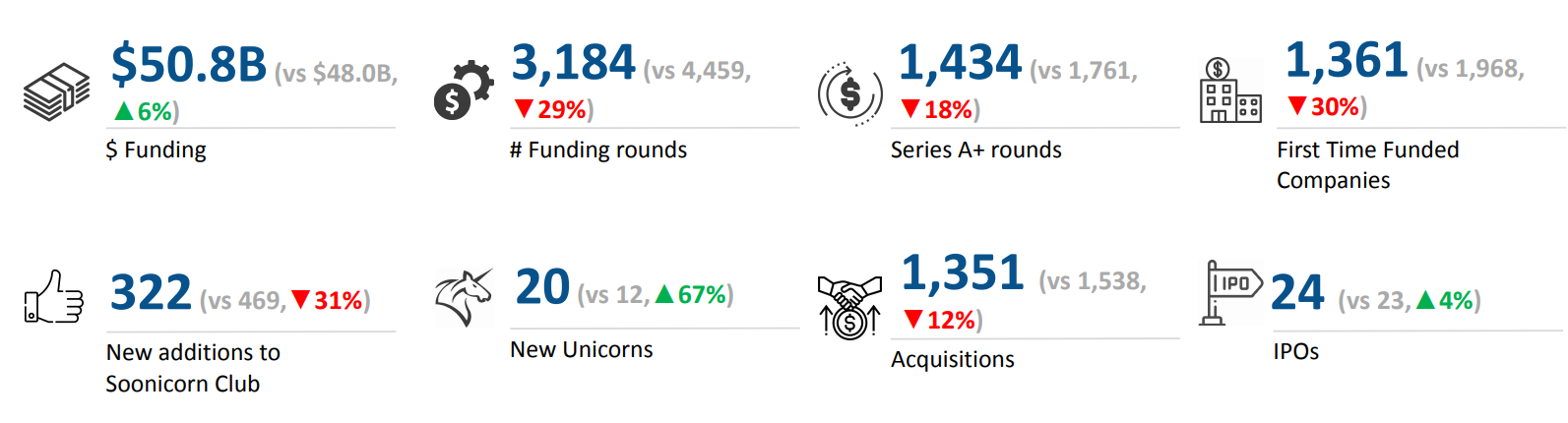

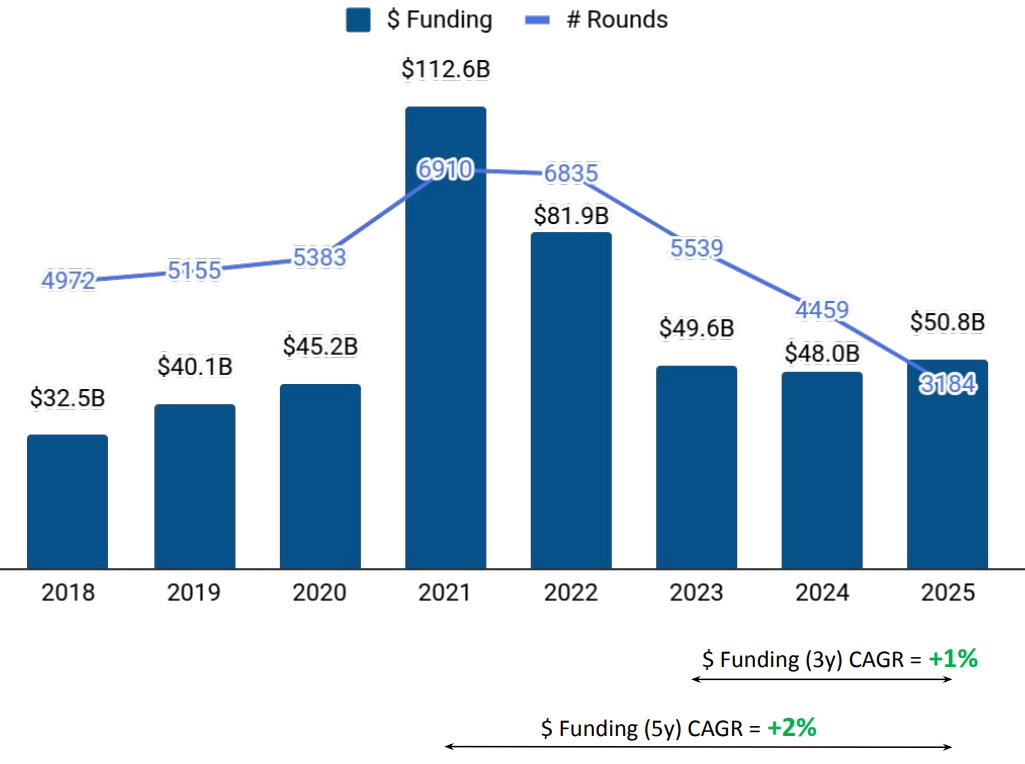

A total of $50.8B was raised by Europe Tech companies in 2025, representing a 6% increase compared to $48B raised in 2024 and a 2% rise compared to $49.6B raised in 2023. Overall funding growth was supported by increased late-stage capital deployment, even as early-stage activity moderated compared to previous years.

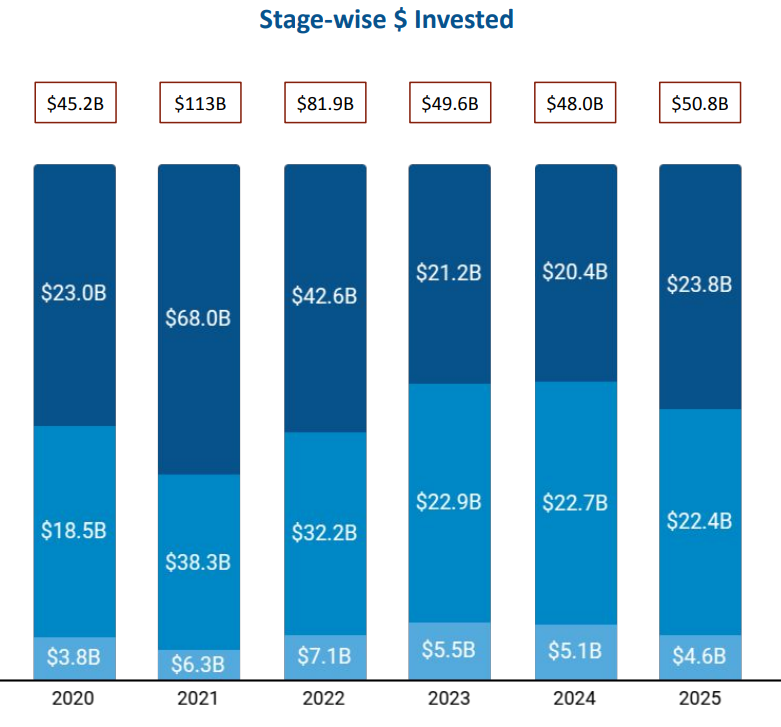

Seed-stage startups in Europe raised $4.6B in 2025, marking a 9% decline from $5.1B in 2024 and a 16% drop from $5.5B in 2023. Early-stage funding totaled $22.4B, slightly lower with a 1% decrease from $22.7B in 2024 and a 2% decrease from $22.9B in 2023. In contrast, late-stage funding reached $23.8B in 2025, reflecting a 17% increase compared to $20.4B in 2024 and a 12% rise compared to $21.2B in 2023, making late-stage investments the largest contributor to total funding during the year.

Enterprise Applications, FinTech, and Life Sciences were the top-performing sectors in 2025 within the Europe Tech ecosystem. The Enterprise Applications sector raised $23.6B, an increase of 30% from $18.1B in 2024 and 26% from $18.6B in 2023. The FinTech sector secured $8.1B, representing a 10% decrease from $9B in 2024 and a 22% decrease from $10.4B in 2023. Life Sciences funding reached $7.9B, up 10% from $7.2B in 2024 and 32% from $5.9B in 2023.

Europe Tech recorded 4 mega funding rounds in 2025, the same number as in 2024 and higher than the 3 rounds in 2023. Companies such as Binance, Mistral AI, and Nscale raised substantial capital through these rounds. Binance raised $2B through a Series C round, Mistral AI raised $2B through a Series C round, and Nscale raised $1.1B through a Series B round. A major portion of mega funding rounds originated from Enterprise Applications, FinTech, and Enterprise Infrastructure.

The year also saw the creation of 20 unicorns, compared to 12 in 2024 and 10 in 2023. On the public markets front, Europe Tech recorded 24 IPOs in 2025, up 4% from 23 IPOs in 2024, but down 20% from 30 IPOs in 2023. Prolight Diagnostics, Coffee Stain, and TeraView were among the companies that went public during the year.

Tech companies in Europe completed 1,351 acquisitions in 2025, reflecting a 12% decline from 1,538 acquisitions in 2024 and a 13% drop from 1,555 acquisitions in 2023. The largest transaction of the year was Worldpay’s acquisition by Global Payments for $24.3B, making it the highest-valued acquisition in 2025. This was followed by Merck’s acquisition of Verona Pharma for $10B.

Funding activity in 2025 was concentrated in key European hubs, with London-based tech firms accounting for 24% of total funding across Europe. Paris followed as the second-largest hub, contributing 10% of the total funding raised by European tech companies during the year.

Investor participation remained strong across stages in the Europe Tech ecosystem. Y Combinator, HTGF, and Kima Ventures emerged as the top seed-stage investors in 2025. At the early stage, Creandum, Google Ventures, and BGF were the most active investors. Durable Capital Partners, DST Global, and Sofina led late-stage investments, backing some of the largest funding rounds in the ecosystem.

The Europe Tech ecosystem recorded $50.8B in funding in 2025, supported by a strong rise in late-stage investments and sustained mega funding activity. While seed and early-stage funding declined compared to previous years, the growth in Enterprise Applications and Life Sciences, along with continued FinTech investment, shaped sector performance. Unicorn creation increased significantly, IPO activity remained active, and acquisitions continued at scale, led by multi-billion-dollar transactions, positioning Europe as an active and diverse technology investment landscape in 2025.