Tracxn has released its Quantum Computing Report 2025, offering a data-driven view of the global quantum computing ecosystem across startups, capital flows, unicorn creation, acquisitions, and investor participation. As of December 2025, the ecosystem comprises 762 startups spanning hardware and enabling technologies, software, Quantum-as-a-Service (QaaS), and applications. While startup formation remains broad-based, capital deployment is highly uneven, with funding increasingly concentrated among a small number of deeply capitalized platforms.

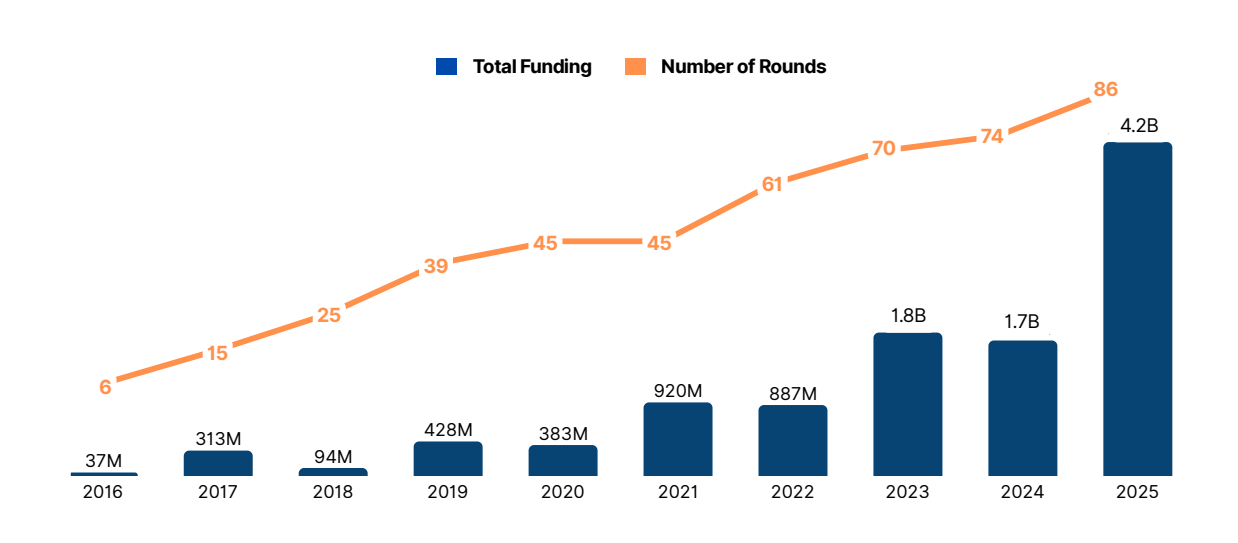

The global quantum computing sector has raised $11.1B in all-time funding across 492 rounds, exhibiting distinct phases of capital intensification. After an initial period of exploratory growth where annual funding fluctuated between $37M and $428M (2016–2020), the sector established a higher baseline in 2021 and 2022, creating a plateau of approximately $900M annually. This momentum shifted structurally from 2023 onward, as capital deployment accelerated sharply to $1.8B in 2023 and $1.7B in 2024, culminating in a record-breaking $4.2B in 2025—a figure driven by high-conviction infrastructure bets rather than broad speculative volume.

As of 2025, funding spans 245 Seed rounds, 213 Early-Stage rounds, and only 34 Late-Stage rounds, reflecting a broad experimentation funnel that narrows sharply at the scale-up phase. Seed and early-stage rounds include transactions such as Silicon Quantum Computing’s $83M Seed, SandboxAQ’s $500M and $300M Series A, and IQM’s $320M Series B, while late-stage capital remains limited in count but highly concentrated, led by PsiQuantum’s $1B and $614M Series E rounds and Quantinuum’s $839M Series E, underscoring the steep technical and capital thresholds required to reach platform scale.

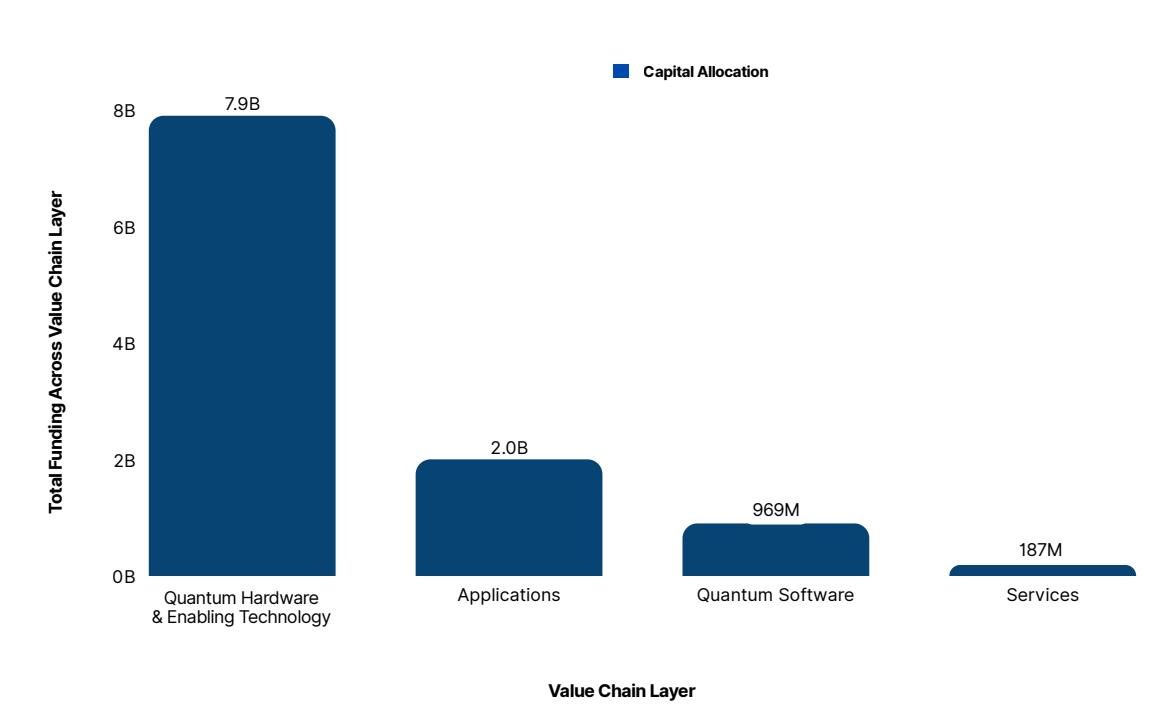

Capital allocation across the quantum value chain is decisively infrastructure-led. Hardware and enabling technologies have absorbed $7.9B of total funding, far exceeding investment in applications ($2B), software ($969M), and services ($187M). While applications account for the largest share of startups at 35% versus 33% for hardware, the funding skew highlights a structurally lower capital intensity at the application layer and a market still governed by foundational system readiness rather than downstream demand alone.

The quantum computing ecosystem has recorded 24 mega rounds ($100M+), led by infrastructure-scale financings such as PsiQuantum’s $1B Series E, Quantinuum’s $839M Series E, and SandboxAQ’s $500M Series A, underscoring the concentration of capital in a small set of late-stage platforms. Unicorn creation remains limited to 5 companies, highlighting that only a narrow cohort has crossed the combined technical, capital-intensity, and scale thresholds required to achieve sustained investor conviction.

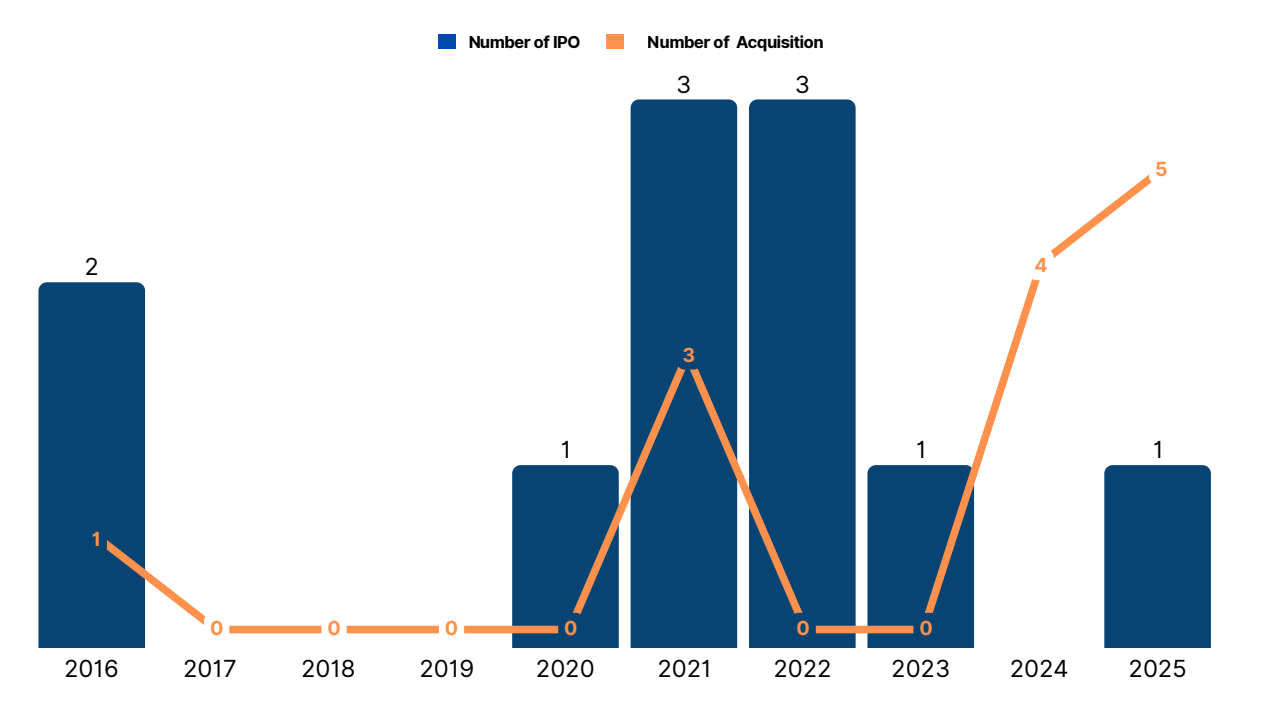

Exit activity remains selective, with 13 acquisitions and 12 IPOs to date, but 2025 marked a record high in acquisitions with five transactions, signaling the onset of strategic consolidation as scaled platforms pursue capability expansion. In contrast, IPO activity has moderated and remains confined to a small set of hardware, security, and full-stack companies with clearer commercialization trajectories, underscoring that liquidity is emerging first through acquisitions rather than public listings.

Funding concentration remains geographically clustered, with the United States dominating global quantum investment. Palo Alto has emerged as the leading hub, securing $3.3B in total funding to date, driven primarily by mega rounds for platforms such as PsiQuantum and SandboxAQ, reinforcing a US-centric capital model anchored in hyperscaler proximity and deep-tech infrastructure. In 2025 alone, Palo Alto captured $1.2B across four rounds, led by PsiQuantum’s $1B Series E, underscoring continued late-stage capital re-concentration around a small number of scale candidates.

Approximately 502 venture capital firms have invested in quantum computing startups to date. Quantonation is the most active investor with 36 rounds, followed by HTGF (13 rounds) and In-Q-Tel (12 rounds), reflecting sustained participation across seed, early, and late-stage funding rounds.

The global quantum computing ecosystem in 2025 YTD is characterized by broad startup formation alongside concentrated capital deployment. Funding has reached $11.1B, driven largely by late-stage mega rounds and a small cohort of deeply capitalized platforms. Hardware and enabling technologies dominate capital allocation, while unicorn creation remains limited to five companies. Acquisition and IPO activity continues at a measured pace, reflecting the long-horizon nature of quantum commercialization.