Tracxn has released its insights on the Karnataka tech ecosystem for the year 2025, outlining funding activity, sector performance, exits, and investor participation during the period. The data highlights notable shifts across funding stages, sector-wise capital allocation, and exit activity, offering a detailed view of how tech companies in Karnataka performed in 2025 compared to previous years.

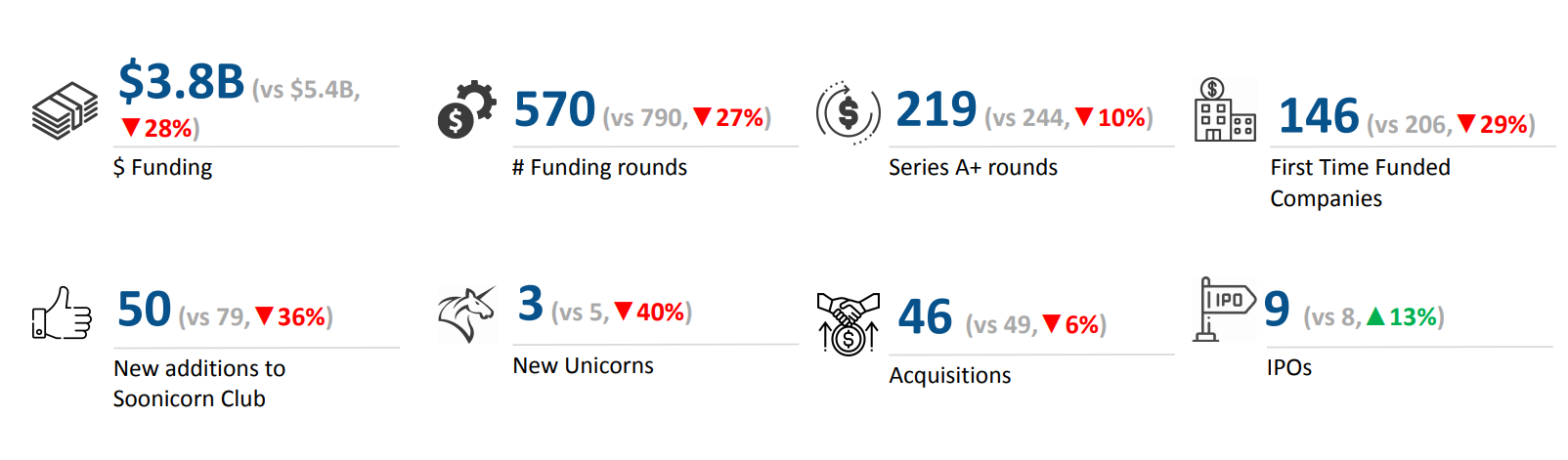

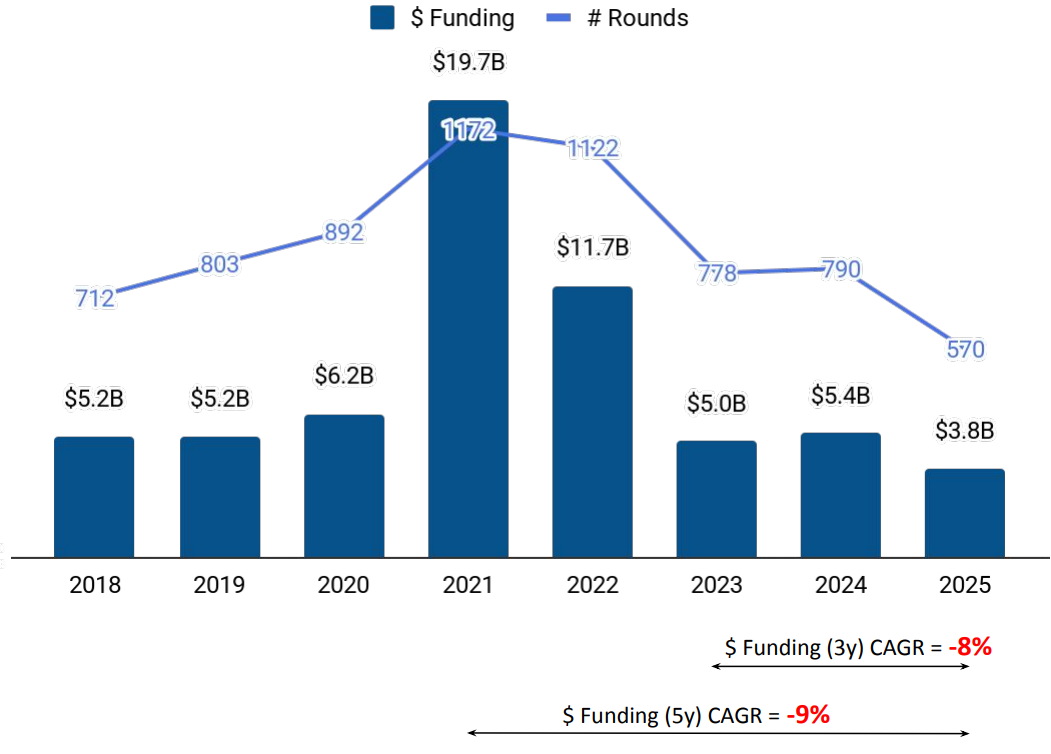

A total of $3.8B was raised by Karnataka-based tech companies in 2025, representing a drop of 28% compared to the $5.4B raised in 2024 and a decline of 23% from the $5.0B raised in 2023. While overall funding levels were lower than in the preceding two years, capital deployment patterns varied significantly across stages, with early-stage funding showing growth even as late-stage investments contracted sharply.

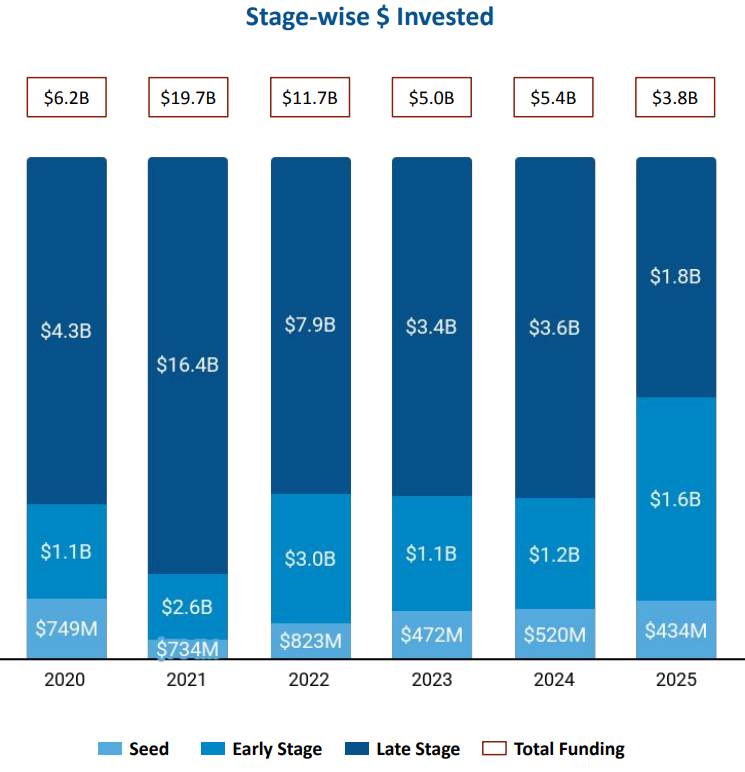

Seed-stage companies in Karnataka raised a total of $434M in 2025, marking a 17% decrease from the $520M raised in 2024 and an 8% decline compared to the $472M raised in 2023. Early-stage funding stood out in 2025, with startups raising $1.6B, an increase of 32% over the $1.2B raised in 2024 and a 37% rise from the $1.1B raised in 2023. Late-stage funding, however, witnessed a significant pullback, with companies raising $1.8B in 2025, a 50% drop from the $3.6B raised in 2024 and a 46% decline compared to the $3.4B raised in 2023.

Enterprise Applications, FinTech, and Retail were the top-performing sectors in Karnataka’s tech ecosystem in 2025. The Enterprise Applications sector recorded total funding of $1.1B in 2025, remaining in line with 2024 levels and reflecting an 11% decrease compared to the $1.3B raised in 2023. FinTech companies raised $1.0B during the year, representing a 47% increase over the $681M raised in 2024, while remaining 13% lower than the $1.2B raised in 2023. Retail tech startups attracted $920M in funding in 2025, which was 36% lower than the $1.4B raised in 2024 and 51% below the $1.9B raised in 2023.

Karnataka recorded three $100M+ funding rounds in 2025, compared to nine such rounds in both 2024 and 2023. Companies such as Zepto, Groww, and Jumbotail raised more than $100M during the year, with Zepto securing $300M in a Series H round, Groww raising $202M through a Series F round, and Jumbotail raising $120M in a Series D round. A major share of the $100M+ funding rounds during the year came from Food and Agriculture Tech, FinTech, and Retail sectors.

The ecosystem also saw three unicorns created in 2025, a 40% decline from the five unicorns added in 2024, while marking a 200% increase compared to the single unicorn created in 2023. On the public markets front, Karnataka tech companies recorded nine IPOs in 2025, up 13% from eight IPOs in 2024 and up 200% from three IPOs in 2023, with Groww, Meesho, and Ather Energy among the companies that went public during the year.

Tech companies in Karnataka completed 46 acquisitions in 2025, representing a 6% decline from the 49 acquisitions recorded in 2024, while marking a 10% increase compared to the 42 acquisitions completed in 2023. The largest acquisition of the year was Groww’s acquisition of Fisdom for $150M, making it the highest-valued deal in 2025. This was followed by ICRA’s acquisition of Fintellix at a transaction value of $26.0M.

Bengaluru-based tech firms accounted for nearly 100% of all funding raised by tech companies across Karnataka in 2025, reinforcing the city’s central role in the state’s tech funding landscape and its dominance in attracting venture capital investments during the year.

Investor participation in the Karnataka tech ecosystem remained active across stages in 2025. Antler, Rainmatter, and Inflection Point Ventures emerged as the top seed-stage investors during the year. At the early stage, Peak XV Partners, Accel, and Elevation Capital were the most active investors in the ecosystem. Late-stage funding activity was led by Sofina, SoftBank Vision Fund, and Think Investments, which were the top investors supporting mature tech companies in Karnataka in 2025.

The Karnataka tech ecosystem raised $3.8B in 2025, reflecting a more subdued funding landscape compared to the previous two years, largely due to a slowdown in late-stage investments. Early-stage funding, however, demonstrated strong momentum, while Enterprise Applications, FinTech, and Retail remained the leading sectors by capital deployment. Exit activity remained active, with multiple public listings and a steady pace of acquisitions. Bengaluru-based startups continued to dominate the ecosystem, accounting for nearly all funding raised across the state.