Tracxn has released its insights on the Spain Tech ecosystem for 2025, highlighting funding activity, stage-wise trends, sector performance, deal flow, and investor participation during the year. The data reflects shifts in capital allocation across funding stages, large-deal activity, and continued momentum in acquisitions and public listings within the Spanish tech landscape.

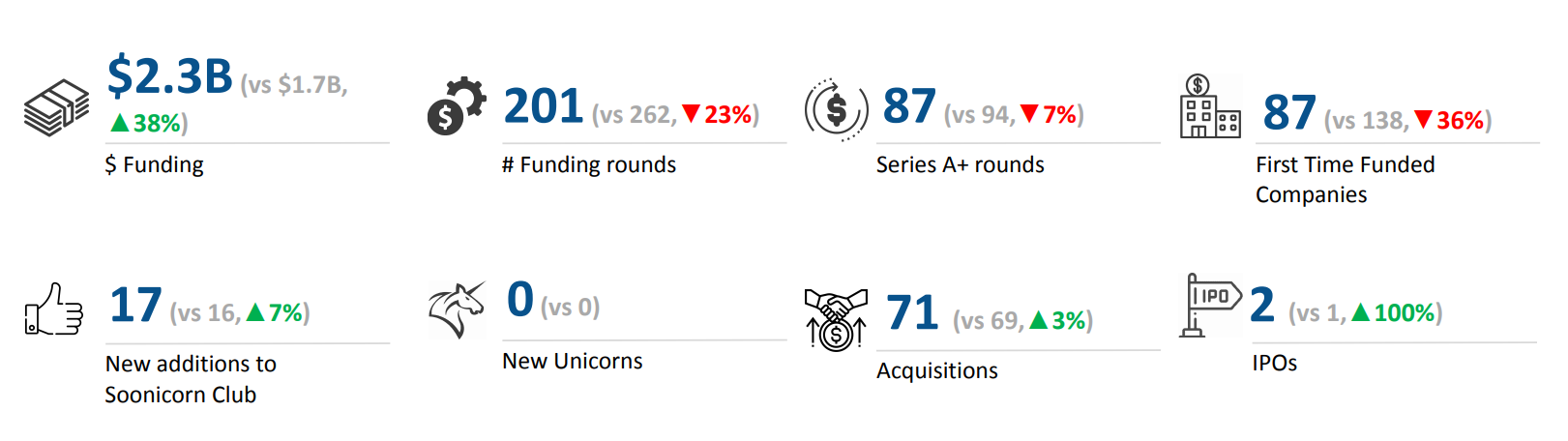

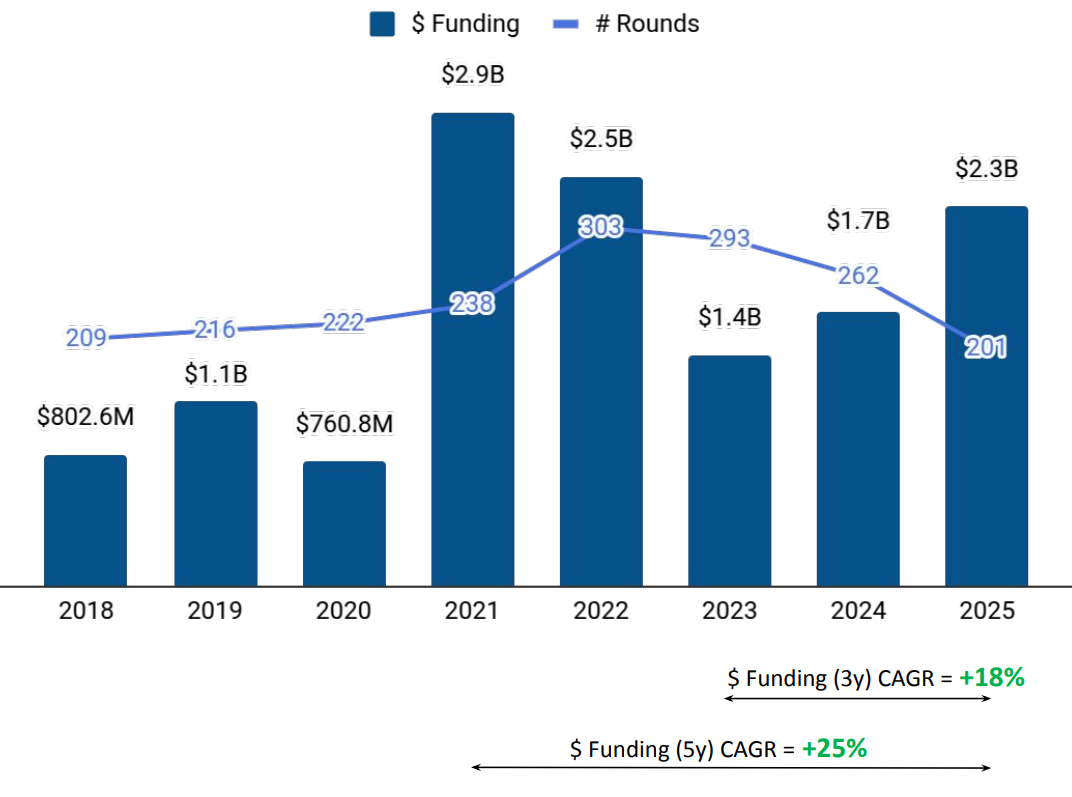

A total of $2.3B was raised by tech companies in Spain in 2025. This represents a rise of 38% compared to the $1.7B raised in 2024 and a rise of 64% compared to the $1.4B raised in 2023. The overall funding level was driven by a sharp increase in early-stage investments, while late-stage funding declined year-over-year.

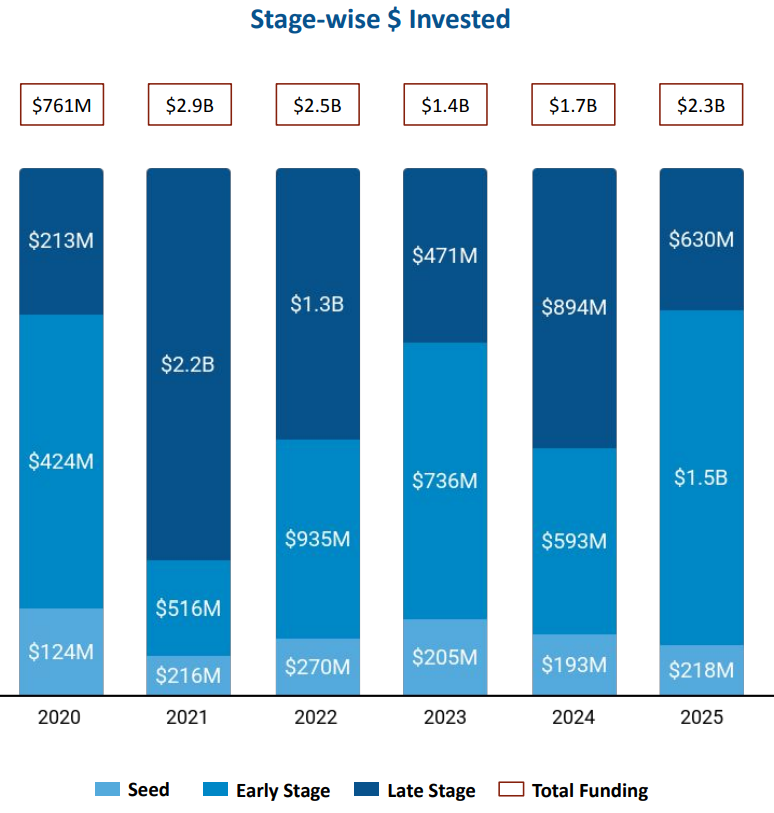

Seed Stage funding in Spain Tech stood at $218M in 2025, reflecting a rise of 13% compared to $193M raised in 2024 and a rise of 6% compared to $205M raised in 2023. Early Stage funding totaled $1.5B in 2025, marking a rise of 148% compared to $593M raised in 2024 and a rise of 100% compared to $736M raised in 2023. In contrast, Late Stage funding reached $630M in 2025, representing a drop of 30% compared to $894M raised in 2024, while recording a rise of 34% compared to $471M raised in 2023.

Uwin

The year 2025 witnessed 6 funding rounds of $100M or more, compared to 2 such rounds in 2024 and 1 in 2023. Companies such as Multiverse Computing, TravelPerk, and Auro raised funding above $100M during this period. Multiverse Computing raised a total of $215M through a Series B round, TravelPerk raised $200M through a Series E round, and Auro raised $187M through a Series B round. A major share of these $100M+ rounds came from Enterprise Applications, Travel and Hospitality Tech, and Auto Tech.

No new unicorns were created in 2025, similar to 2024 and 2023. Spain Tech recorded 2 IPOs in 2025, up 100% from 1 in 2024 and in line with 2023, with HBX Group and Student Property Income SOCIMI among the companies that went public.

Tech companies in Spain completed 71 acquisitions in 2025, marking a rise of 3% compared to 69 acquisitions in 2024 and a rise of 13% compared to 63 acquisitions in 2023. The largest acquisition of the year was vlex, which was acquired by Clio for $1B. This was followed by the acquisition of Touchland by Church & Dwight at a price of $880M.

Barcelona-based tech firms accounted for 35% of all funding raised by tech companies across Spain in 2025. Madrid followed, contributing 31% of the total funding raised during the year.

K Fund, Eoniq, and Itnig emerged as the top seed-stage investors in the Spain Tech ecosystem in 2025. Bonsai Partners, Seaya, and Axon Partners Group were the most active early-stage investors during the year.

The Spain Tech ecosystem recorded total funding of $2.3B in 2025, supported by a strong rise in early-stage investments and an increase in the number of $100M+ funding rounds. Enterprise Applications, Travel and Hospitality Tech, and Life Sciences accounted for the largest share of capital deployed during the year. While late-stage funding declined compared to 2024, the surge in early-stage activity, continued acquisition momentum, and the absence of new unicorn creation defined the overall funding landscape in 2025.