Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: Africa Tech Q3 2024. The report, based on Tracxn’s extensive database, provides insights into the African Tech space.

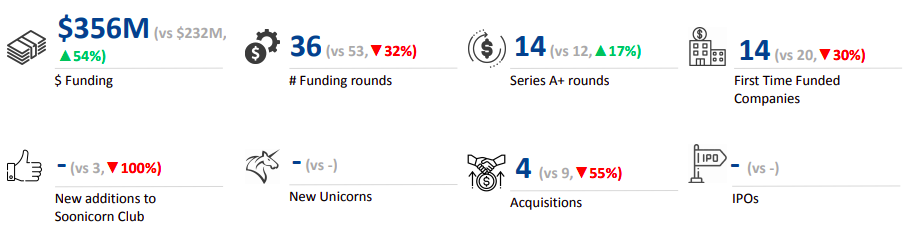

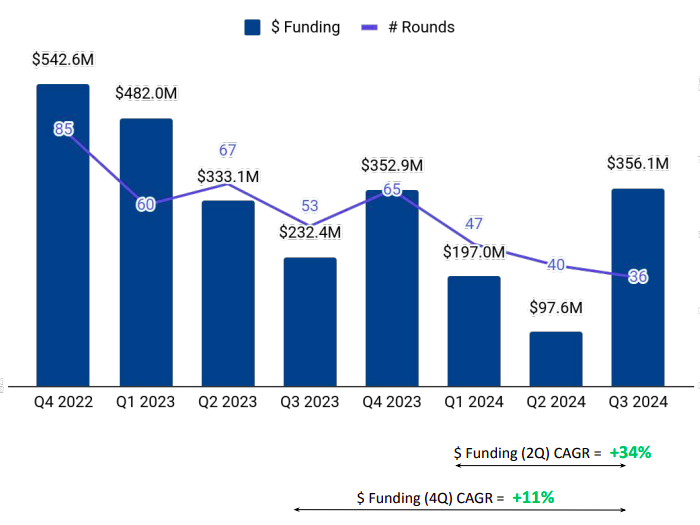

There has been some recovery. African tech startups secured a total funding of $356 million in Q3 2024, representing a spike of 264.69% from $97.6 million raised in the previous quarter (Q2 2024), and an increase of 53.21% compared with $232 million raised in the corresponding quarter last year (Q3 2023).

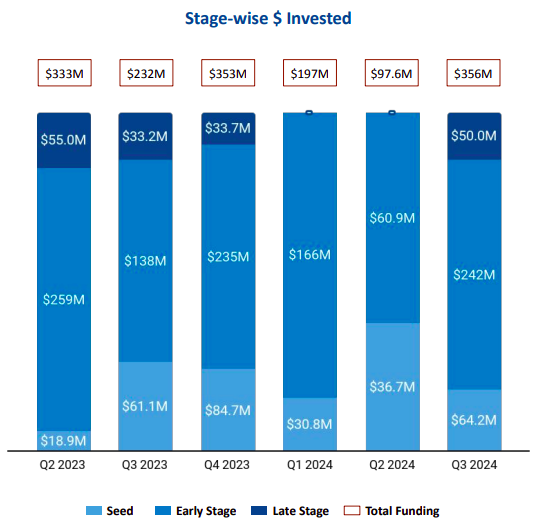

The sector attracted late-stage investments worth $50 million in Q3 2024, an increase of 50.6% compared to $33.2 million raised in Q3 2023. Seed-stage funding rose 5.14% to $64.2 million in Q3 2024 from $61.1 million in Q3 2023. Early-stage funding, too, rose 75.09% to $242 million in Q3 2024, from $138 million raised in Q3 2023.

Top-performing sectors in Q3 2024 were FinTech, High Tech, and Enterprise Infrastructure. Funding raised by FinTech companies increased 633% and 169% when compared with Q2 2024 and Q3 2023, respectively.

The High Tech segment witnessed a 953% increase in funding in Q3 2024 compared with Q2 2024 and saw a rise of 541% from Q3 2023. Enterprise Infrastructure companies witnessed a 642.57% increase in funding in the third quarter of 2024, compared with Q2 of 2024. The Enterprise Infrastructure space did not attract any funding in Q3 2023.

Only MNT Halan reported a $100M+ round in Q3 2024, raising $158 million in a Series B round led by IFC. Further, the third quarter of 2024 has not witnessed any IPOs or new unicorns. Only one African tech startup has gone public in 2024 so far, in the second quarter of the year.

The African tech startup ecosystem witnessed four acquisitions in Q3 2024, as against seven and nine in Q2 2024 and Q3 2023, respectively. Hisa, Quizac, DawnDusk and Quicket were the companies that were acquired in Q3 2024.

Giza took a strong lead in terms of city-wise funding across the continent. Startups based in Giza raised $163.1 million in Q3 2024, followed by those based in Cairo ($59 million) and Nairobi ($51.4 million).

Y Combinator, Flat6Labs, and 500 Global were the overall top investors in the African tech ecosystem. EQ2 Ventures, Renew Capital, and Equitable Ventures were the top seed-stage investors in the Africa Tech ecosystem in Q3 2024, while Nyca Partners, Acrew Capital and EBRD took the lead in early-stage investments.

(Data for Q3 2024 has been taken from Jul 1, 2024 - Sep 20, 2024)