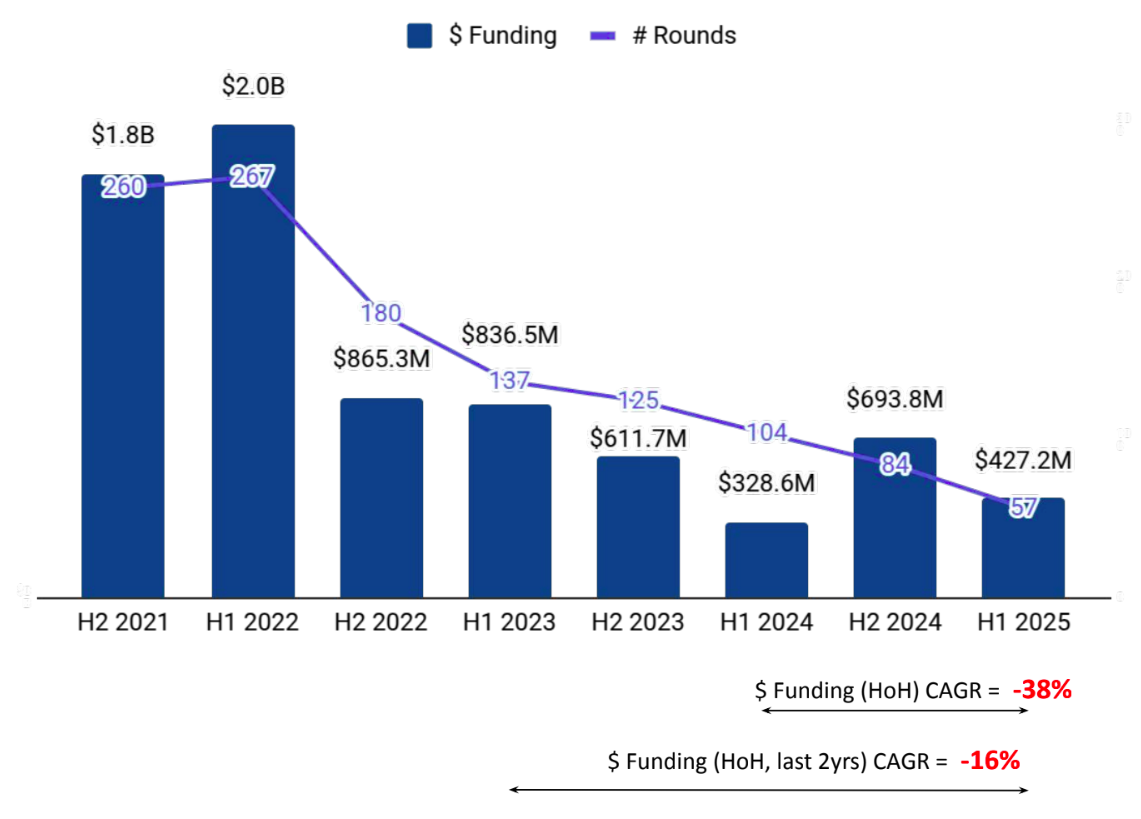

Tracxn has released its Africa Tech H1 2025 Funding Report, offering a detailed view of funding trends, sectoral performance, acquisitions, and investor activity across the continent. The African tech ecosystem raised a total of $427M in H1 2025, reflecting a notable drop in funding activity compared to the previous half-year. Despite the decline, the region recorded a modest year-over-year increase, with early-stage funding and key sectors like FinTech and Auto Tech showing pockets of growth.

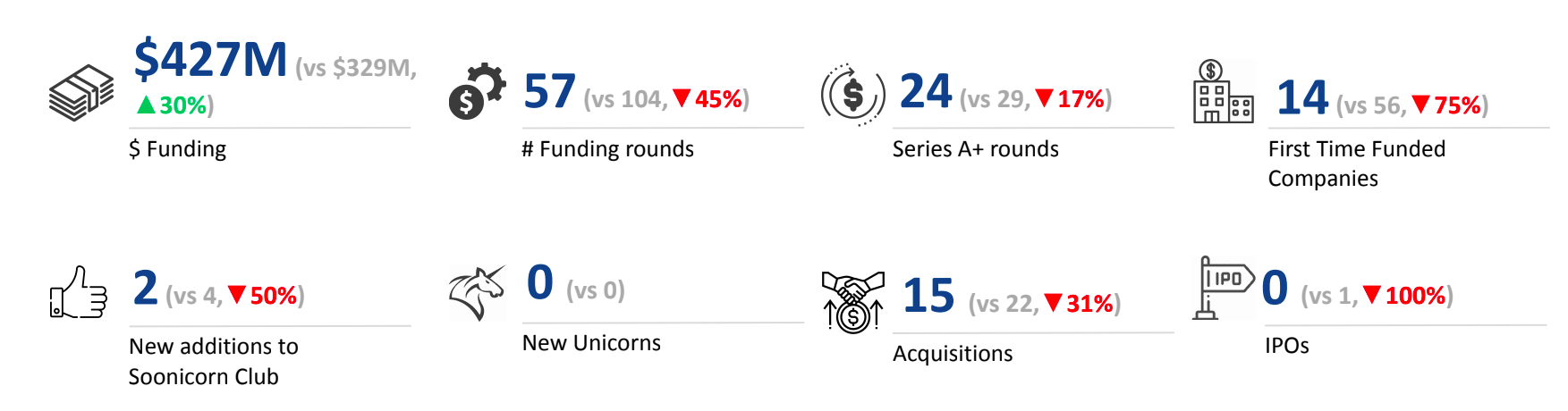

Africa’s tech ecosystem raised a total of $427M in H1 2025, a drop of 38% compared to the $694M raised in H2 2024. On a year-over-year basis, funding rose by 30% compared to $329M raised in H1 2024. This period did not witness any $100M+ funding rounds, compared to 2 rounds in H2 2024 and 1 round in H1 2024.

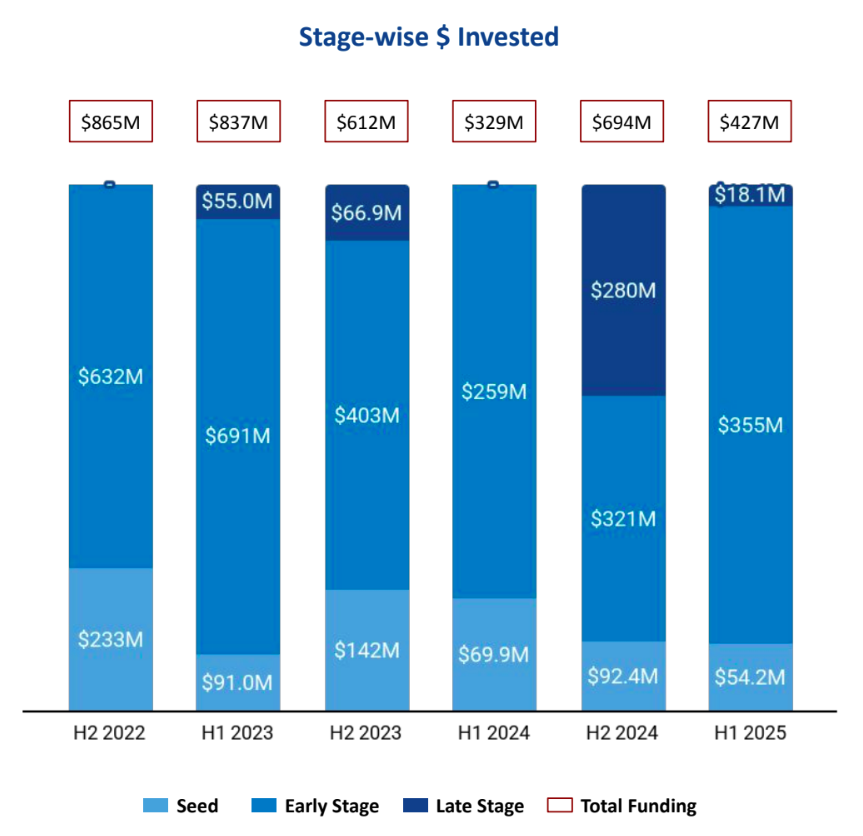

Seed Stage saw a total funding of $54.2M in H1 2025, a drop of 41% compared to $92.4M raised in H2 2024, and a drop of 22% compared to $69.9M raised in H1 2024. Early Stage saw a total funding of $355M in H1 2025, an increase of 11% compared to $321M raised in H2 2024, and an increase of 37% compared to $259M raised in H1 2024. Late Stage witnessed a total funding of $18.1M in H1 2025, a drop of 94% compared to $280M raised in H2 2024, and no funding was seen in H1 2024.

FinTech, Enterprise Applications, and Auto Tech were the top-performing sectors in H1 2025 in this space. The FinTech sector saw a total funding of $193M in H1 2025, which is a drop of 65% when compared to $557M raised in H2 2024 and an increase of 9% when compared to $177M raised in H1 2024. The Enterprise Applications sector saw a total funding of $180M in H1 2025, which is a drop of 39% when compared to $295M raised in H2 2024 and an increase of 183% when compared to $63.5M raised in H1 2024. The Auto Tech sector saw a total funding of $88M in H1 2025, which is an increase of 203% when compared to $29M raised in H2 2024 and a rise of 430% when compared to $16.6M raised in H1 2024.

No companies raised funds above $100M in H1 2025. No unicorns were created in H1 2025 and H1 2024. Additionally, no companies went public in H1 2025.

Tech companies in Africa saw 15 acquisitions in H1 2025, which is a 25% increase as compared to 12 acquisitions in H2 2024 and a decrease of 31% compared to 22 acquisitions in H1 2024. Bank Zero, Fatura, and Baobab+ were acquired by Lesaka, Maxab, and BioLite respectively, in H1 2025.

Cairo-based tech firms accounted for 16% of all funding seen by tech companies across Africa. This was followed by Cape Town at a close second.

Flat6Labs, Y Combinator and Techstars were the overall top investors in the Africa Tech ecosystem. Renew Capital, Plug and Play Tech Center and Speedinvest were the top seed-stage investors in the Africa Tech ecosystem for H1 2025. Norrsken22, Prosus, and QED Investors were the top early-stage investors in the Africa Tech ecosystem for H1 2025. CommerzVentures, Globis Capital Partners and Al Mada Ventures were the top late stage investors in the Africa Tech ecosystem for H1 2025.

The Africa tech ecosystem experienced a contraction in overall funding during H1 2025, led by sharp declines in seed and late-stage investments. While early-stage funding showed resilience with a notable uptick, the absence of $100M+ rounds, IPOs, and unicorns underscores a cautious investment climate. FinTech remained the leading sector by absolute funding, though Enterprise Applications and Auto Tech exhibited stronger growth momentum. Acquisition activity picked up, with 15 deals reported, and investor participation remained strong, especially at the seed and early stages.