Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: Africa Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the African Tech space.

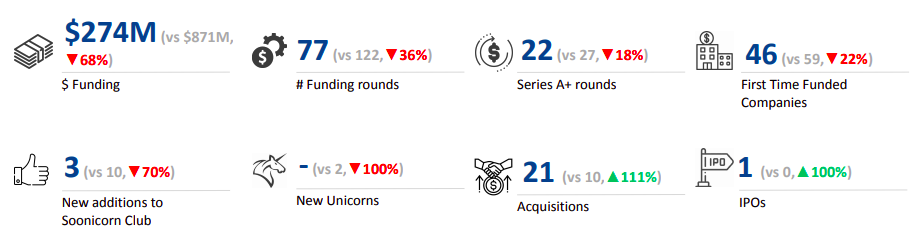

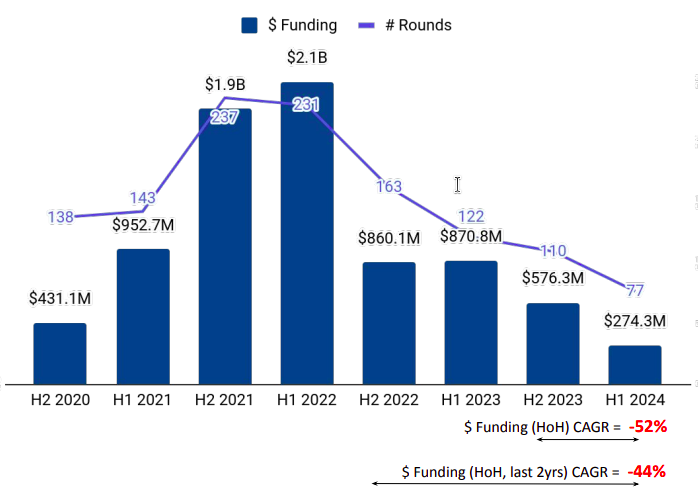

The Africa Tech startup ecosystem has secured total funding of $274 million in H1 2024, a 52.4% drop from the $576.3 million raised in H2 2023 and a 68% drop from the $870.8 million raised in H1 2023.

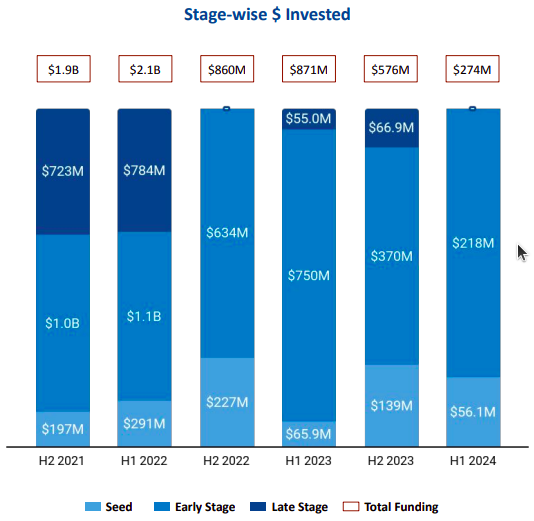

Seed-stage funding saw a total funding of $56.1 million in H1 2024, a decline of 14.9% from $65.9 million raised in the first half of 2023. Early-stage funding stood at $218 million in H1 2024, a plummet of 70.9% from the $750 million raised in H1 2023.

The first six months of 2024 did not witness any late-stage rounds, as against $67 million and $55 million raised in late-stage H2 2023 and late-stage H1 2023 respectively. H1 2024 has witnessed only one $100M+ funding round. Moove has raised a total of $100 million in a Series B round led by Future Africa and Uber, valuing the company at over $750 million. Further, no new unicorns have emerged this year so far.

There has been improvement in terms of exits. Compared to H1 2023, there were more than twice as many acquisitions in H1 2024. We Buy Cars was the only company to go public, a significant change from 2023, which did not witness any IPOs.

FinTech, Energy Tech and High Tech were the top-performing segments in H1 2024. FinTech companies in Africa saw a 76% decline in funding, from $627 million in H1 2023 to $151 million in H1 2024. Funding in the Energy Tech sector surged 1936% to $50.5 million in H1 2024 from $2.48 million in H1 2023. The High Tech segment saw a 33% decline in funding, to $46.3 million in H1 2024 from $69.5 million in H1 2023.

Lagos ranked first in terms of funding raised in H1 2024, accounting for 41% of the total investments garnered by tech startups across the continent. Companies based in Lagos raised $114 million in H1 2024, followed by those based in Nairobi ($33.1 million) and Cairo ($25.6 million).

Y Combinator, Flat6Labs and 500 Global are the all-time overall top investors in the Africa Tech ecosystem. Renew Capital, 500 Global and Ingressive Capital were the overall top investors in the Africa Tech ecosystem in H1 2024. A.Capital Ventures, Goodwell Investments and Ecosystem Integrity Fund were the overall top early-stage investors in the Africa Tech ecosystem for H1 2024.