Tracxn has released its insights on the Australia Tech ecosystem for 2025, highlighting funding activity, stage-wise trends, sector performance, deal flow, and investor participation during the year. The data reflects shifts in capital allocation across funding stages, strong late-stage momentum, and continued activity in acquisitions and public listings within the Australian tech landscape.

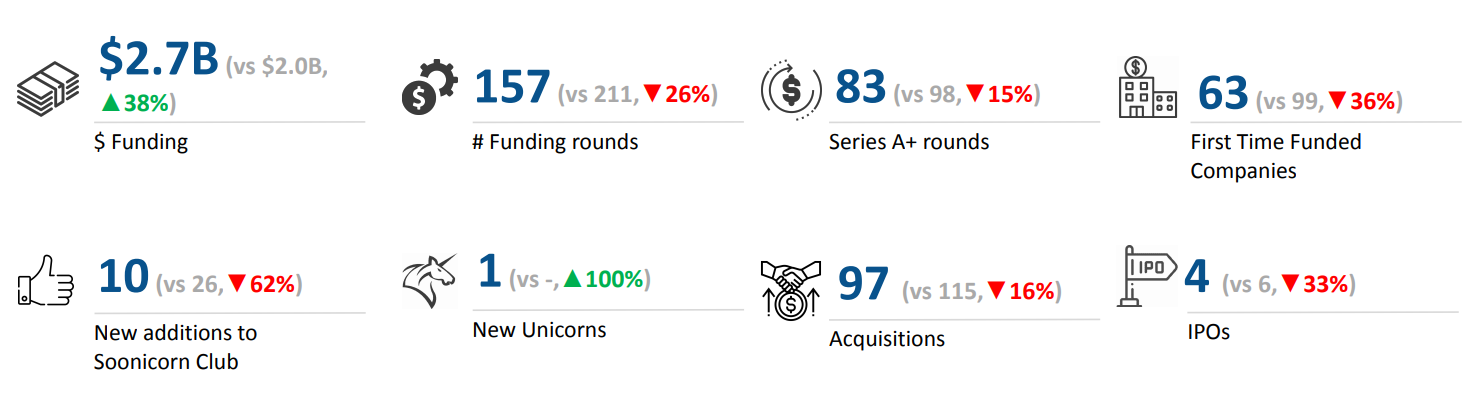

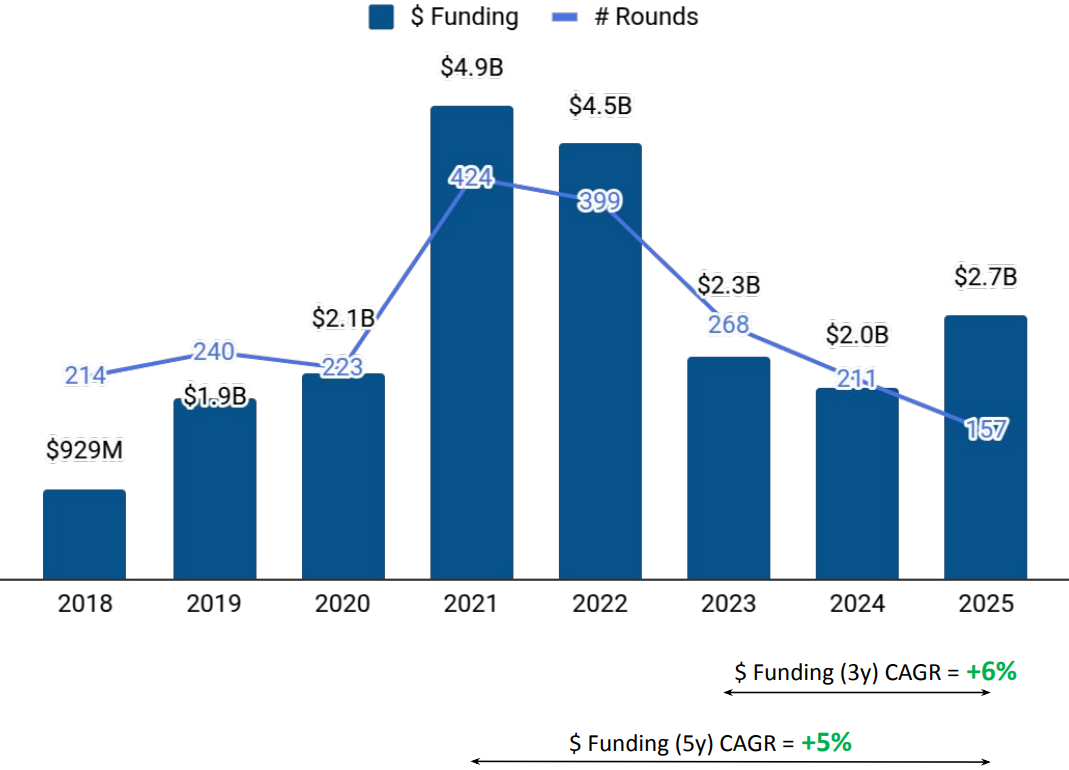

A total of $2.7B was raised by tech companies in Australia in 2025. This represents a rise of 38% compared to the $2B raised in 2024 and a rise of 19% compared to the $2.3B raised in 2023. The increase in overall funding was primarily driven by a significant rise in late-stage investments, while early-stage and seed-stage funding recorded year-over-year declines.

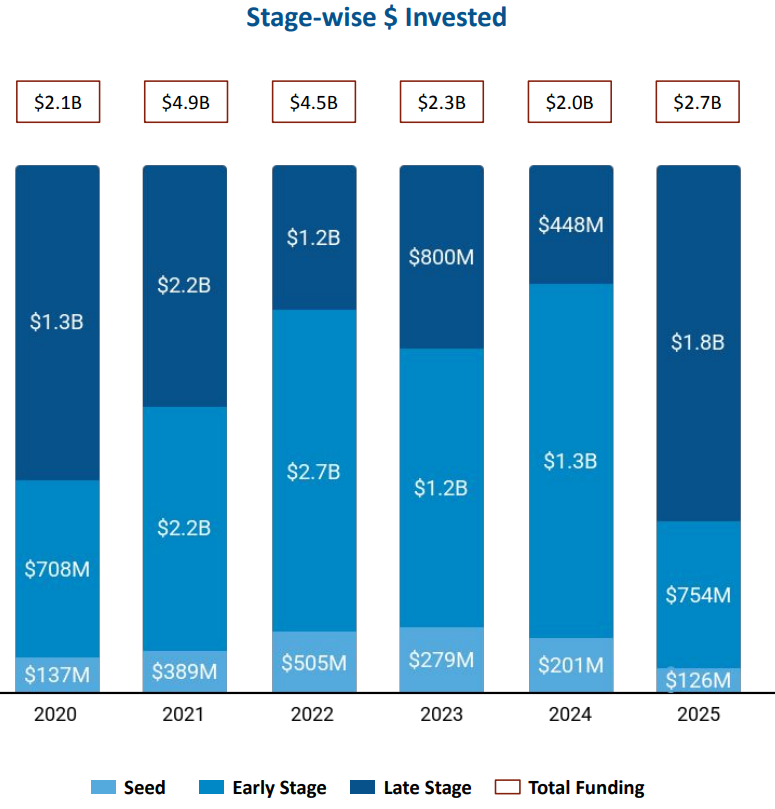

Seed Stage funding in Australia Tech stood at $126M in 2025, reflecting a drop of 37% compared to $201M raised in 2024 and a drop of 55% compared to $279M raised in 2023. Early Stage funding totaled $754M in 2025, a decline of 43% compared to $1.3B raised in 2024 and a decline of 38% compared to $1.2B raised in 2023. In contrast, Late Stage funding reached $1.8B in 2025, marking a rise of 309% compared to $448M raised in 2024 and a rise of 129% compared to $800M raised in 2023.

Enterprise Applications, FinTech, and Enterprise Infrastructure were the top-performing sectors in the Australia Tech ecosystem in 2025. The Enterprise Applications sector saw total funding of $1.5B in 2025, an increase of 43% compared to $1.1B raised in 2024 and an increase of 23% compared to $1.2B raised in 2023. The FinTech sector recorded $830M in total funding in 2025, representing an increase of 52% compared to $546M raised in 2024 and an increase of 12% compared to $739M raised in 2023. The Enterprise Infrastructure sector attracted $623M in funding in 2025, registering a rise of 941% compared to $60M raised in 2024 and a rise of 711% compared to $77M raised in 2023.

The year 2025 witnessed 7 funding rounds of $100M or more, compared to 4 such rounds in 2024 and 3 in 2023. Companies such as Airwallex, Firmus, and Protecht raised funding above $100M during this period. Airwallex raised a total of $330M through a Series G round, Firmus raised $547M through Series E and Series D rounds, and Protecht raised $280M through an Unattributed round.

One unicorn was created in 2025, compared to none in 2024 and 2023 each. Australia Tech recorded 4 IPOs in 2025, down 33% from 6 in 2024 and down 20% from 5 in 2023, with Aemhpa, Epiminder, NEXSEN BioTech, and Tetratherix among the companies that went public.

Tech companies in Australia completed 97 acquisitions in 2025, marking a drop of 16% compared to 115 acquisitions in 2024 and a drop of 3% compared to 100 acquisitions in 2023. The largest acquisition of the year was Domain Group, which was acquired by CoStar Group for $1.9B. This was followed by the acquisition of Micromine by The Weir Group at a price of $840M.

Sydney-based tech firms accounted for 32% of all funding raised by tech companies across Australia in 2025. Melbourne followed closely, contributing 31% of the total funding raised during the year.

Antler, Startmate, and Blackbird Ventures emerged as the top seed-stage investors in the Australia Tech ecosystem in 2025. Breakthrough Victoria, Insight Partners, and In-Q-Tel were the most active early-stage investors during the year. PSG and DST Global led late-stage investments, standing out as the top late-stage investors in the Australia Tech ecosystem in 2025.

The Australia Tech ecosystem recorded total funding of $2.7B in 2025, supported by a sharp increase in late-stage investments and a higher number of $100M+ funding rounds. Enterprise Applications, FinTech, and Enterprise Infrastructure accounted for the largest share of capital deployed during the year. While seed and early-stage funding declined compared to previous years, the rise in late-stage funding, continued acquisition activity, and the creation of one unicorn shaped the overall funding landscape in 2025.

Uwin