Tracxn has released its Australia Tech - 9M 2025 Report, presenting a detailed view of the country’s technology investment trends. Australia’s tech ecosystem recorded notable shifts in funding activity, with overall investment rising compared to the previous year. The report highlights a strong rebound in late-stage rounds and continued investor focus across Enterprise Applications, FinTech, and Enterprise Infrastructure sectors.

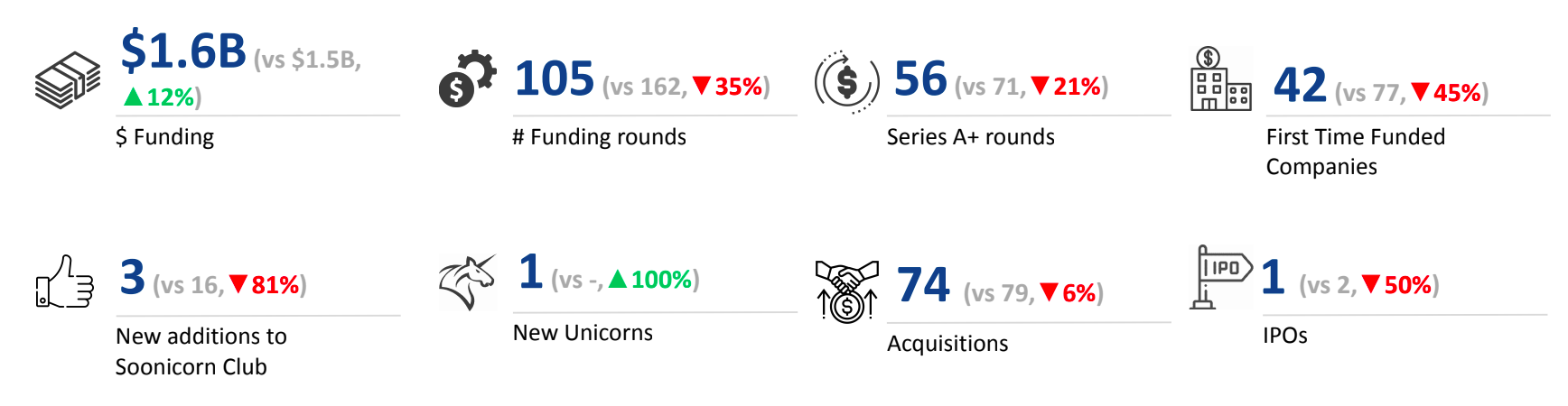

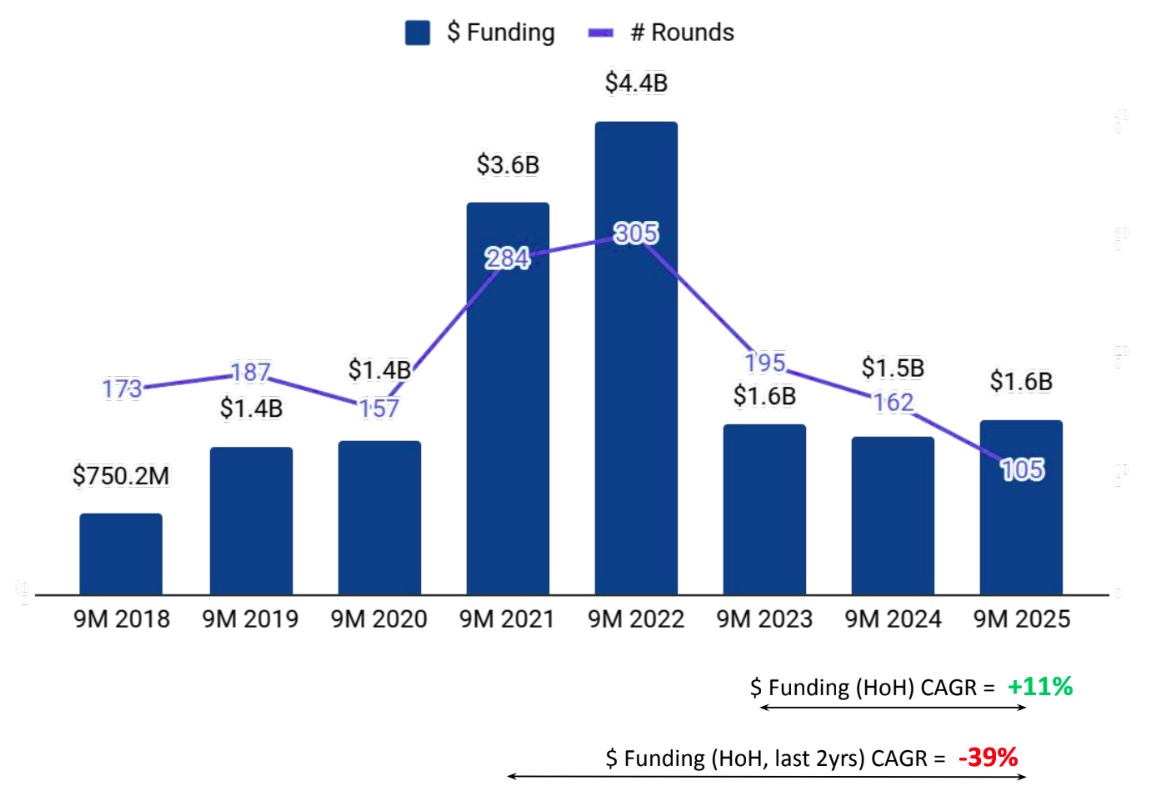

Australia’s tech sector raised a total of $1.6B in 9M 2025, marking a 12% rise compared to $1.5B in 9M 2024, and the same level as in 9M 2023. Despite the overall moderation at earlier stages, strong late-stage activity drove funding growth, supported by sustained investor interest across Enterprise Applications, FinTech, and Enterprise Infrastructure sectors.

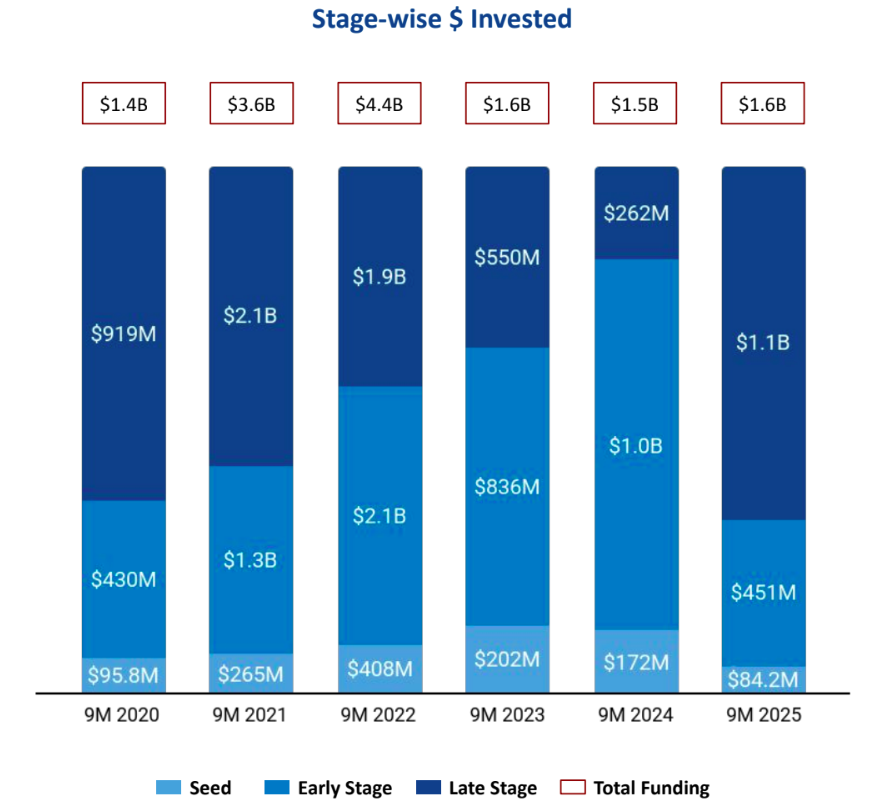

Funding activity across stages in Australia reflected contrasting trends in 9M 2025. Seed Stage funding stood at $84.2M, registering a 51% decline from $172M in 9M 2024 and a 58% drop compared to $202M in 9M 2023. Early Stage funding reached $451M, marking a 56% decrease from $1.0B in 9M 2024 and a 46% fall from $836M in 9M 2023. In contrast, Late Stage funding showed strong momentum, climbing to $1.1B in 9M 2025, a 318% rise from $262M in 9M 2024 and a 99% increase compared to $550M in 9M 2023, underscoring investor confidence in mature companies.

The top-performing sectors in Australia during 9M 2025 were Enterprise Applications, FinTech, and Enterprise Infrastructure. Enterprise Applications led with $921M in funding, a 35% increase from $682M in 9M 2024 and a 17% rise compared to $790M in 9M 2023. FinTech followed with $477M raised, marking a 13% decrease from $546M in 9M 2024 and a 15% decline from $561M in 9M 2023. Enterprise Infrastructure also showed remarkable growth with $242M raised, up 1056% from $20.9M in 9M 2024 and 217% higher than $76.3M in 9M 2023.

Australia recorded five $100M+ funding rounds in 9M 2025, compared to three such rounds in 9M 2024 and one in 9M 2023. Notable large rounds included Protecht ($280M, Unattributed round), Firmus ($220M, Series D), and Airwallex ($150M, Series F). Companies such as AdvanCell and Harrison also raised over $100M during the period.

The country witnessed one IPO in 9M 2025, down 50% from two in 9M 2024 and 67% lower than three in 9M 2023. Tetratherix was the only company to go public during the period, marking the sole listing in Australia’s tech ecosystem this year. The ecosystem also added one new unicorn in 9M 2025, representing a 100% rise compared to none in both 9M 2024 and 9M 2023.

Australia’s M&A landscape remained active in 9M 2025, with 74 acquisitions recorded during the period. This represented a 6% decline from 79 acquisitions in 9M 2024 and a 3% drop compared to 76 in 9M 2023. Despite the marginal slowdown in deal volume, several high-value transactions underscored continued strategic activity in the market. The largest deal was Domain Group’s $1.9B acquisition by CoStar Group, followed by Micromine’s $840M acquisition by The Weir Group, highlighting sustained investor confidence in Australia’s tech ecosystem.

Sydney accounted for 46% of all funding raised by Australian tech companies in 9M 2025, making it the leading city in terms of capital inflow. Melbourne followed as the second-largest hub, contributing 21% of the total funding raised during the period.

Investor participation in Australia’s tech ecosystem remained diverse across stages in 9M 2025. Antler, Startmate, and Blackbird Ventures emerged as the most active investors at the seed stage, supporting early innovation and startup formation. At the early stage, Breakthrough Victoria, Co:Act, and In-Q-Tel played a leading role in driving growth-focused investments. Meanwhile, PSG and DST Global Partners stood out as the top late-stage investors, backing mature companies with substantial growth potential.

The Australia tech ecosystem in 9M 2025 demonstrated renewed momentum, driven by a surge in late-stage investments and strong performances across the Enterprise Applications, FinTech, and Enterprise Infrastructure sectors. Despite declines at the seed and early stages, overall funding rose 12% compared to 9M 2024. The emergence of one new unicorn, multiple large funding rounds, and major acquisitions underscore the ecosystem’s steady growth trajectory, with Sydney and Melbourne continuing to lead as key innovation hubs.