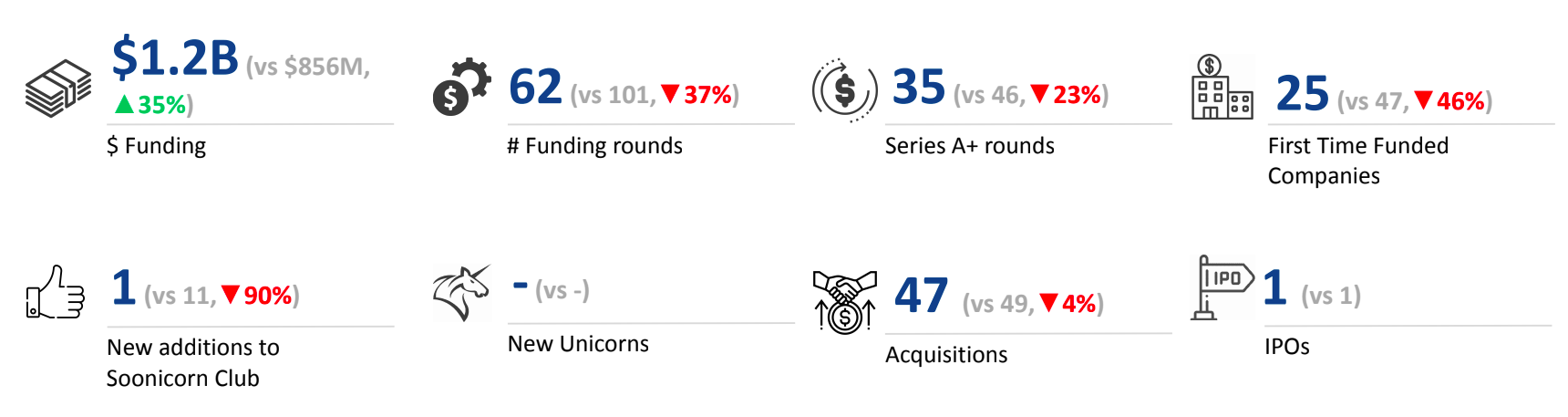

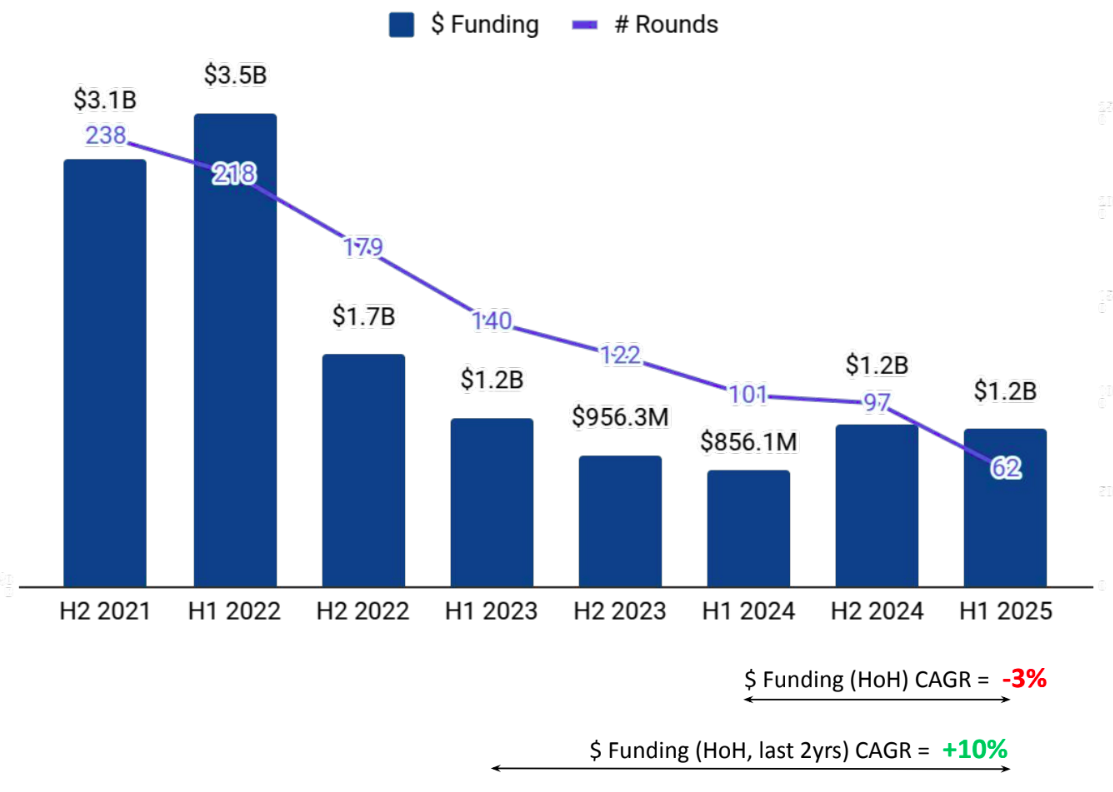

Tracxn has released its Australia Tech H1 2025 Funding Report, capturing investment activity across the country's technology landscape for the first half of the year. The report reveals a total of $1.2B raised by Australian tech companies, reflecting a marginal 3% increase over H2 2024 and a 35% jump compared to H1 2024. Despite shifts in funding across stages, Australia’s ecosystem continues to see robust capital inflow driven by large late-stage deals and strong sectoral performance.

Australia’s tech sector raised a total of $1.2B in H1 2025, reflecting a 3% increase compared to $1.19B in H2 2024, and a 35% rise from $856M in H1 2024. This modest growth reflects continued investor interest across consecutive halves, reinforcing the resilience of the Australian tech ecosystem.

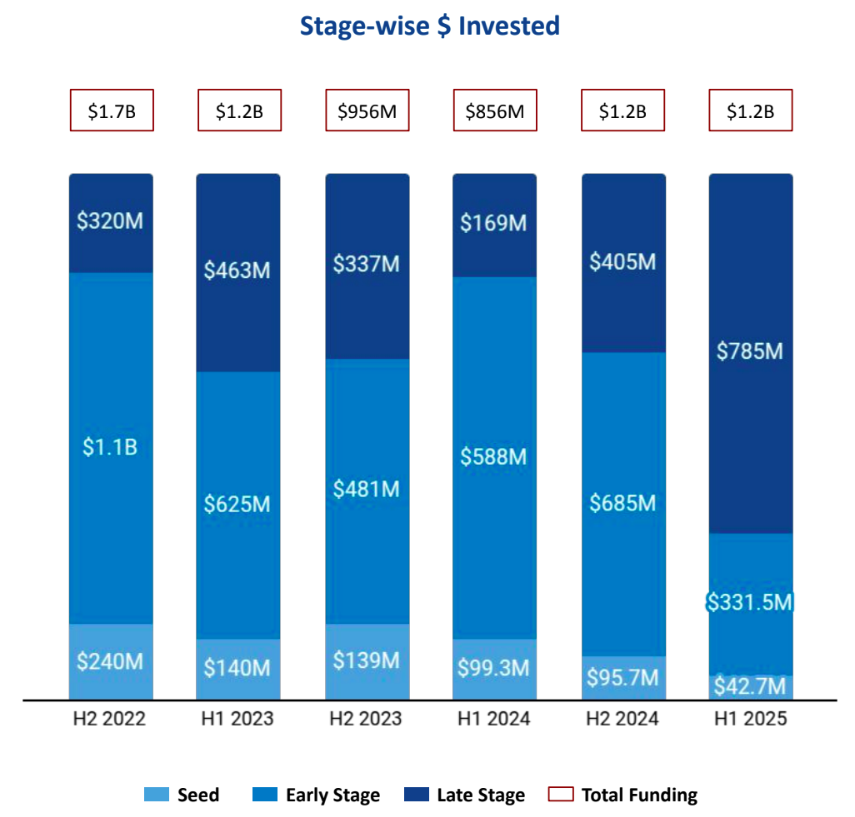

Seed Stage saw a total funding of $42.7M in H1 2025, a drop of 55% compared to $95.7M raised in H2 2024, and a drop of 45% compared to $99.3M raised in H1 2024. Early Stage saw a total funding of $331M in H1 2025, a drop of 52% compared to $685M raised in H2 2024, and a drop of 47% compared to $588M raised in H1 2024. Late Stage witnessed a total funding of $785M in H1 2025, an increase of 94% compared to $405M raised in H2 2024, and an increase of 365% compared to $169M raised in H1 2024.

Enterprise Applications, FinTech, and Retail were the top-performing sectors in H1 2025. Enterprise Applications sector saw a total funding of $794M in H1 2025, which is a drop of 1.51% when compared to $805M raised in H2 2024 and an increase of 197% when compared to $267M raised in H1 2024. FinTech sector saw a total funding of $481M in H1 2025, which is a drop of 24% when compared to $635M raised in H2 2024 and an increase of 119% when compared to $219M raised in H1 2024. Retail sector saw a total funding of $179M in H1 2025, which is a drop of 45% when compared to $327M raised in H2 2024 and an increase of 292% when compared to $45M raised in H1 2024.

H1 2025 has witnessed 4 100M+ funding rounds when compared to 3 such rounds in H2 2024 and 2 such rounds in H1 2024. Companies like Protecht, Airwallex, AdvanCell, Harrison have managed to raise funds above $100M in this period. Rush Gold was the only company to go public in H1 2025. No unicorns were created in H1 2025, H2 2024 and H1 2024.

Tech companies in Australia saw 47 acquisitions in H1 2025, which is a 23% decline from 61 acquisitions in H2 2024 and a drop of 4% compared to 49 acquisitions in H1 2024. Micromine was acquired by The Weir Group at a price of $840M. This became the highest valued acquisition in H1 2025 followed by the acquisition of GreenSquareDC by Partners Group at a price of $755M.

Sydney based tech firms accounted for 54% of all funding seen by tech companies across Australia. This was followed by Melbourne at a distant second.

Blackbird Ventures, AirTree and Main Sequence were the overall top investors in Australia ecosystem. Antler, Blackbird Ventures and LaunchVic were the top seed stage investors in Australia Tech ecosystem for H1 2025. Gandel Invest, Insight Partners and Breakthrough Victoria were the top early stage investors in Australia Tech ecosystem for H1 2025.PSG and DST Global Partners were the top late stage investors in Australia Tech ecosystem for H1 2025. Late stage VC investments saw United States based PSG and based DST Global Partners add 1 company each to their portfolios.

The Australia tech ecosystem maintained its momentum in H1 2025, with total funding reaching $1.2B and a notable surge in late-stage investments. Enterprise Applications, FinTech, and Retail sectors led capital inflow, while Sydney remained the dominant city for tech funding. Although no new unicorns emerged and IPO activity remained subdued, the presence of multiple $100M+ deals and high-value acquisitions highlighted sustained investor interest in scaling ventures.