Tracxn has released its insights on the Australian Artificial Intelligence ecosystem for 2025, analysing funding activity, stage-wise capital flows, sectoral concentration, geographic distribution, and exit dynamics. The report examines how investor behaviour evolved through the year, offering a structural view of capital deployment across Australia’s rapidly scaling but uneven AI landscape.

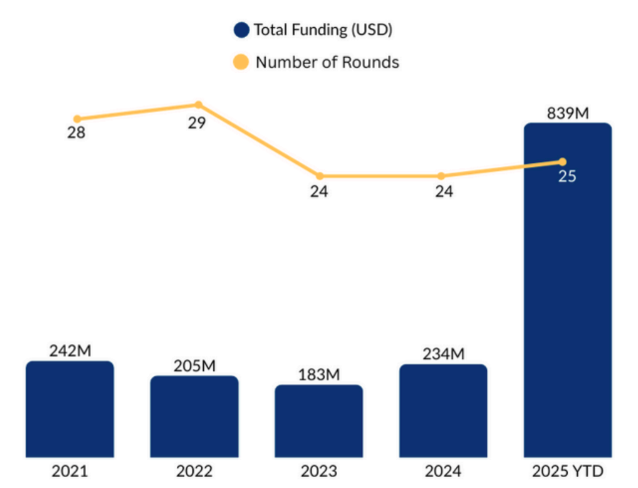

Australian AI start-ups raised $839M in equity funding in 2025, making it the most funded year on record. This surge reflects a decisive break from earlier funding cycles, with capital increasingly concentrated in a limited number of scale-stage companies rather than distributed across the broader start-up base. While overall funding volumes expanded sharply, the median round size remained at $4M, indicating continued valuation discipline outside of a few exceptional late-stage rounds.

Stage-wise, capital deployment in 2025 was overwhelmingly late-stage. Infrastructure-focused companies absorbed the majority of new funding, led by Firmus’ $327M Series E and $220M Series D, alongside Harrison AI’s $112M Series C. In contrast, early- and seed-stage funding remained comparatively restrained, reinforcing a bifurcated funding environment where scale-stage conviction coexists with cautious early-stage underwriting.

From a sectoral perspective, AI Infrastructure became the focal point of capital deployment with $547M raised post 2023 timeframe, accounting for nearly all infrastructure-layer funding to date. This reflects investor alignment with sovereign compute, energy-linked AI assets, and long-duration infrastructure platforms. Within the application layer, Vertical AI Solutions attracted $981M in all-time funding, with healthcare and life sciences, and deep tech applications leading deployment due to regulatory defensibility and mission-critical adoption.

&zN8wj;

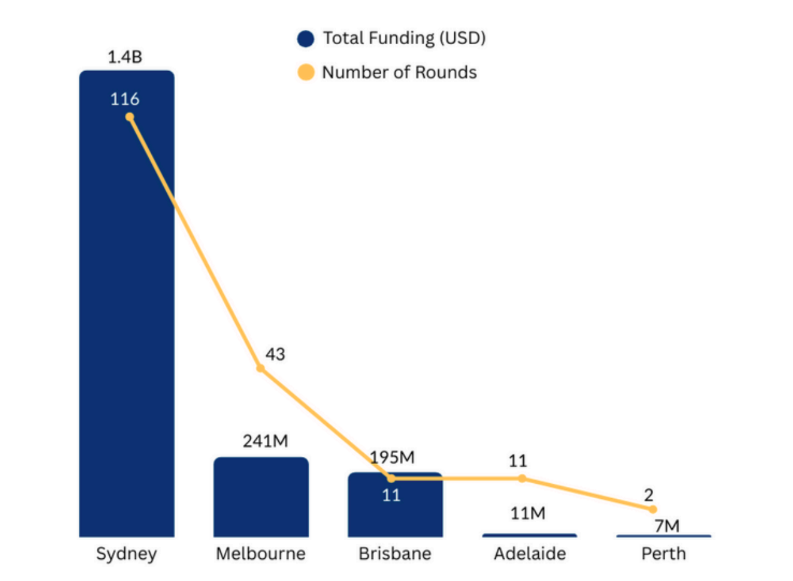

Geographically, funding concentration can be witnessed. Sydney-based AI companies accounted for $1.4B in cumulative funding, driven by the presence of late-stage infrastructure and deep-tech players. Melbourne followed with $241M, while other cities remained marginal contributors, underscoring a structurally hub-dominated national AI market.

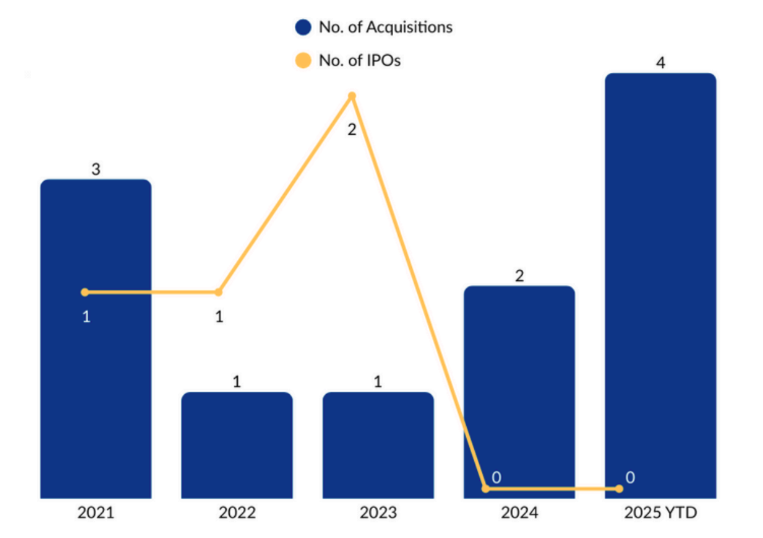

In terms of market maturity, Australia recorded 25 all-time AI exits, with exit behaviour shifting decisively post-2023. While IPOs dominated earlier cycles, recent years have seen acquisitions emerge as the primary exit pathway, reflecting consolidation dynamics and increased participation from strategic and international acquirers. This transition signals growing commercial maturity, albeit within a still-narrow liquidity funnel.

Overall, Australia’s AI ecosystem in 2025 transitioned into an infrastructure-anchored, late-stage capital regime, characterised by selective scale underwriting, concentrated geographic dominance, and consolidation-led exits. While headline funding reached new highs, capital formation remains structurally uneven—favouring execution-ready platforms aligned with sovereign priorities over broad-based ecosystem expansion.