Tracxn, a SaaS-based market intelligence platform, tracking 5M+ entities worldwide, has released a report providing a comprehensive overview of the B2C E-Commerce startup ecosystem in India. This sector encompasses companies involved in the online sale of products or services to consumers across categories such as food, fashion, electronics, automobiles, real estate, and consumer services, including Internet-first brands, marketplaces, and listing platforms, as well as platforms offering consumer services online, such as hyperlocal deliveries and hotel bookings.

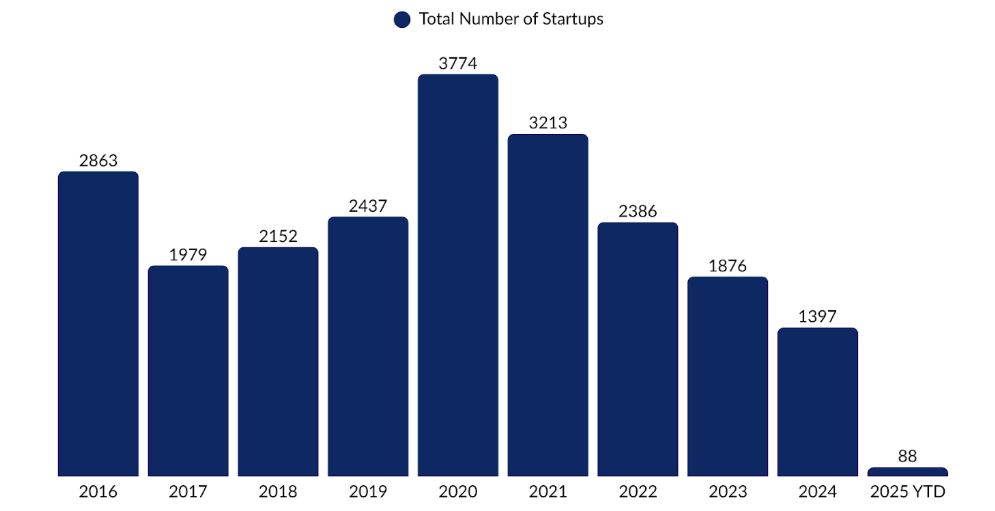

To date, approximately 34,000 B2C E-Commerce startups have been founded in India. Over the last decade (2016–2025 YTD), more than 22,000 new startups have emerged, constituting nearly two-thirds of the total ecosystem. This rapid evolution is driven by surging smartphone penetration, growing internet accessibility (reaching 1 billion subscribers), and the rise of digital payment systems like UPI.

Sports

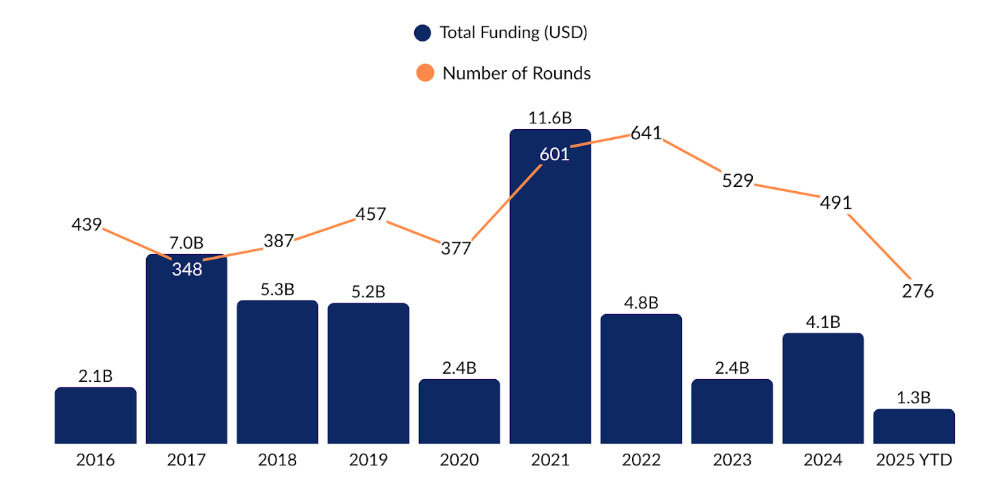

The India B2C E-Commerce space has cumulatively attracted over $57B in all-time equity funding across 5,600+ rounds. Funding activity has been robust over the past decade (2016-2025 YTD), starting at $2.1B in 2016 and spiking to a peak high of $11.6B in 2021, before stabilizing. The significant funding in 2021 was propelled by landmark mega deals, including Flipkart’s $3.6B and Swiggy’s $1.25B Series J rounds. The ecosystem has recorded 102 mega funding rounds ($100M+) to date.

Leading the funding chart is Flipkart with $12.1B raised, followed by Ola with $3.8B and Swiggy with $3.6B. This concentration of funding highlights online retail, mobility, and food delivery as key promising sectors.

N8

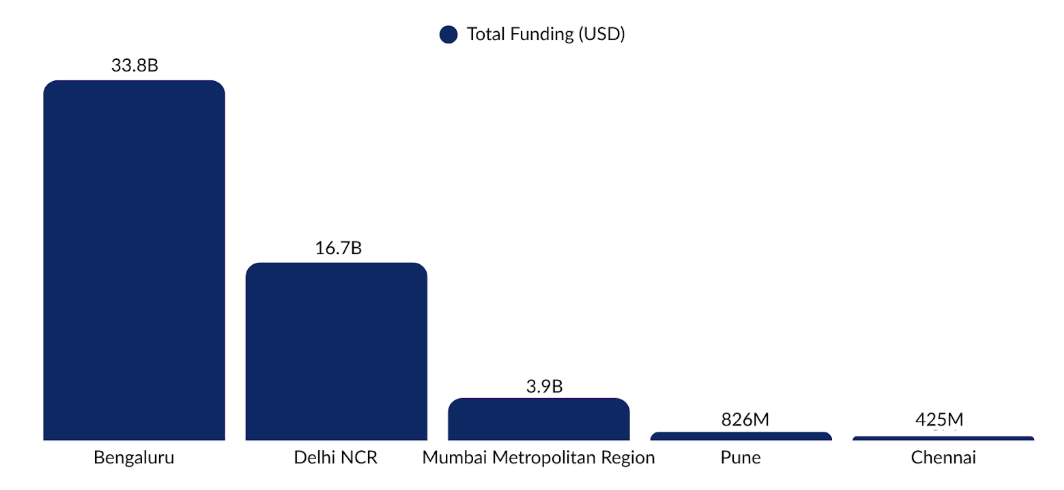

Geographically, Bengaluru is the leading hub, having secured $33.8B in total funding to date (as of 2025 YTD), primarily driven by Flipkart and Ola. Delhi NCR is the second-most funded city, with $16.7B raised (as of 2025 YTD), led by OYO and Snapdeal. Together with Mumbai Metropolitan Region, Pune, and Chennai, the top five cities host 11,300+ active startups.

Around 1,100 VCs have invested in India's B2C E-Commerce to date (until 2025 YTD). Accel is the most active investor with 132 rounds, followed by Blume Ventures (129) and Fireside Ventures (102). In 2025 YTD, 180+ VCs have participated, including 31 first-time investors, indicating sustained new investor interest.

The India B2C E-Commerce ecosystem has produced 31 Unicorns so far: six publicly listed and 25 privately held. Rapido is the most recent Unicorn (July 2024). The sector has seen 235 all-time acquisitions, with Pepperfry being a recent example, and 64 all-time IPOs, with Zappfresh being the latest to go public.

The Indian B2C E-Commerce ecosystem is founded on a strong base of over $57B in cumulative funding, with a decade of activity seeing cyclical peaks driven by major companies like Flipkart. Bengaluru remains the central hub for funding. With 31 unicorns, a diverse range of companies, and active VC participation (including over $8B raised by women-led startups), the sector demonstrates high growth and maturity, though its exit landscape shows an active mix of acquisitions and growing public listings.