Uwin

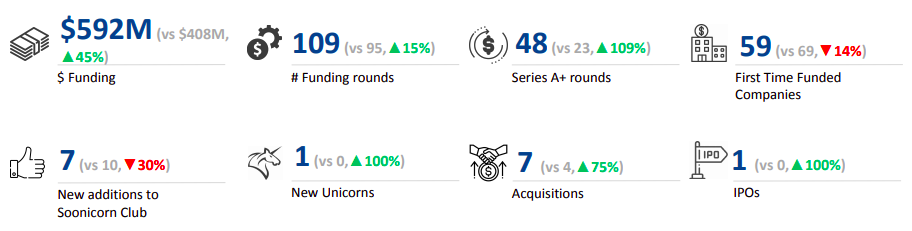

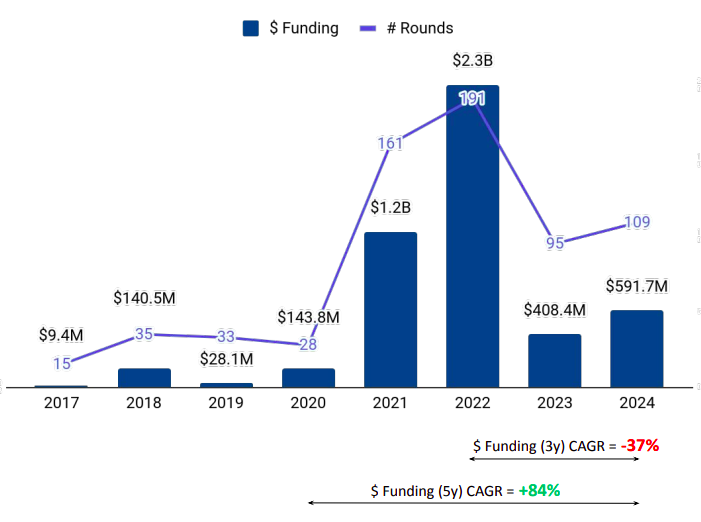

The Southeast Asia (SEA) blockchain ecosystem experienced its highest-ever annual funding in 2022, raising $2.27 billion. However, macroeconomic challenges and geopolitical tensions led to a sharp decline in funding in the following years. Despite this, 2024 marked a recovery with total funding in the Blockchain Technology space reaching $592 million in 2024, representing a 45% increase compared to the $408 million raised in 2023, though it remained 74% lower than the 2022 peak.

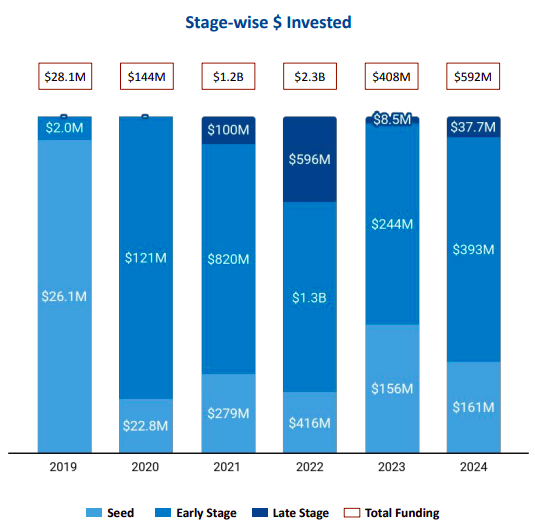

The sector also saw improvements across various funding stages in 2024. Seed-stage funding reached $161 million in 2024, a 3% uptick from $156 million raised during the previous year (2023). Early-stage funding grew 61% to $393 million, from $244 million raised in the previous year. Late-stage funding experienced the most dramatic growth, surging by 344% to $37.7 million from $8.5 million in 2023, although these figures remain significantly lower than those recorded in 2022.

SDAX secured $50 million in its Series B funding round, making it the highest-funded company in the Blockchain Technology sector in 2024. This was followed by Sygnum, which raised $40 million in its Series B round, and WadzpPay, which raised $37 million in a Series C round. Further, Polyhedra Network became the only new unicorn from this space in 2024, after raising $20 million in a Series B round.

Cryptocurrencies, Blockchain Infrastructure, and Smart Contracts were the top-funded segments in Southeast Asia’s Blockchain Technology sector in 2024. The Cryptocurrencies segment attracted total funding of $325 million in 2024, a growth of 20% compared to $271 million raised in 2023. The Blockchain Infrastructure segment witnessed a total funding of $287 million in 2024, an increase of 152% compared with the $114 million raised in 2023. The Smart Contracts segment raised $19.6 million in 2024, nearly 10 times higher than the $2 million raised in the previous year.

The year also saw increased activity in terms of exits, with seven acquisitions recorded, a significant increase from the four acquisitions in 2023. Notable deals included Propine being acquired by Komainu and SolanaFM by Jupiter. Tridentity became the only company in this space to go public in 2024, after an absence of IPOs the previous year.

Singapore led the region in blockchain funding, followed by Hanoi and Kuala Lumpur. Blockchain Technology startups based in Singapore raised $483 million in 2024, while those based in Hanoi and Kuala Lumpur raised $18 million and $12 million, respectively.

The most active investors in the SEA blockchain sector included NGC, Animoca Brands, and OKX. Spartan Group, Hashkey Capital, and Alliance DAO took the lead in seed-stage investments, while early-stage funding was primarily driven by UOB, Taisu, and IDG Capital.

In 2024, the blockchain sector benefited from government initiatives aimed at promoting blockchain adoption across various industries and the region’s strong cryptocurrency adoption. Countries like Thailand and Vietnam are leading these efforts. Thailand has been exploring blockchain applications for cross-border payments, supply chain financing, and document authentication. Meanwhile, Vietnam has ambitious plans to become a global blockchain hub in the next five years by encouraging local firms to develop blockchain platforms and highlighting the technology’s benefits.

As the region undergoes a digital revolution, blockchain technology will play a crucial role in driving economic growth and unlocking opportunities for innovation. With favourable conditions and increasing adoption, the SEA blockchain sector is poised for continued growth in the coming years.