Tracxn has released its California Tech Q1 2025 Funding Report, detailing a sharp resurgence in the state’s tech investment landscape. The quarter saw robust growth in overall funding activity, fueled primarily by a surge in late-stage investments and an uptick in large $100M+ deals. While seed-stage activity experienced a downturn, sectors like Enterprise Applications and Enterprise Infrastructure emerged as major drivers of capital inflow.

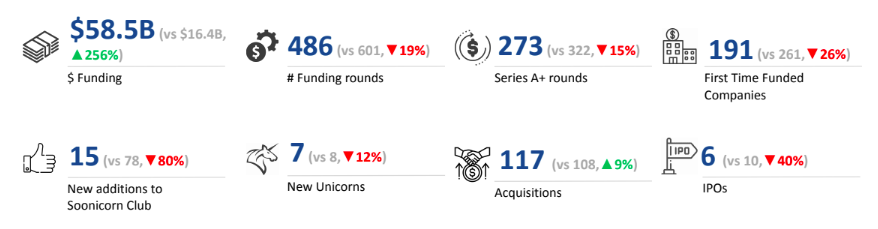

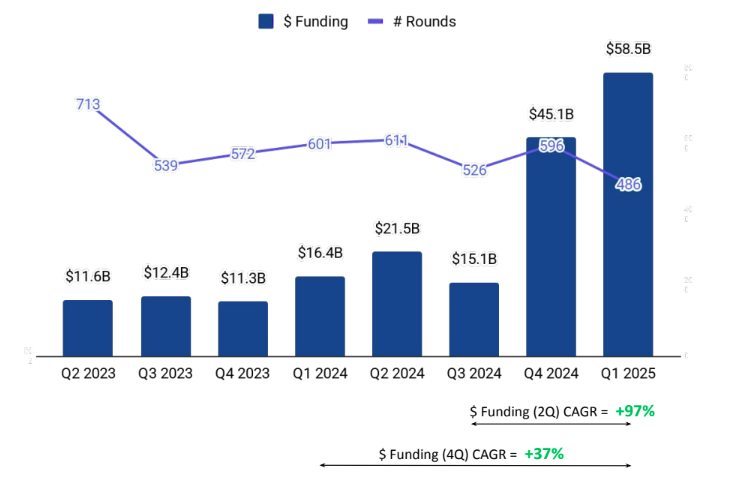

A total of $58.5B was raised in Q1 2025, marking an increase of 30% compared to the $45.1B raised in Q4 2024 and a substantial rise of 256% from the $16.4B raised in Q1 2024. This rebound underscores a strong funding environment in California’s tech ecosystem, particularly in later-stage and high-value transactions.

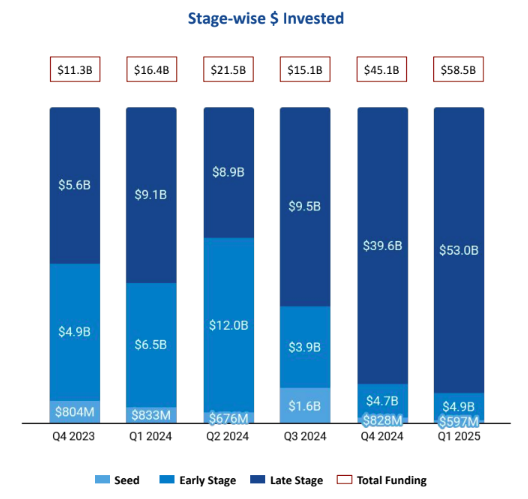

Seed Stage saw a total funding of $597M in Q1 2025, a drop of 28% compared to $828M in Q4 2024 and $833M in Q1 2024. Early Stage witnessed a total funding of $4.9B in Q1 2025, representing a modest increase of 4% over the $4.7B raised in Q4 2024 but a decline of 25% from $6.5B in Q1 2024. The most significant momentum was seen in Late Stage, which recorded a total funding of $53B in Q1 2025, a 34% rise from $39.6B in Q4 2024 and an extraordinary increase of 482% compared to $9.1B in Q1 2024.

Enterprise Applications emerged as the top-performing sector in Q1 2025, raising $53.8B. This marked an increase of 64% compared to $32.8B in Q4 2024 and a staggering 516% rise from $8.7B in Q1 2024. Enterprise Infrastructure followed with a total funding of $5.0B in Q1 2025, which is a 59% drop compared to $12.2B in Q1 2024 but a 140% increase compared to $2.1B in Q1 2024. Life Sciences raised $2.2B in Q1 2025, showing a 25% increase compared to $1.8B in Q1 2024 and a decline of 38% from $3.6B in Q4 2024.

In Q1 2025, California saw 38 $100M+ funding rounds, slightly down from 41 in Q4 2024 and 39 in Q1 2024. Companies like OpenAI, Anthropic, Infinite Reality, Eikon, and Impetus raised funds exceeding $100M this quarter. A major part of these $100M+ funding rounds came from Enterprise Applications, Enterprise Infrastructure, and Life Sciences. OpenAI raised a total of $40B in a Series F round, valuing the company at over $300B. Anthropic secured $3.5B in a Series E round, while Infinite Reality raised $3.0B in a Series E round, valuing the company at over $12.2B. NeOnc Technologies, Triller, Karman Space & Defense, and Aardark Therapeutics were among the companies that went public in Q1 2025. There were 7 unicorns created in Q1 2025, which is a 12% decrease compared to 8 unicorns in Q1 2024.

Tech companies in California recorded 117 acquisitions in Q1 2025, a 27% increase from 92 acquisitions in Q4 2024 and a 9% rise compared to 108 in Q1 2024. The highest-valued acquisition was Ampere Computing, acquired by SoftBank Group for $6.5B, followed by Inari Medical’s acquisition by Stryker for $4.9B.

San Francisco-based tech firms accounted for 84% of all funding seen by tech companies across California, maintaining a dominant position. Los Angeles followed at a distant second in terms of funding volume.

Y Combinator, a16z, and Sequoia Capital were the overall top investors in the California Tech ecosystem. Y Combinator, South Park Commons, and Gradient Ventures led seed-stage investments in Q1 2025. SoftBank Vision Fund, Cross Creek, and Bond Capital were the top late-stage investors during the period. At the early stage, Khosla Ventures, Lightspeed Venture Partners, and General Catalyst were the leading investors. Among VCs, United States-based Y Combinator led the most number of investments in Q1 2025 with 23 rounds, while General Catalyst added 13 new companies to its portfolio.

The California tech ecosystem experienced a strong resurgence in Q1 2025, propelled by a dramatic increase in late-stage funding and large-ticket deals. The dominance of Enterprise Applications, along with steady activity in Life Sciences and Enterprise Infrastructure, highlights a renewed investor appetite. While seed-stage funding contracted, increased acquisition activity and landmark fundraises by firms like OpenAI and Anthropic helped sustain overall market momentum.