Tracxn has released its H1 2025 Tech Funding Report highlighting key shifts in California’s tech investment landscape. The first half of the year witnessed a strong rise in overall funding, driven by a surge in late-stage and $100M+ deals. While seed-stage funding and unicorn creation saw a decline, enterprise-focused sectors remained dominant.

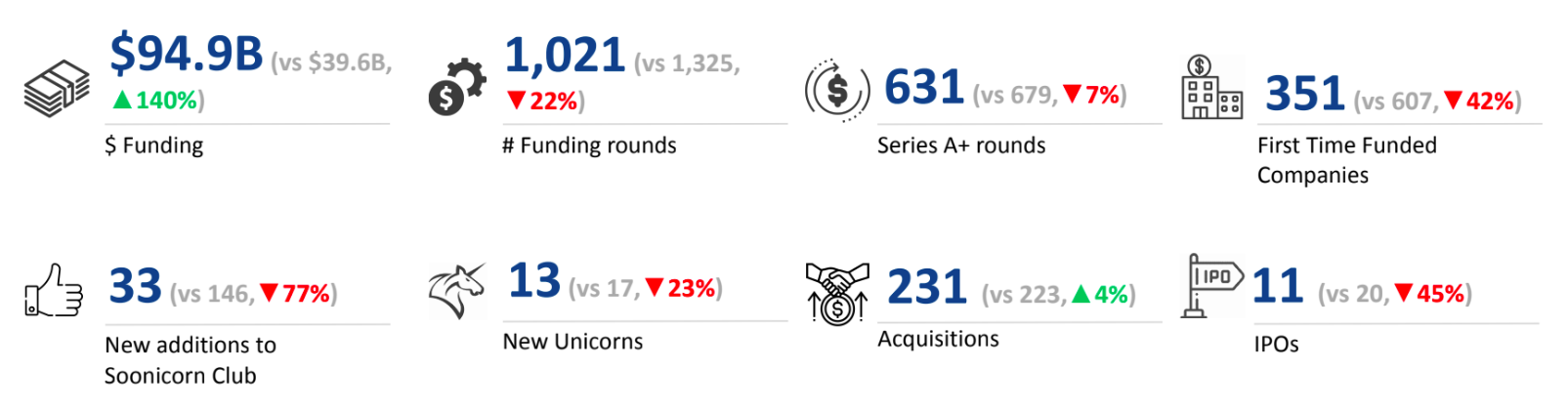

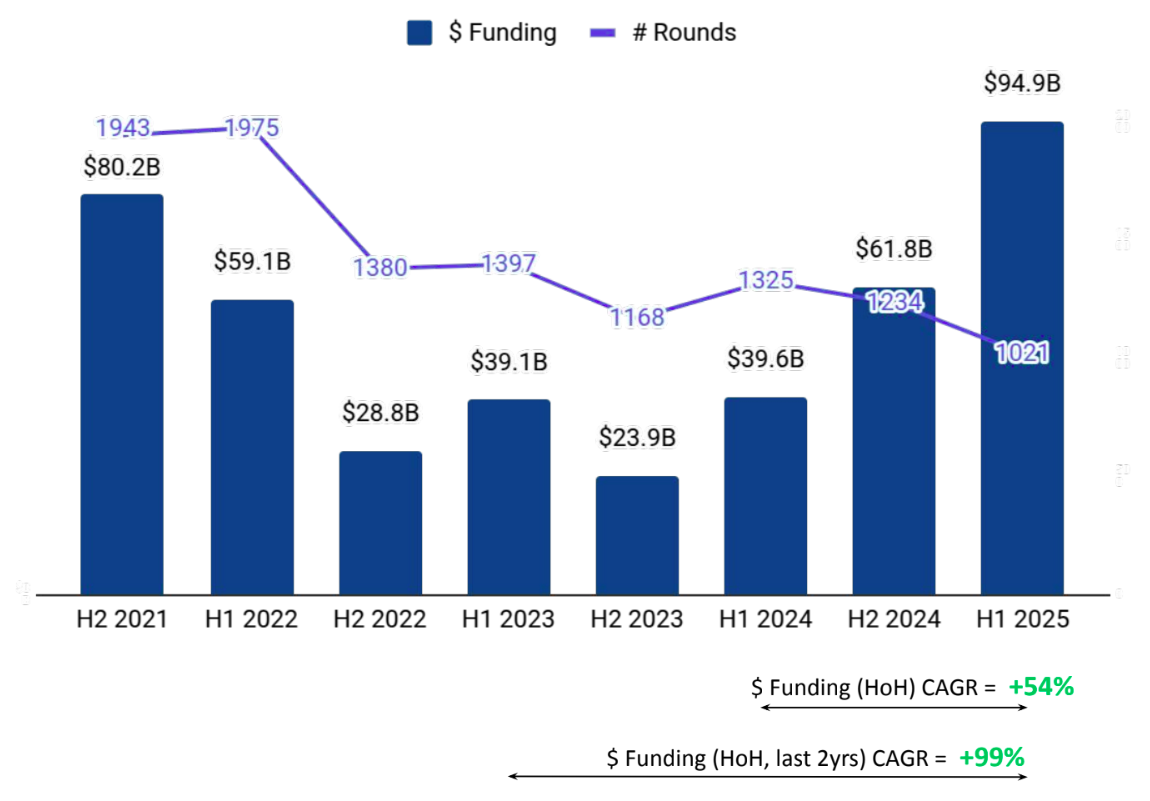

A total of $94.9B was raised in H1 2025, reflecting a sharp increase of 54% compared to $61.8B raised in H2 2024, and a remarkable 140% increase from $39.6B raised in H1 2024. The surge in overall funding highlights strong momentum in large-scale investments, especially in late-stage companies.

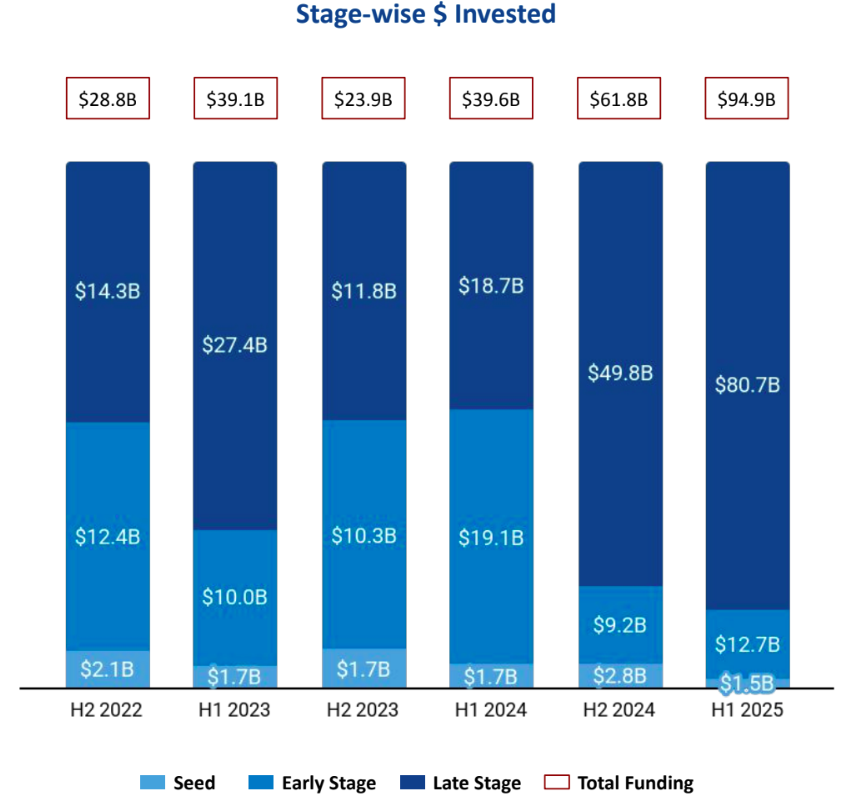

Seed Stage saw a total funding of $1.5B in H1 2025, marking a drop of 45% compared to $2.8B raised in H2 2024, and a 12% decline from $1.7B in H1 2024. Early Stage witnessed a total funding of $12.7B in H1 2025, an increase of 38% compared to $9.2B in H2 2024, but a 33% drop compared to $19.1B in H1 2024. Late Stage funding dominated the landscape, with $80.7B raised in H1 2025 up 62% from $49.8B in H2 2024 and a staggering 331% increase compared to $18.7B in H1 2024.

Enterprise Applications, Enterprise Infrastructure and Aerospace, Maritime and Defense Tech were the top-performing sectors in H1 2025 in this space. Enterprise Applications emerged as the top-performing sector, raising $72.0B in H1 2025 an increase of 74% compared to $41.3B in H2 2024 and a rise of 198% from $24.1B in H1 2024. Enterprise Infrastructure saw a total funding of $5.6B in H1 2025, down 65% from $16.2B in H2 2024 but up 29% compared to $4.4B in H1 2024. Aerospace, Maritime and Defense Tech sector saw a total funding of $4.0B in H1 2025, which is an increase of 55% when compared to $2.6B raised in H2 2024, and a rise of 549% when compared to $622.1M raised in H1 2024.

&zN8wj;

H1 2025 saw 91 $100M+ funding rounds, compared to 75 in H2 2024 and 84 in H1 2024. Companies like OpenAI, Scale, Anthropic, Anduril, and SSI raised over $100M in this period. OpenAI raised a total of $40B in a Series F round, Scale secured $14.3B in a Series G round, and Anthropic raised $3.5B in a Series E round. There were 13 unicorns created in H1 2025, marking a 28% decline from 18 in H2 2024 and a 23% drop from 17 in H1 2024. Chime, Omada, Hinge Health, and SmartStop Self Storage were among the companies that went public in H1 2025.

Tech companies in California saw 231 acquisitions in H1 2025, an increase of 21% compared to 191 in H2 2024 and a 4% rise from 223 in H1 2024. Informatica was acquired by Salesforce Ventures for $8B, becoming the highest-valued acquisition in H1 2025. The second-largest deal was OpenAI’s acquisition of iO at a valuation of $6.5B.

San Francisco-based tech firms accounted for 78% of all funding received by tech companies across California, positioning the city as the top funding hub. It was followed by Palo Alto at a distant second in terms of investment share.

Y Combinator, Andreessen Horowitz, and Sequoia Capital were the overall top investors in the California tech ecosystem in H1 2025. Y Combinator, South Park Commons, and General Catalyst were the most active seed-stage investors. Khosla Ventures, Lightspeed Venture Partners, and Bessemer Venture Partners led early-stage investments. Bond Capital, Prosperity7 Ventures, and DST Global Partners were the top late-stage investors in the region. Among VCs, United States-based Sequoia Capital led the most number of investments in H1 2025 with 22 rounds, while another U.S.-based fund, New Enterprise Associates, added 13 new companies to its portfolio. Late-stage VC investments saw Bond Capital and Saudi Arabia-based Prosperity7 Ventures add 2 and 4 companies respectively to their portfolios.

The California tech ecosystem experienced a significant rebound in H1 2025, driven by a surge in late-stage funding and a wave of $100M+ mega-rounds. Enterprise Applications emerged as the standout sector, while San Francisco remained the epicenter of tech investment activity in California. Despite a decline in seed-stage funding and unicorn creation, robust acquisition activity and investor engagement from top VC firms highlighted continued confidence in high-growth enterprise and infrastructure segments.