Tracxn, a leading global SaaS-based market intelligence platform, has released its Annual Report: Canada Tech Annual Report 2024. Based on Tracxn’s extensive database, the report provides insights into the Canadian Tech space.

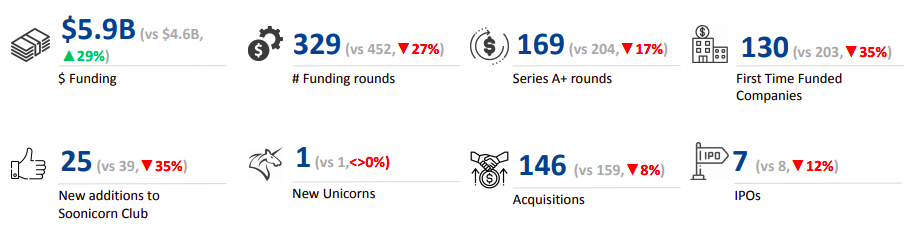

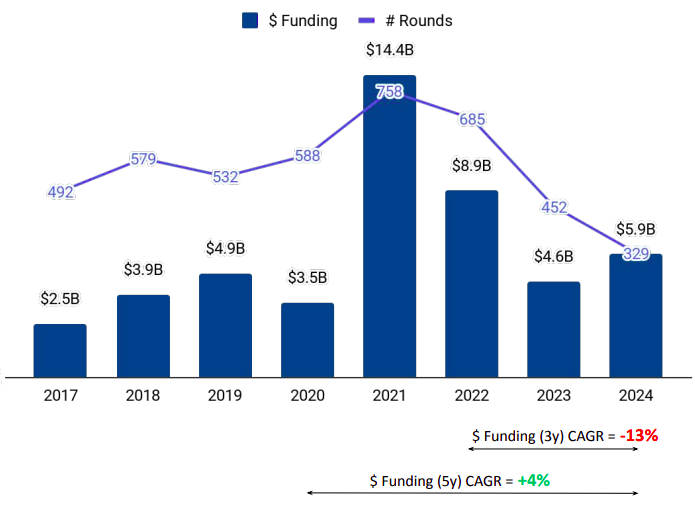

In 2024, Canadian tech startups raised $5.9 billion in funding, representing a 29% increase from the $4.6 billion secured in 2023 and a drop of 33.48% compared to the $8.9 billion raised in 2022.

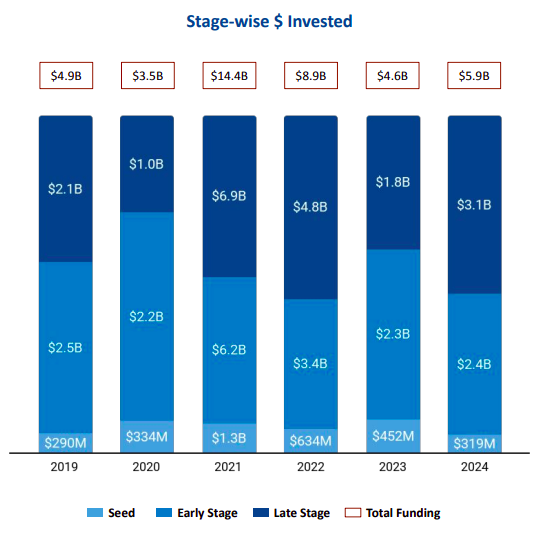

Stage-wise Investment Trends

● Late-Stage Funding: Late-stage investments surged to $3.1 billion in 2024, marking a 72.22% increase compared to $1.8 billion in 2023.

● Seed-Stage Funding: Seed-stage investments dropped by 29.42%, falling to $319 million in 2024 from $452 million in 2023.

● Early-Stage Funding: Early-stage funding experienced a marginal 4.35% increase, totaling $2.4 billion in 2024, compared to $2.3 billion in 2023.

Sectoral Performance

Top-performing sectors in 2024 included Enterprise Applications, High Tech, and Life Sciences:

● Enterprise Applications: Funding increased by 65.71% compared to 2023 and a marginal drop of 5% compared to 2022.

● High Tech: Funding rose by 5% compared to 2023, but declined by 10.82% compared to 2022.

● Life Sciences: Funding increased by 79% in 2024 relative to 2023, and growth of 41% compared to 2022.

Top cities leading the landscape

● Toronto-based tech firms accounted for 50.18% of all funding raised by Canadian tech companies, dominating the national landscape.

● Burnaby followed at a distant second, contributing 15.68% of the total funding.

Leading Investors

Real Ventures, Y Combinator, and Inovia Capital emerged as the top investors in the Canadian tech ecosystem, actively supporting startups across various stages.

Mergers & Acquisitions

The Canadian tech ecosystem recorded 146 acquisitions in 2024, down from 159 in 2023. Notable deals include:

● Nuvei’s acquisition by Advent International for $6.3B, the highest-valued deal of the year.

● Fusion Pharmaceuticals’s acquisition by Astrazeneca for $2.4B.

This data underscores the evolving dynamics of the Canadian tech ecosystem, reflecting both growth opportunities and challenges across different funding stages, sectors, and regions.