Tracxn has released its Canada Tech 9M 2025 Funding Report, outlining key shifts in the country’s technology investment landscape. During the first nine months of 2025, Canada’s tech ecosystem demonstrated moderate funding growth, marked by a strong rebound in late-stage rounds and notable activity across core enterprise and environment-focused sectors.

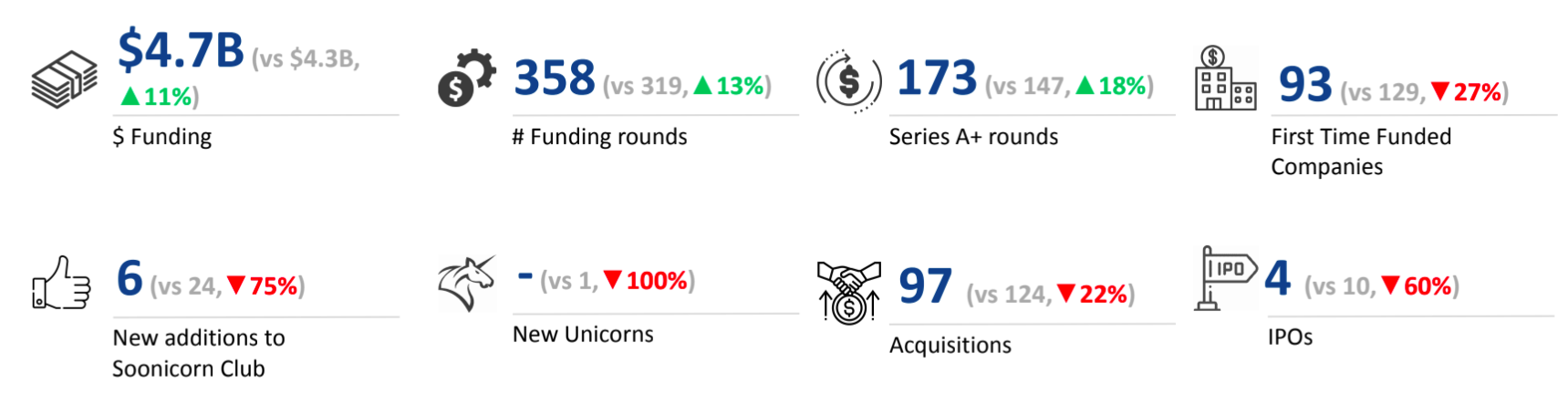

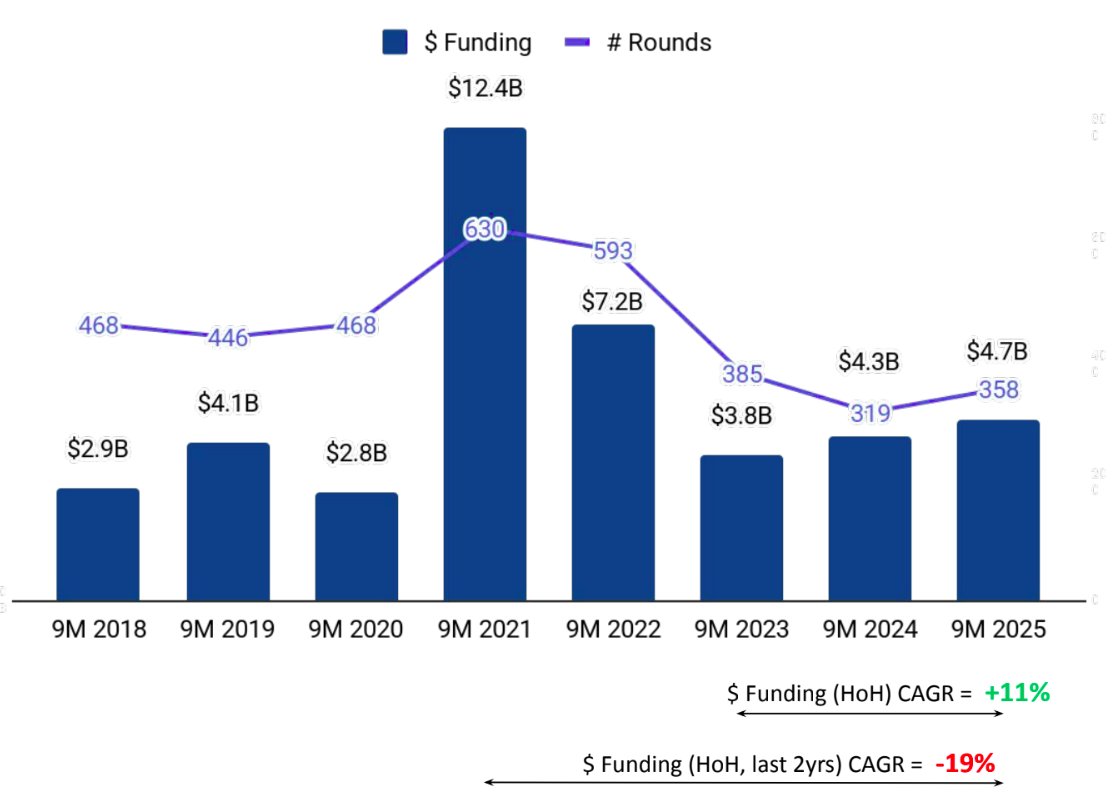

Canada’s tech sector raised a total of $4.7B in 9M 2025, marking an 11% increase compared to $4.3B in 9M 2024 and a 25% rise from $3.8B in 9M 2023. The growth was primarily fueled by robust late-stage investment activity, which helped offset declines in early and seed-stage funding.

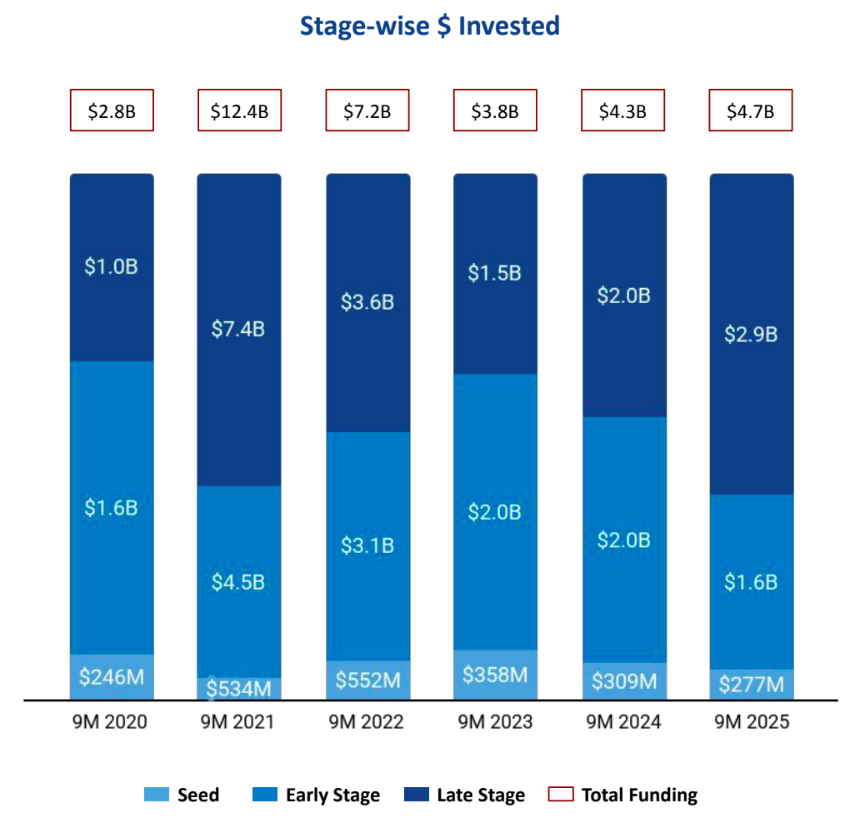

Funding activity across stages in Canada showed mixed momentum during 9M 2025. Seed-stage funding stood at $277M, reflecting a 10% decline from $309M in 9M 2024 and a 22% drop from $358M in 9M 2023. Early-stage funding reached $1.6B, registering a 20% decline compared to $2.0B raised in both 9M 2024 and 9M 2023, suggesting a slowdown in investments targeting growth-phase startups. Late-stage funding, however, gained strong traction, amounting to $2.9B, a 46% increase from $2.0B in 9M 2024 and a 99% rise compared to $1.5B in 9M 2023, underscoring solid investor confidence in mature ventures.

Enterprise Applications, Enterprise Infrastructure, and Environment Tech emerged as the top-performing sectors in Canada during 9M 2025. The Enterprise Applications sector recorded total funding of $2.9B, marking a 10% rise compared to $2.6B in 9M 2024 and a 29% increase from $2.3B in 9M 2023. The Enterprise Infrastructure sector stood out as a key catalyst for Canada’s tech funding growth in 9M 2025, securing $1.1B, more than 19x and 23x increase from the same period of 2024 and 2023 respectively. The jump was primarily driven by 5C’s $835M round, which dominated the sector’s total and signaled strong investor conviction in scalable infrastructure solutions. Meanwhile, the Environment Tech sector attracted $769M, registering a 127% increase from $338M in 9M 2024 and a rise of over 30% compared to $594M in 9M 2023.

Canada recorded 10 funding rounds exceeding $100M in 9M 2025, up slightly from 9 such rounds in both 9M 2024 and 9M 2023. Leading the list, 5C raised $835M in a PE round, followed by Cohere, which secured $500M in a Series D round, and Kardium, which raised $250M in a Series C round. Other notable companies crossing the $100M mark included StackAdapt and Hydro Ottawa, highlighting continued investor confidence in large-scale funding opportunities across the Canadian tech ecosystem.

Canada’s IPO activity moderated in 9M 2025, with four companies going public compared to 10 in 9M 2024 and seven in 9M 2023, reflecting a slowdown in new listings. The companies that debuted on the public markets during this period were Atlas Energy Corp, Neural Therapeutics, Pioneer AI Foundry, and Lotus Creek. Unicorn activity remained muted in 9M 2025, with no new unicorns emerging during the period, compared to one each recorded in 9M 2024 and 9M 2023.

Canada’s M&A activity slowed in 9M 2025, with 97 acquisitions recorded during the period, representing a 22% decline from 124 acquisitions in 9M 2024 and a 19% drop from 120 acquisitions in 9M 2023. The period was marked by several high-value transactions, led by Thoma Bravo’s $12.3B acquisition of Dayforce, the largest deal of the year, followed by CB Biotechnology’s $254M acquisition of Theratechnologies.

Funding activity in Canada was concentrated around key innovation hubs. Toronto-based tech firms accounted for 39% of the total funding raised across the country, while Montreal-based companies contributed 24% of overall investments during 9M 2025.

Investor participation in Canada’s tech ecosystem remained active and well-distributed across all funding stages in 9M 2025, reflecting sustained investor confidence and engagement across the country’s startup landscape. Y Combinator, BoxOne Ventures, and Panache Ventures emerged as most active investors at the seed stage, supporting early innovation and startup formation. At the early stage, OMERS, Framework Venture Partners, and T1D Fund played a leading role in driving growth-focused investments. Meanwhile, CGF, Sapphire Ventures, and Durable Capital Partners led activity at the late stage, backing the country’s expanding pool of mature tech companies.

The Canada tech ecosystem showed steady momentum in 9M 2025, with overall funding increasing from the previous period, supported by a strong rebound in late-stage investments. Robust activity across Enterprise Applications, Enterprise Infrastructure, and Environment Tech reflected continued investor focus on scalable enterprise solutions and innovation-driven sectors. Although no new unicorns emerged and IPO and acquisition activity moderated, the consistent funding growth highlights the resilience and maturity of Canada’s tech landscape during the period.