Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: Canada Tech Q3 2024. The report, based on Tracxn’s extensive database, provides insights into the Canada Tech space.

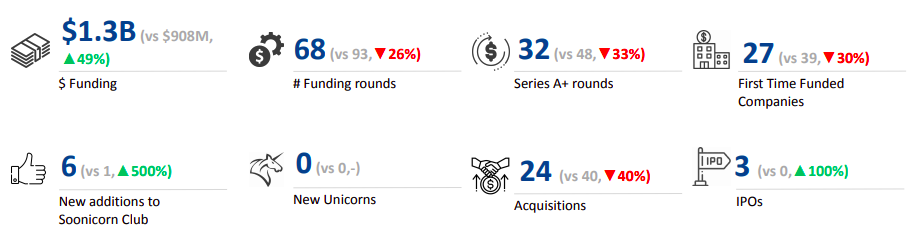

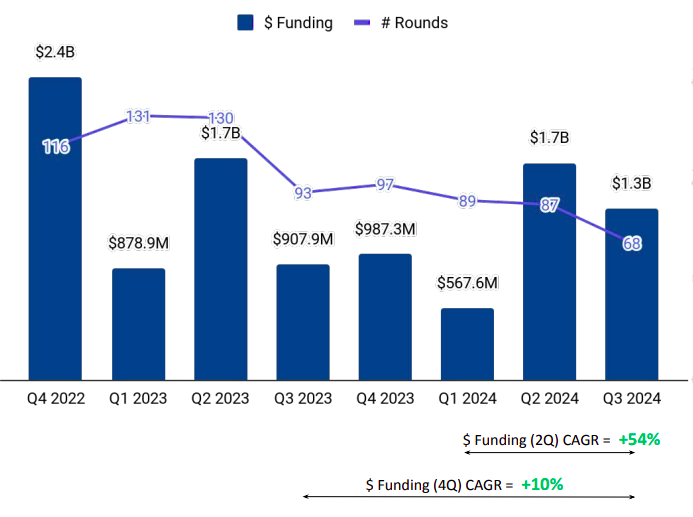

In terms of startup funding, Canada is the sixth highest funded country in Q3 2024. Funding raised by Canadian tech startups rose 48.28% to $1.35 billion in Q3 2024 from $908 million in the corresponding quarter last year (Q3 2023). However, this is a 20.99% drop compared with the $1.7 billion raised during the previous quarter (Q2 2024).

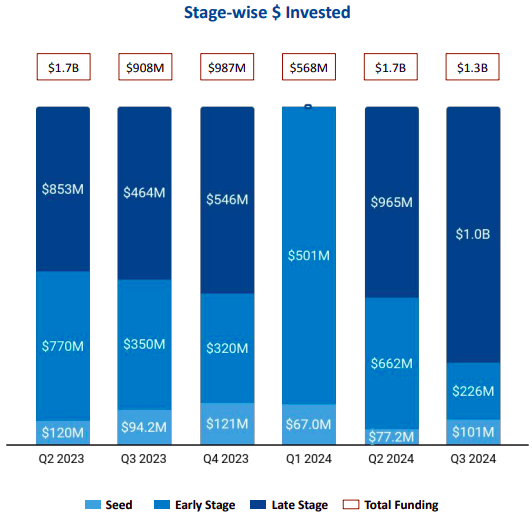

The sector secured late-stage funding worth $1.02 billion in Q3 2024, a 119.76% jump from $464 million raised in Q3 2023. Seed-stage funding grew 7.1% to $101 million in the third quarter of 2024, from $94.2 million raised in Q3 2023. Early-stage investments also fell 35.49% to $226 million in Q3 2024, from $350 million raised in the corresponding quarter last year.

Most Canadian tech startups raised smaller-sized rounds in Q3 2024. Clio was the only company that managed to raise more than $100 million in Q3 2024, securing $900 million in a Series F round led by New Enterprise Associates, valuing the company at over $3 billion.

The top-performing sectors in Q3 2024 were Enterprise Applications, High Tech and Life Sciences. Funding raised in the Enterprise Applications space saw a 125% surge in Q3 2024 compared with Q3 2023. Funding raised by the High Tech segment fell 58% in Q3 2024, compared with the corresponding quarter in 2023. Funding raised by companies in the Life Sciences space grew 97% in Q3 2024, compared with Q3 2023.

There was also an absence of new unicorns during the third quarter of this year. The number of acquisitions stood at 24 in Q3 2024, significantly lower than 35 in Q2 2024 and 40 in Q3 2023. Some of the acquired companies include Givex, Book4Time and Trader, which were bought by Shift4, Agilysys and AutoScout24, respectively in Q3 2024.

Three Canadian tech startups - Windfall Geotek, NextGen and BrandPilot AI - went public in Q3 2024. This is an improvement from the lack of IPOs in Q3 2023 and Q2 2024.

Burnaby took the lead in city-wise funding in the third quarter of this year, due to Clio’s $900 million funding round. This is followed by Toronto ($118.7 million) and Vancouver ($96.2 million) at a distant second and third, respectively.

Real Ventures, Y Combinator, and Inovia Capital were the all-time top investors in the Canadian tech ecosystem. Inovia Capital, MaRS Investment Accelerator Fund and Diagram Ventures were the top seed-stage investors in the Canada Tech landscape in Q3 2024. TCV, CapitalG and Tidemark were the top late-stage investors during the same period, while Industry Ventures, Greensoil PropTech Ventures and Thrive Capital were the top early-stage investors.

The startup ecosystem in Canada is facing challenges but remains vibrant and dynamic. The country's strong tax environment and supportive government policies continue to attract and retain top talent and investment.

(Data for Q3 2024 has been taken from Jul 1, 2024 - Sep 16, 2024)