Tracxn has released its Canada Tech H1 2025 Funding Report, providing a detailed snapshot of the country's tech investment landscape during the first half of 2025. Canada emerged as the 6th highest funded country globally, surpassing China and France, which ranked 7th and 8th respectively. While overall funding experienced a decline compared to the previous half-year, growth in sectors like Environment Tech and FinTech signaled renewed investor interest in sustainability-driven innovation.

&zN8wj;

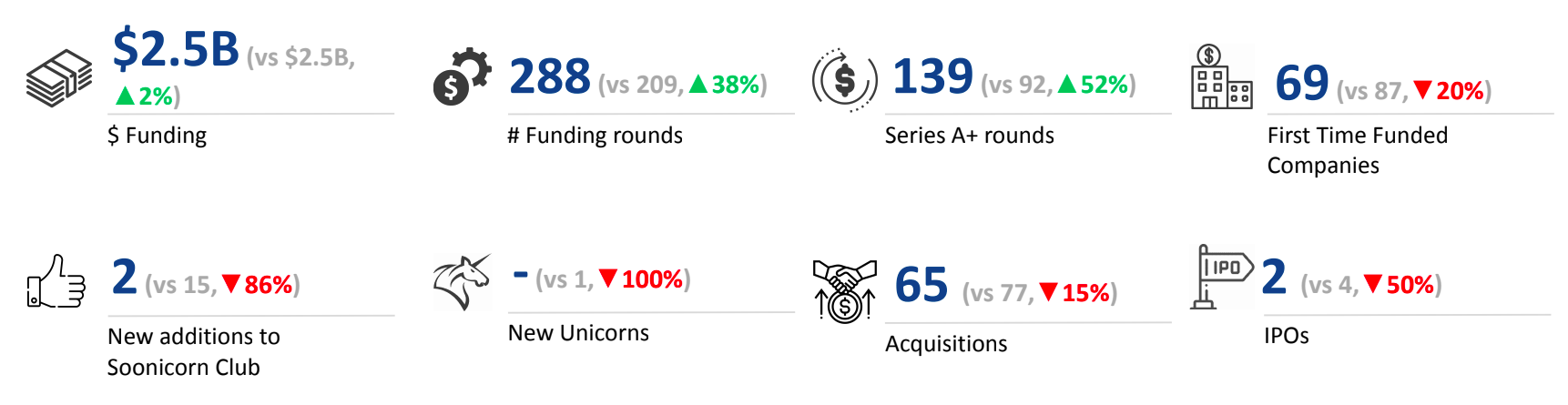

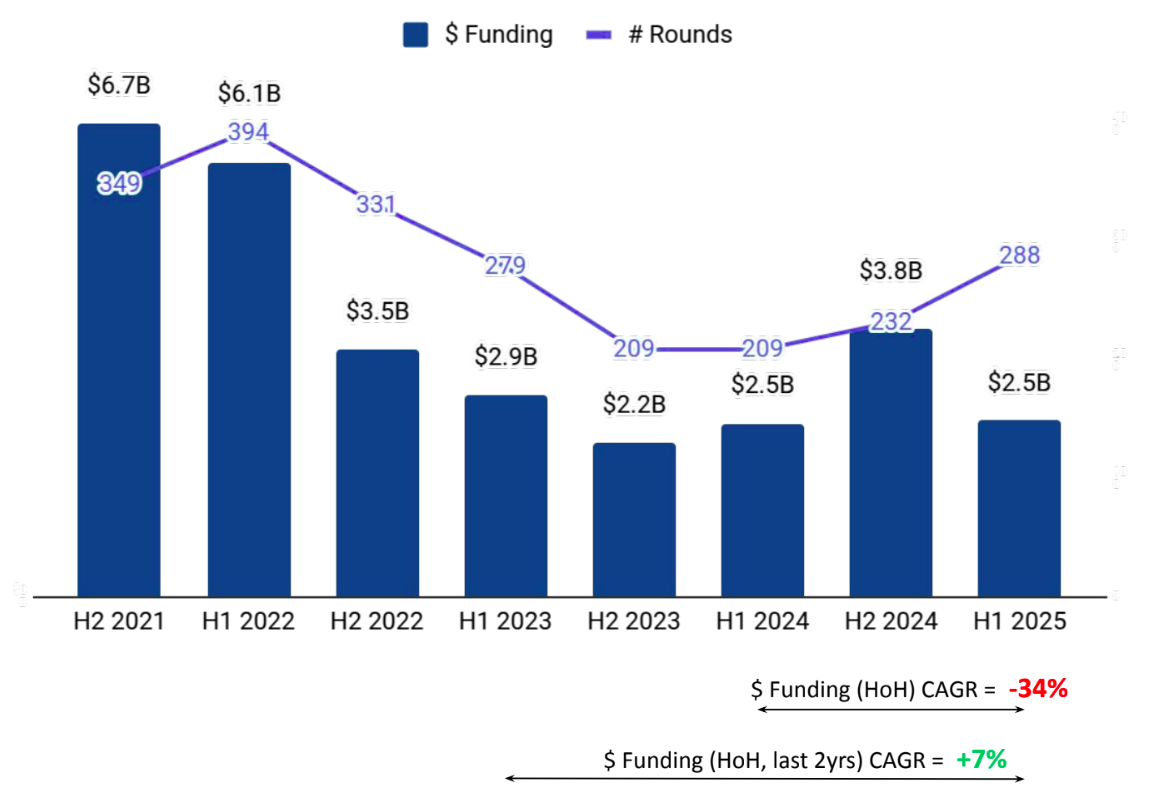

A total of $2.5B was raised in H1 2025, marking a 34% decline from the $3.8B raised in H2 2024. However, this represents a modest increase of 2% when compared to the $2.46B raised in H1 2024. Despite the quarterly downturn, the year-on-year rise reflects a stabilizing trend in capital inflow for Canadian tech companies.

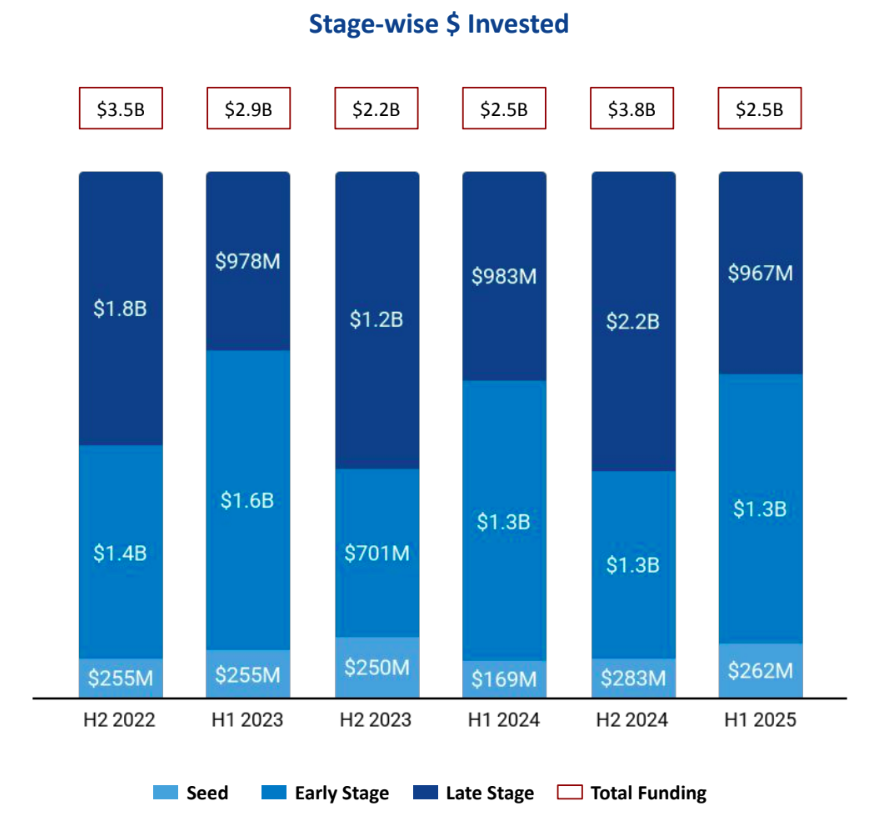

Seed Stage funding totaled $262M in H1 2025, a drop of 8% from $283M in H2 2024, yet a significant 55% increase compared to $169M in H1 2024. Early Stage funding stood at $1.26B, down 5% from $1.34B in H2 2024 and a 3% decrease from $1.3B in H1 2024. Late Stage funding reached $967M in H1 2025, reflecting a substantial 55% drop compared to $2.2B in H2 2024 and a 2% decline from $983M in H1 2024.

Sports

Enterprise Applications, Environment Tech, and FinTech emerged as the top-performing sectors in H1 2025. The Enterprise Applications sector saw $1.1B in funding, down 61% from $2.9B in H2 2024 and 17% lower than the $1.3B recorded in H1 2024. Environment Tech attracted $638M, marking a 233% increase from $192M in H2 2024 and a 160% rise from $245M in H1 2024. FinTech recorded $428M in funding, reflecting a sharp 45% increase from $295M in H2 2024 and a 42% rise from $301M in H1 2024.

Canada had five $100M+ funding rounds in H1 2025, matching the count from H2 2024 but falling short of the seven recorded in H1 2024. Companies like StackAdapt, Hydro Ottawa, Hydrostor, Tailscale, and Aspect Biosystems secured funding above $100M during the period. StackAdapt raised a total of $235M in a Series B round. Hydro Ottawa secured $234M in an Unattributed round, while Hydrostor raised $200M in a Series D round. Neural Therapeutics and Lotus Creek were the only two companies that went public in H1 2025. No unicorns were created in H1 2025 or H2 2024, in contrast to one unicorn created in H1 2024.

Tech companies in Canada witnessed 65 acquisitions in H1 2025, a 13% decline compared to 75 in H2 2024 and a 15% decrease from 77 in H1 2024. MDA was acquired by SatixFy for $193M, marking the highest-valued acquisition during this period. This was followed by the acquisition of WonderFi by Robinhood at a price of $179M.

Toronto remained the top-funded city, accounting for 41% of all funding raised by tech firms in Canada during H1 2025. Vancouver followed, securing 15% of the total funding.

BDC, Accelerator Centre, and Techstars were the overall top investors in the Canada tech ecosystem in H1 2025. Y Combinator, BoxOne Ventures, and Diagram Ventures led seed-stage investments. Radical Ventures, OMERS, and Canapi Ventures emerged as the most active investors in early-stage deals, while CGF was the top late-stage investor during the period. Among venture capital firms, United States-based Y Combinator led the highest number of investments with 31 rounds. Canada-based fund Amplify Capital added 2 new companies to its portfolio.

The Canada tech ecosystem remained resilient in H1 2025, ranking 6th globally in total funding. While overall capital inflow declined from the previous half-year, strong performances in sectors like FinTech and Environment Tech signaled renewed investor confidence. Despite a dip in late-stage investments and absence of unicorn creation, the market showed momentum in IPO activity and consistent participation in $100M+ deals. Toronto and Vancouver continued to dominate funding distribution, backed by robust investor activity from both domestic and international players.