Tracxn, a SaaS-based market intelligence platform, has released a report providing a comprehensive overview of the Clean Energy Tech startup ecosystem in the United Kingdom. This sector encompasses tech companies focused on generating energy from natural and renewable sources (including solar, wind, hydro, biomass, and organic hydrogen), as well as technologies for efficient clean energy transmission and environmentally sound storage.

To date, approximately 280 Clean Energy Tech startups have been founded in the UK. Over the last decade (2016–2025 YTD), more than 125 new startups have emerged, constituting nearly 45% of the total ecosystem. Renewable Energy Tech is the dominant category with 145 active startups, forming the backbone of the sector. Smart Grid technologies follow with 62 active startups, while Energy Storage Tech, with 29 active startups, is a critical enabler for scaling renewable energy adoption.

Of the 210+ active startups, over 100 are funded. Around 80 of these have secured Seed or later funding, with nearly 40 reaching Series A or beyond.

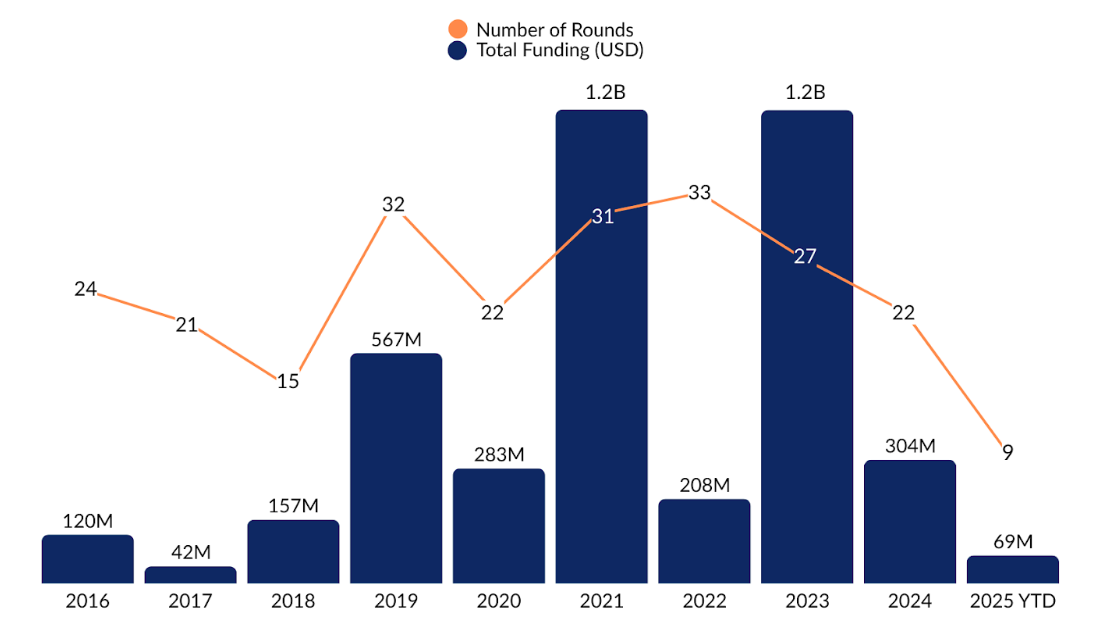

The UK Clean Energy Tech space has cumulatively attracted $4.3B in all-time equity funding across 289 rounds. Funding activity has been cyclical over the past decade (2016-2025 YTD), starting at $119.8M in 2016 and spiking to peak highs of $1.2B in both 2021 and 2023, before leveling off in 2024. The significant funding in 2021 was largely driven by Octopus Energy’s landmark mega deals of $655M and $300M, both raised in Series E rounds.

Leading the funding chart is Octopus Energy with nearly $2.0B raised, a figure that underscores strong support for its low-carbon technologies, especially heat pumps, and international expansion. OVO Energy follows with $516M, focusing on repowering the UK's onshore wind farms, and Oxford Photovoltaics has raised $202M, pioneering breakthroughs in perovskite solar technology.

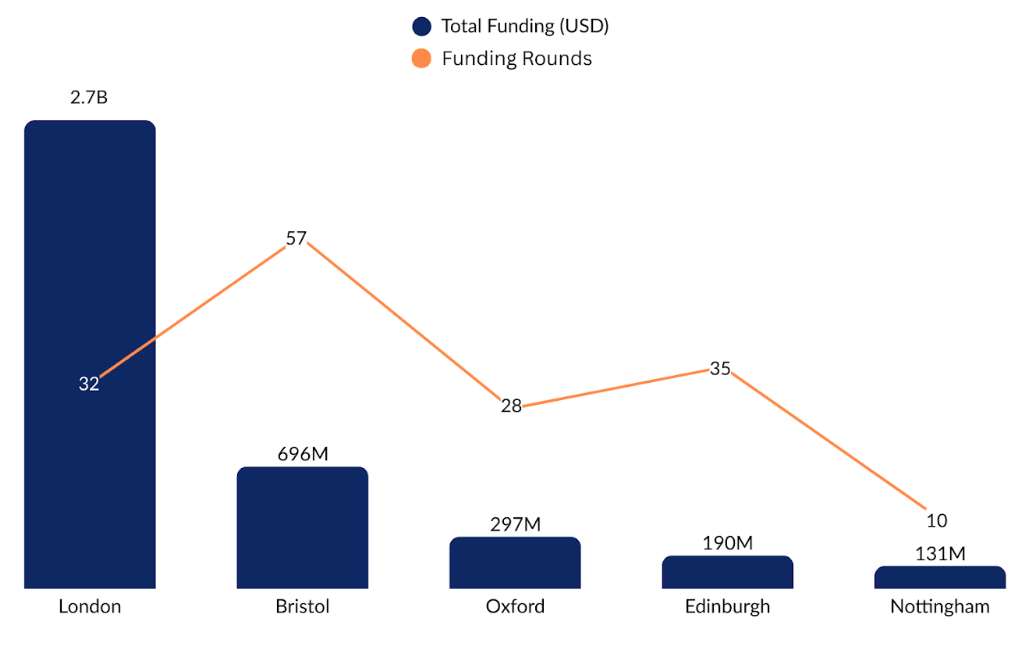

Geographically, London is the leading hub, having secured $2.7B in total funding to date (as of 2025 YTD), primarily driven by Octopus Energy ($2.0B) and Highview Power ($143M). Bristol is the second-most funded city, with $696M raised (as of 2025 YTD), led by OVO Energy ($516M) and Kaluza ($100M).

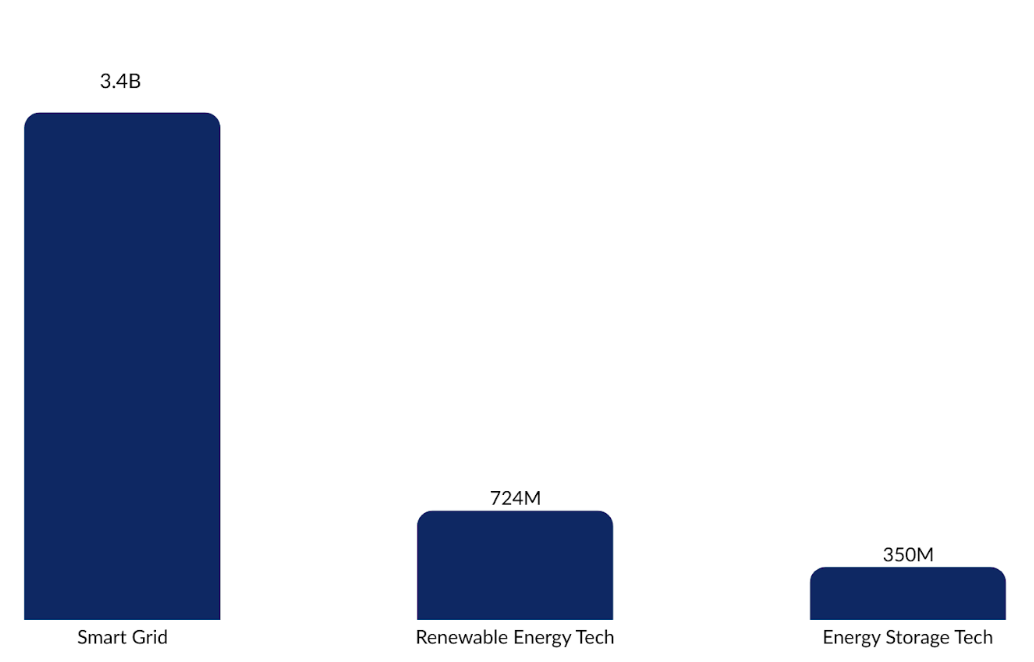

Sectorally, the Smart Grid sector holds the highest all-time funding at $3.4B. This is followed by Renewable Energy Tech with $724M and Energy Storage Tech with $350M.

Around 90 VCs have invested in the UK's Clean Energy Tech to date (until 2025 YTD). BGF is the most active investor with 6 rounds, followed by Par Equity, Green Angel Ventures, and Metavallon with 5 rounds each. In the period 2016–2025 YTD, the number of first-time VCs equaled or exceeded the count of existing investors in four of the ten years (2018, 2019, 2020, and 2023), indicating sustained new investor interest.

The UK Clean Energy Tech ecosystem has produced two unicorns so far: Octopus Energy and OVO Energy. The sector has seen 20 acquisitions to date, with no startups achieving an IPO.

The UK Clean Energy Tech ecosystem is founded on a strong base of $4.3B in cumulative funding, with over a decade of activity seeing cyclical peaks driven by major companies like Octopus Energy. Smart Grid technologies leads in total capital raised, while London remains the central hub. With two unicorns and active VC participation, the sector demonstrates maturity, though its exit landscape is currently focused on acquisitions.