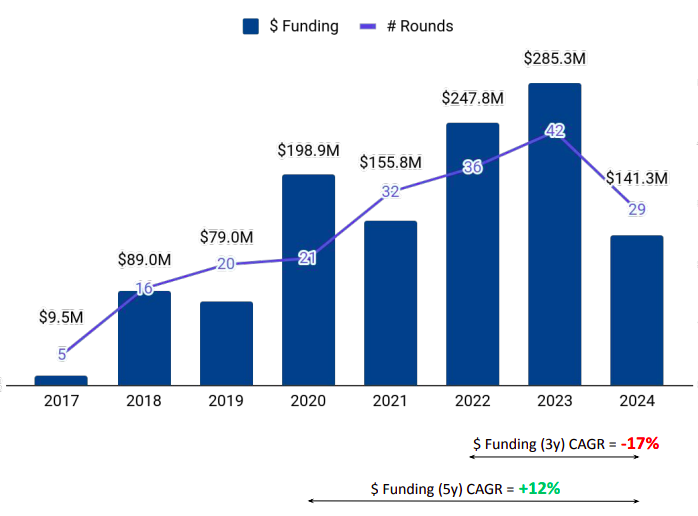

Southeast Asia’s ClimateTech sector has grown amid a challenging investment climate in the past few years, with 163 funded companies. The sector has seen a healthy amount of interest from venture capital funds, which have participated in rounds worth $1.01 billion since 2019.

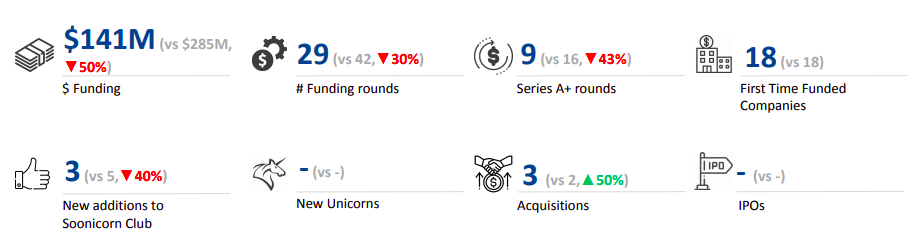

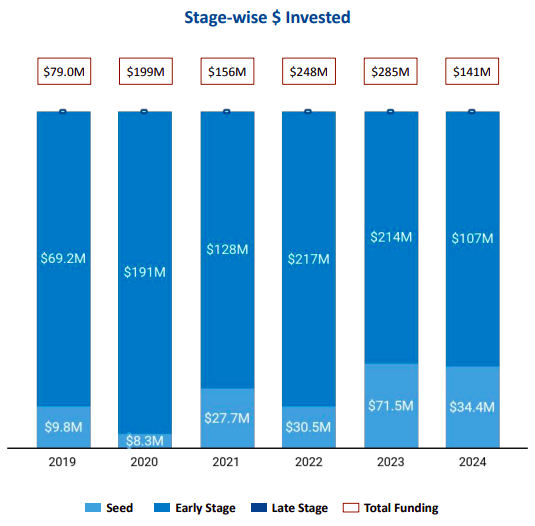

Total funding in 2024 amounted to $141 million, reflecting a 50% drop from the all-time high of $285 million in 2023 and a 43% decline compared with $248 million in 2022. Investors have become cautious due to global macroeconomic uncertainties, including elevated borrowing costs and a slowdown in demand.

The sector secured $107 million in early-stage funding in 2024, a 50% decrease from $214 million in 2023. Seed-stage funding fell 52% to $34.4 million from $71.5 million in 2023. It is worth noting that this sector has not received late-stage funding in the past decade, including 2024.

There was an absence of big-ticket rounds in 2024. SINGAUTO reported the largest round in 2024, raising $45 million in a Series A round. This was Sportsfollowed by Climate Impact X, which raised $22.3 million in a Series B funding round, and Rize, which raised $14 million in a Series A round.

Air Pollution Management Tech companies garnered $27.6 million in 2024, marking a 790% surge from $3.1 million in 2023 and an 82% rise from $15.2 million in 2022. Other top-performing segments include Smart Grid Technology and Water & Wastewater Management Tech. The Smart Grid Technology sector secured $12.5 million in 2024, with no funding in the previous two years. The Water & Wastewater Management Tech raised $2.5 million in 2024, a 47% decline compared with $4.7 million in 2023.

The sector saw three acquisitions in 2024, including ENVEA’s acquisition of Asia Pacific Air Quality (APAQ) Group for an undisclosed amount.

Singapore took the lead in terms of city-wise funding, followed by Makati and Thu Dau Mot. ClimateTech companies based in Singapore raised $126 million, while those headquartered in Makati and Thu Dau Mot raised $8 million and $4 million respectively.

SEEDS Capital, Entrepreneur First, and Wavemaker Impact were the top overall investors. Wavemaker Impact, East Ventures, and 500 Global were the top seed-stage investors in 2024, and GenZero emerged as the leading early-stage investor.

Regional Initiatives and Support

Southeast Asian governments have launched several initiatives to bolster the ClimateTech ecosystem:

● Singapore Climate Ventures (SGCV): Provides commercialization support and global expertise to startups.

● Indo-Pacific Climate Tech 100: Connects high-potential startups with investors.

● Climate Impact Innovations Challenge (CIIC): Offersunds to promising Indonesian ClimateTech ventures.

Conclusion

Despite economic uncertainties in 2024, Southeast Asia’s ClimateTech sector continues to attract venture capital interest and government support. However, the absence of late-stage funding, unicorns, and IPOs in 2024 highlights the need for renewed focus on scaling innovations and sustaining investor interest. The region’s strategic initiatives and targeted investments provide a foundation for long-term growth in tackling climate challenges.