Tracxn, a globally renowned SaaS-based market intelligence platform, today unveiled its latest report on D2C Jewellery Brands. This report provides comprehensive insights into India’s D2C Jewellery sector, covering funding raised by startups, major industry players, and the key trends shaping the landscape.

Traditionally, India’s jewellery market was largely unorganised, with local jewellers being the primary experts for customers. However, the rise of online brands has revolutionised jewellery shopping in India, fostering greater trust and expanding the market significantly. The Direct-to-Consumer (D2C) jewellery segment has seen significant global growth, with over 2,500 startups now operating in this space. Of these, more than 250 companies have successfully secured funding.

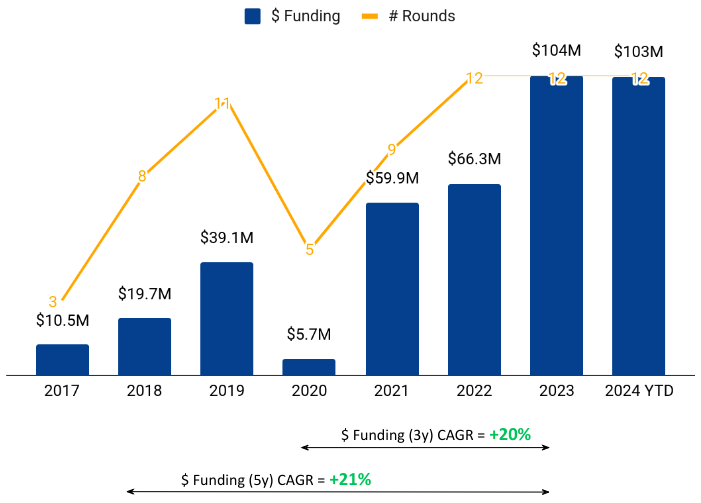

Although 2021 was the highest year for global funding in this sector, with $211 million raised, there has been a gradual decline since then. However, India has experienced an upward trend since its lowest point in 2020, reaching a peak over the recent two years (2023 and 2024 YTD) with an increase of around 1725%, rising from $5.7 million to over $100 million.

In the D2C jewellery sector, India has emerged as a significant hub, with over 550 startups out of the 2,740 globally operating in this space. In 2023, the D2C jewellery segment in India raised a total of $104 million, marking a 57% increase from the $66.3 million secured in 2022. As of 2024, the segment has already garnered $103 million in funding. This surge in investment is being driven by evolving consumer preferences for personalized, convenient shopping experiences, alongside technological advancements such as virtual try-on tools and AI-powered personalization. The industry's focus on sustainability and customization has further fueled its expansion, attracting both investors and consumers alike.

India is the second-largest importer and consumer of gold in the world, following China. The sector has undergone a significant shift towards formalisation, moving away from the era when buying jewellery meant relying solely on trusted local jewellers. Today, consumers are increasingly turning to the organised market.

Commenting on the findings, Neha Singh, Co-Founder of Tracxn, said "As consumer preferences reshape the jewellery market, we stand on the brink of an era defined by innovation and reinvention. With the sector continuing to grow and mature, brands that can adapt to changing demands, focus on sustainability, and leverage digital platforms are poised to lead the next phase of growth. This is truly an exciting era of reinvention for the jewellery market, both in India and globally."

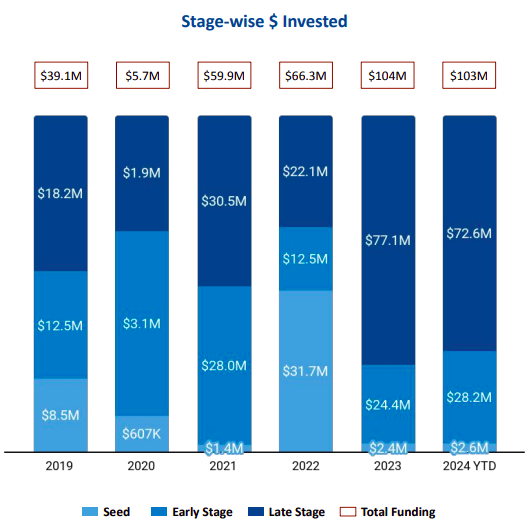

In 2023, early-stage funding reached $24.4 million, reflecting a 95% increase from the $12.5 million raised in 2022. The current year has seen further progress, with $28.2 million raised to date—the highest early-stage funding recorded in this segment. Late-stage funding followed a similar upward trajectory, with $77.1 million raised in 2023—a remarkable 249% increase from the $22.1 million secured in 2022. This set a new record for late-stage funding in the segment, and 2024 has already seen $72.6 million in late-stage investments so far. In Seed-stage funding, only $2.4 million was raised, which was a 92% decline from the $31.7 million secured in 2022. 2024 has shown a modest recovery, with $2.6 million in seed-stage funding so far.

According to the report, Q3 2024 emerged as the highest-funded quarter in the segment’s history, bringing in $71.5 million. However, no funding rounds exceeding $100 million have been recorded over the past two years.

Key players such as BlueStone, which offers subscription-based precious jewellery, raised a total of $193 million over the past two years through five consecutive funding rounds. Another notable company, Ultrahuman, a provider of smart health rings, secured $39.6 million across three consecutive rounds in the same period. The majority of companies emerging in this sector are led by highly accomplished graduates from prestigious institutions such as IIM Ahmedabad, IIT Delhi, and IIM Calcutta. These founders bring a wealth of expertise and innovative thinking, fostering a new wave of startups that are shaping the industry with their cutting-edge solutions.

While this segment has not yet produced any unicorns or IPOs, it has witnessed three acquisitions to date. In fact, the sector is thriving with soonicorns like GIVA, BlueStone, Ultrahuman, and Melorra, each driving innovation in fine jewellery and online retail, and elevating the country’s global profile.

One significant acquisition occurred in 2023, when Metaman acquired Drip Project, a D2C brand offering jewellery for both men and women, for $1 million. Additionally, Yellow Chimes, an online brand offering artificial jewellery for men and women, was acquired by GlobalBees in 2021, while CaratLane, a leading D2C jewellery brand, was acquired by Titan Company for $53.6 million in 2016.

Bengaluru, Chennai, and Mumbai have emerged as the top cities for funding in India’s D2C jewellery startup ecosystem, with Bengaluru accounting for over 77% of the total funding in this segment.

Saama Capital, Accel, and Kalaari Capital are the leading investors overall in this space. In the past two years, All In Capital, Blume Ventures, and AC Ventures have stood out as the top seed investors, while Alteria Capital, Premji Invest, and A91 Partners have dominated early-stage funding. For late-stage investments, Nava Limited, Pratithi Investments, and 360 One have been the top backers in this segment.

The roadmap ahead

In terms of innovation and growth trajectory, technological advancements have been pivotal in reshaping the consumer experience. Features like virtual try-ons and AI-driven personalization have not only heightened consumer engagement but also set new standards for the industry. Sustainability and customization have emerged as central themes, influencing consumer preferences and driving industry evolution.

On a global scale, India has taken the lead in terms of funding share within the D2C jewellery sector, surpassing the United States and Finland, accounting for over 40% of total funding. This dominance highlights India's growing significance in the global jewellery market, underlining the region's pivotal role in shaping the industry's future trajectory and innovations.