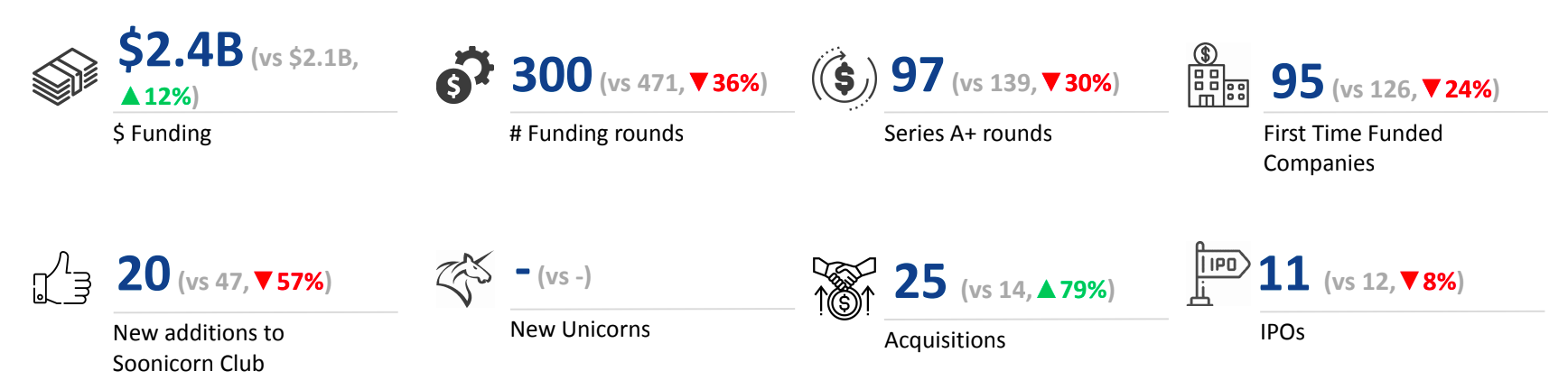

Tracxn has released its analysis of Delhi NCR’s tech funding landscape for 9M 2025, highlighting key investment movements across stages, sectors, and cities. The data shows strong late-stage momentum and continued occurrence of large-ticket deals, while early and seed-stage investments softened compared to the previous period. IPO and acquisition activity also gained visibility, further shaping the region’s tech ecosystem.

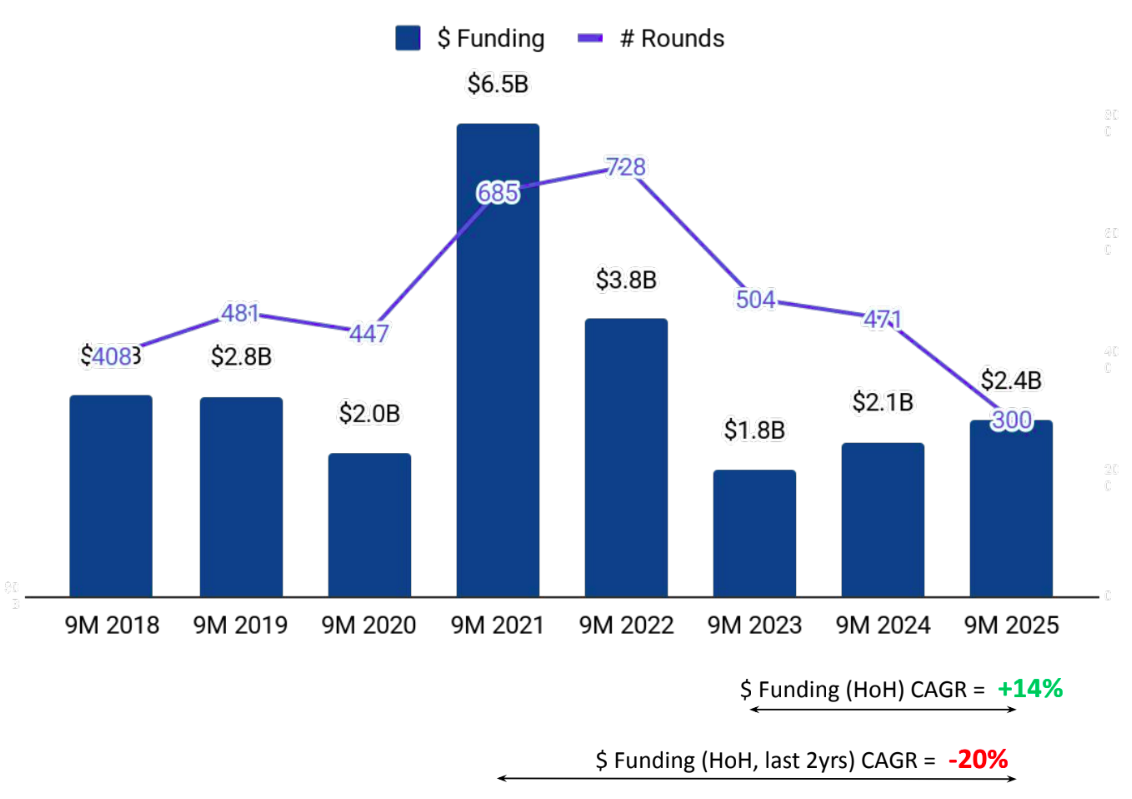

Delhi NCR tech companies raised a total of $2.4B in 9M 2025, a 12% increase compared to $2.1B in 9M 2024 and a 34% rise from $1.8B recorded in 9M 2023. The period continued to witness healthy investment participation, though shifts across funding stages and sectors played a key role in shaping overall market activity.

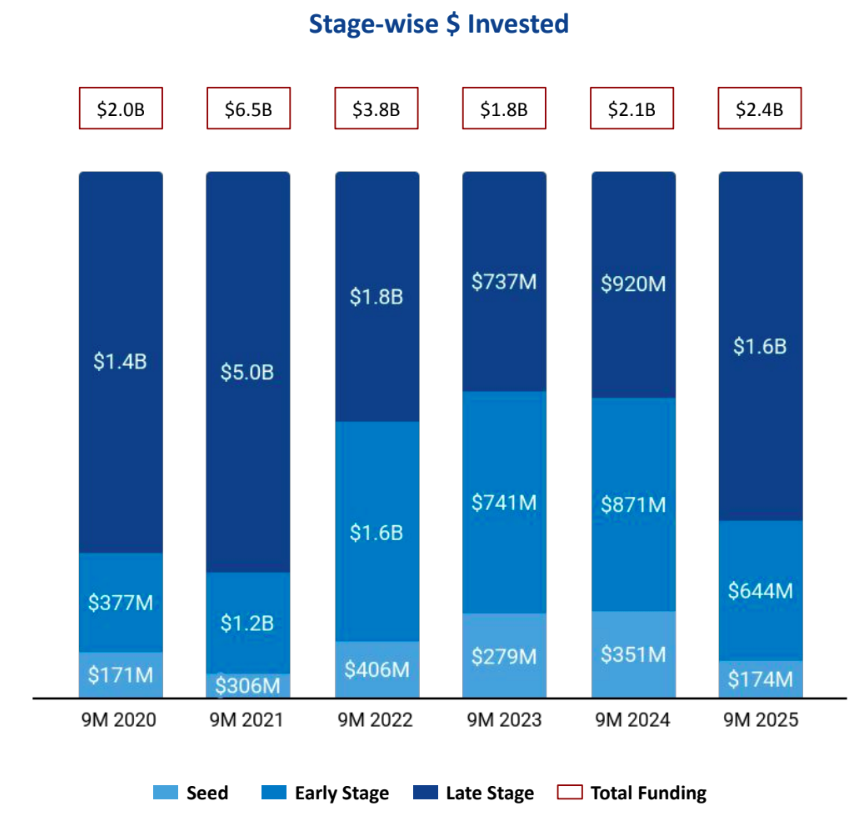

Funding activity across stages in Delhi NCR showed mixed trends in 9M 2025. Seed-stage funding stood at $174M, reflecting a 50% decline from $351M in 9M 2024 and a 38% drop from $279M in 9M 2023. Early-stage investment totaled $644M, marking a 26% decrease compared to $871M in 9M 2024 and a 13% decline from $741M in 9M 2023. In contrast, late-stage funding recorded strong momentum, reaching $1.6B in 9M 2025, a 77% rise from $920M in 9M 2024 and a 121% increase compared to $737M raised in 9M 2023.

Auto Tech, Retail, and Enterprise Applications emerged as the top performing sectors in 9M 2025. The Auto Tech sector saw total funding of $1.3B in 9M 2025, an increase of 517% compared to $218M raised in 9M 2024 and an increase of 520% compared to $217M raised in 9M 2023. The Retail sector recorded funding of $576M in 9M 2025, a decrease of 2% compared to $590M raised in 9M 2024 and an increase of 7% compared to $538M raised in 9M 2023. Enterprise Applications secured $374M in 9M 2025, a decrease of over 12% compared to $424M raised in 9M 2024 and an increase of over 3% compared to $362M raised in 9M 2023. A major part of the $100M+ deals came from Auto Tech, Retail & Aerospace, Maritime and Defense Tech.

Three $100M+ funding rounds were recorded in Delhi NCR in 9M 2025, matching the three seen in both 9M 2024 and 9M 2023. Erisha E Mobility raised $1.0B in a Series D round, Spinny secured $131M in a Series F round, and Raphe mPhibr raised $100M in a Series B round, all crossing the $100M mark. These large-ticket deals were primarily driven by the Auto Tech, Retail & Aerospace, Maritime and Defense Tech space.

The period also saw notable public market activity, with 11 IPOs in 9M 2025, down 8% from 12 in 9M 2024 but up 83% compared to 6 in 9M 2023. Companies that went public during this period included BharatRohan, Matrix-Geo, Urban Company, and Aditya Group.

Tech companies in Delhi NCR saw 25 acquisitions in 9M 2025, a rise of 79% compared to 14 acquisitions in 9M 2024 and a rise of 4% compared to 24 acquisitions in 9M 2023. Wingify was acquired by Everstone Capital at a price of $200M, making it the highest-value acquisition in 9M 2025, followed by the acquisition of Ecom Express by Delhivery at a price of $165M.

Delhi continued to lead the region’s innovation landscape, commanding 57% of all tech funding in 9M 2025, reinforcing its position as the primary hub within Delhi NCR. Gurugram followed with 34% of total investments, reflecting its sustained appeal among growth-stage and late-stage backers.

Investor participation in Delhi NCR’s tech ecosystem remained robust across stages in 9M 2025. Venture Catalysts, Inflection Point Ventures, and India Accelerator emerged as the most active investors at the seed stage, backing early-stage startups across the region. At the early stage, Vertex Ventures, Peak XV Partners, and RPSG Capital Ventures played significant roles in supporting companies scaling into their next phase of growth. At the mature end of the market, Blue Dot Partners led late-stage investment activity in the Delhi NCR tech ecosystem during the period.

The Delhi NCR tech market in 9M 2025 recorded a notable rise in overall funding, supported by strong late-stage investments and three $100M+ mega deals. Auto Tech, Retail, and Enterprise Applications led sector activity, while the region also saw increased acquisition momentum and continued IPO participation. Although seed and early-stage funding weakened, significant late-stage capital helped drive overall investment volumes and maintain Delhi NCR’s position as a major Indian tech hub.