Tracxn, a SaaS-based market intelligence platform, tracking 5M+ entities worldwide, has released a report providing a comprehensive overview of the Defence Tech startup ecosystem in Europe. This sector covers tech companies developing advanced hardware, software, and technology-enabled solutions for military and national security, including autonomous systems, AI-driven analytics, and secure communications. The report excludes traditional defense contractors and combat weapon developers.

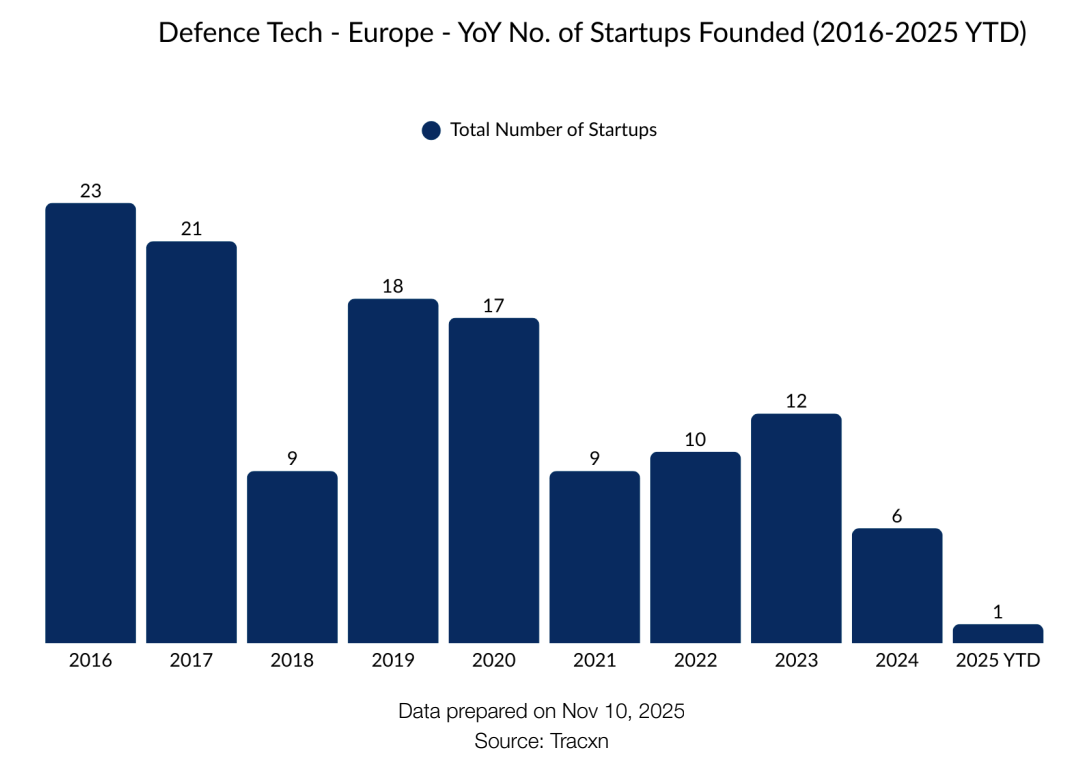

To date, approximately 384 Defence Tech startups have been founded in Europe. Over the last decade (2016–2025 YTD), 120+ new startups have emerged, constituting nearly 32% of the total ecosystem.

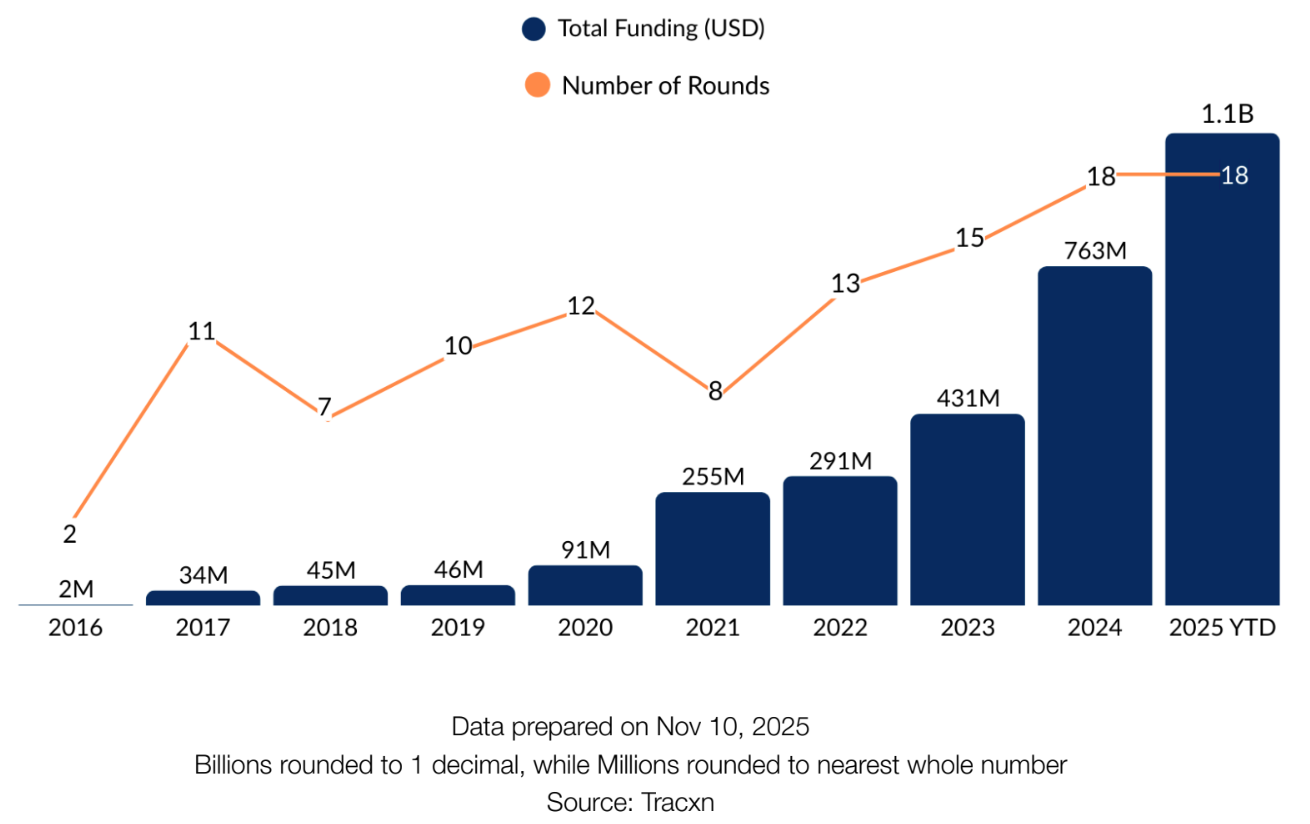

The European Defence Tech space has cumulatively attracted over $3B in all-time equity funding across 130+ rounds. Funding activity has surged over the past decade, jumping from just $2M in 2016 to a peak of $1.1B in 2025 YTD. The significant funding in 2025 was propelled by landmark mega deals, including Helsing’s $694M Series D round. The ecosystem has recorded 6 mega funding rounds ($100M+) to date, all concentrated between Helsing and Quantum Systems.

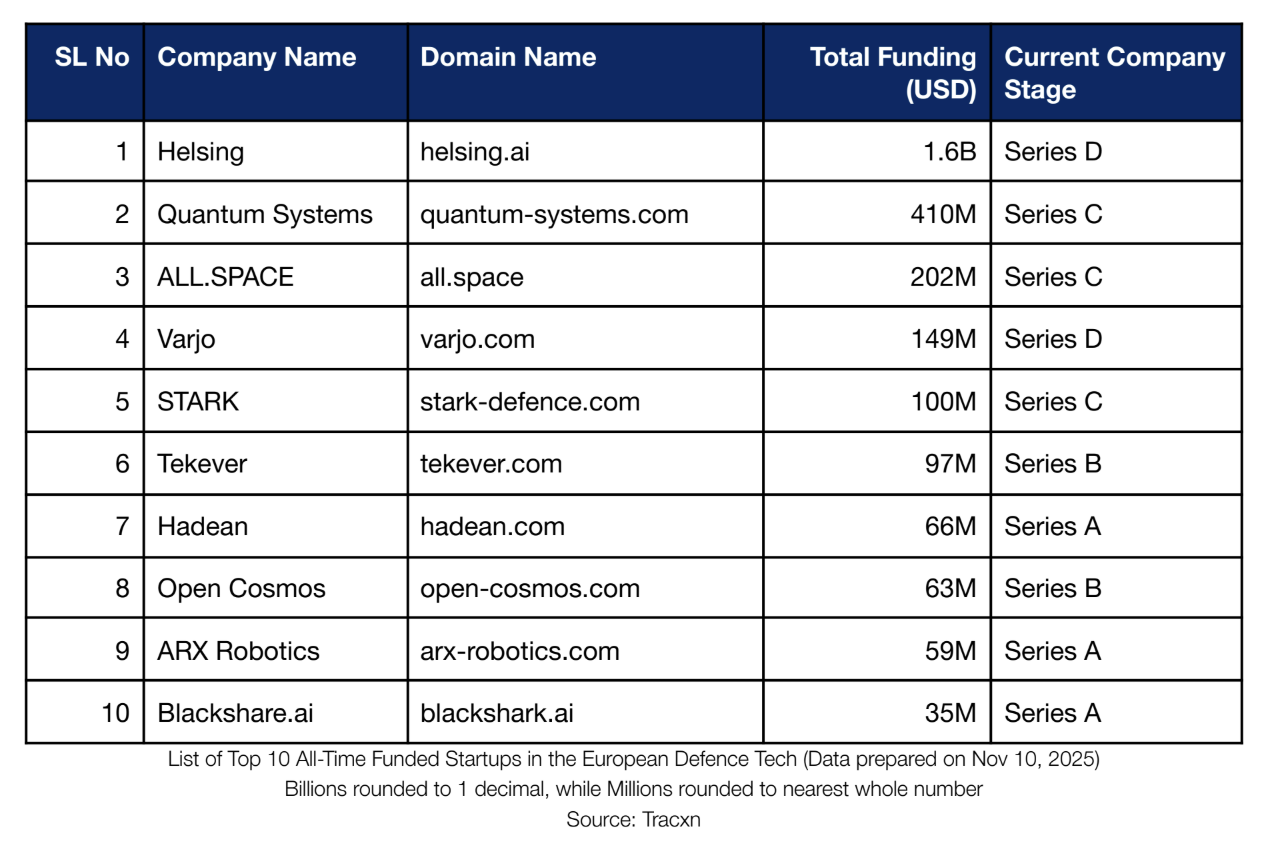

Leading the funding chart is Helsing with $1.6B raised, followed by Quantum Systems with $410M and ALL SPACE with $202M. This concentration highlights investor interest in dual-use potential, government contracts, and satellite technologies.

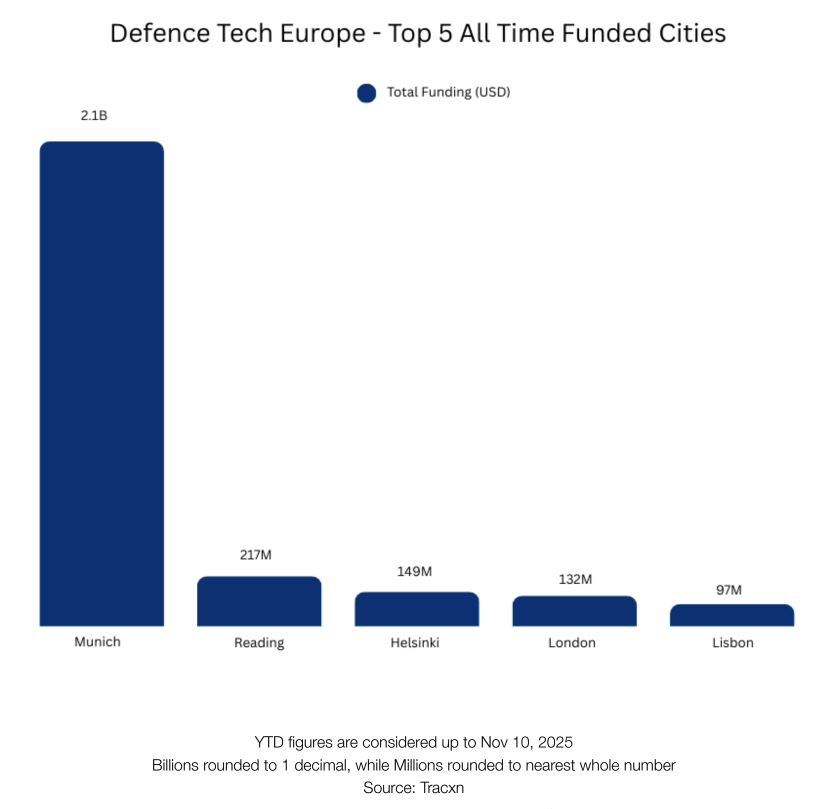

Geographically, Munich (Germany) is the leading hub for capital, having secured $2.1B in total funding to date, primarily driven by Helsing and Quantum Systems. Reading (UK) is the second-most funded city with $217M, followed by Helsinki (Finland) with $149M. In terms of active startups, London leads the region with 12 companies.

Around 119 VCs have invested in European Defence Tech to date, with nearly half (59 of 119) entering the ecosystem for the first time since 2022. Project A is the most active investor with 9 rounds, followed by the NATO Innovation Fund. In 2025 YTD, Project A led activity with 5 rounds, displacing the NATO Innovation Fund, which led in 2024 with two rounds.

Tekever, Helsing, and Quantum Systems are the three Unicorns in the European Defence Tech ecosystem, highlighting investor focus on AI-driven solutions and tech-enabled innovation.

The ecosystem has witnessed 27 acquisitions and 15 IPOs to date. Acquisitions were focused on strengthening surveillance and electronic warfare capabilities, while IPOs have been used to accelerate global expansion and increase investment in R&D.

Aided by rising defence budgets and supportive policy initiatives, the European Defence Tech ecosystem is gaining further momentum, strengthening regional defence capabilities and technological sovereignty.