Tracxn, a leading private market intelligence platform, has released its latest EV in India Annual Funding Report – 2025. The proprietary report provides key insights into India's Electric Vehicle (EV) ecosystem, highlighting funding raised by startups, development across stages and the key trends shaping the sector's landscape.

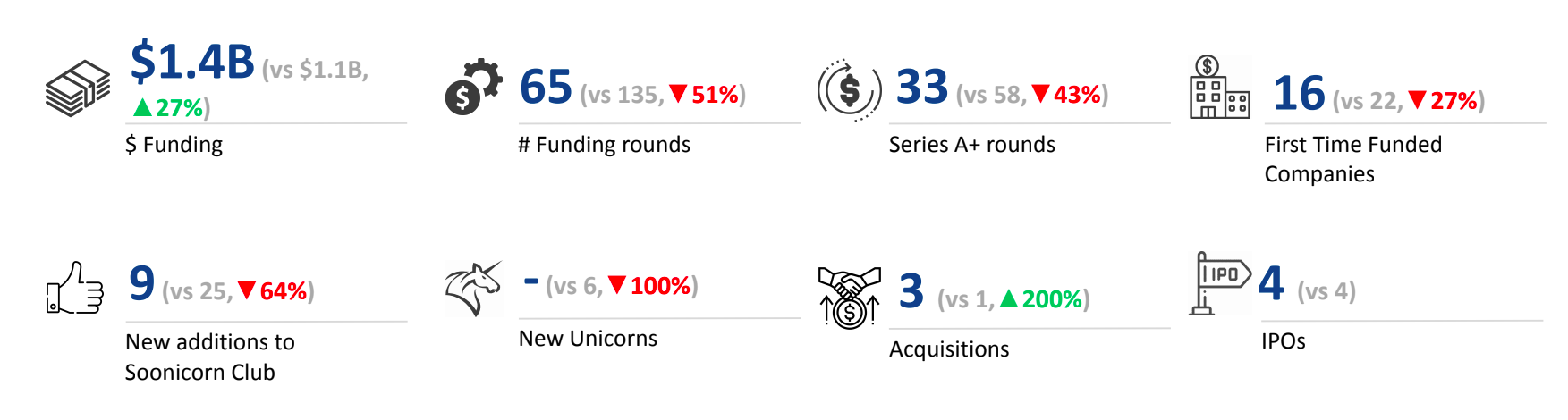

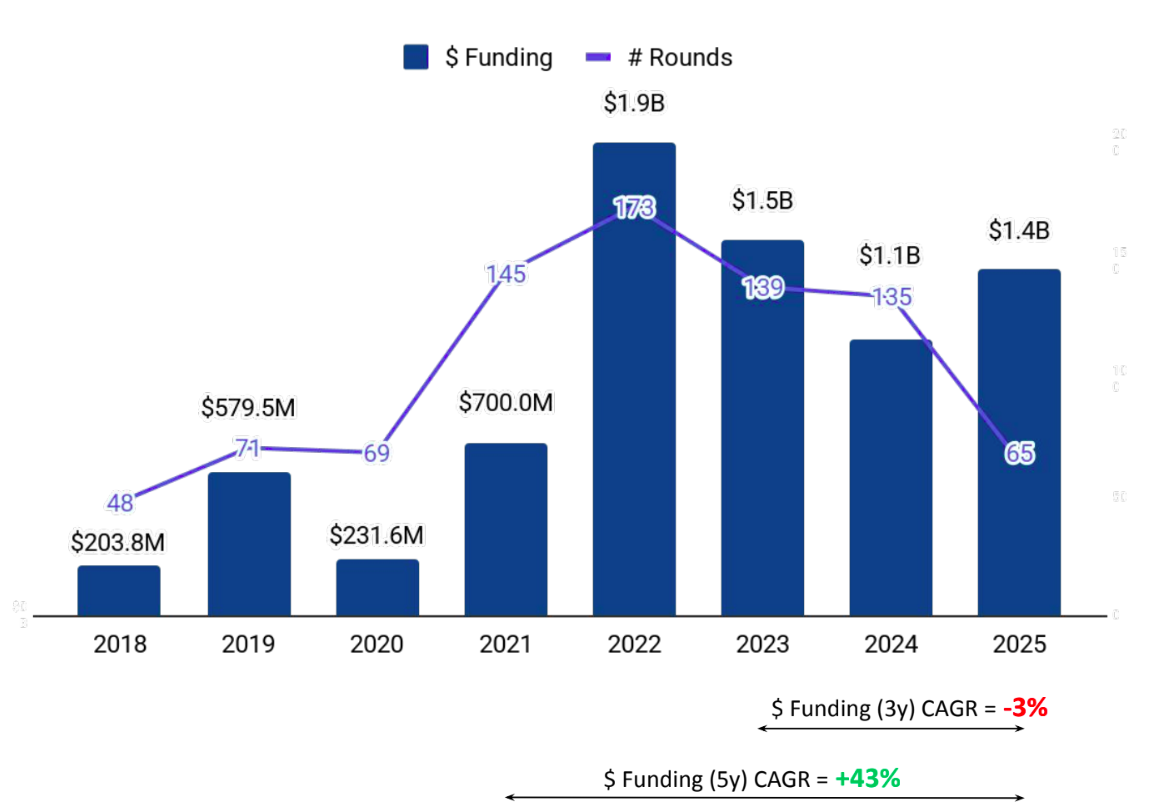

India's EV sector raised $1.4B in 2025 YTD, marking a 27% increase over the $1.1B raised in 2024. This significant capital was concentrated in just 65 funding rounds (down sharply from 135 in 2024), indicating greater investor discipline. Overall funding was dominated by Electric Vehicle Manufacturers, which raised $1.2B, with Delhi leading the city rankings with $1.1B in total funding.

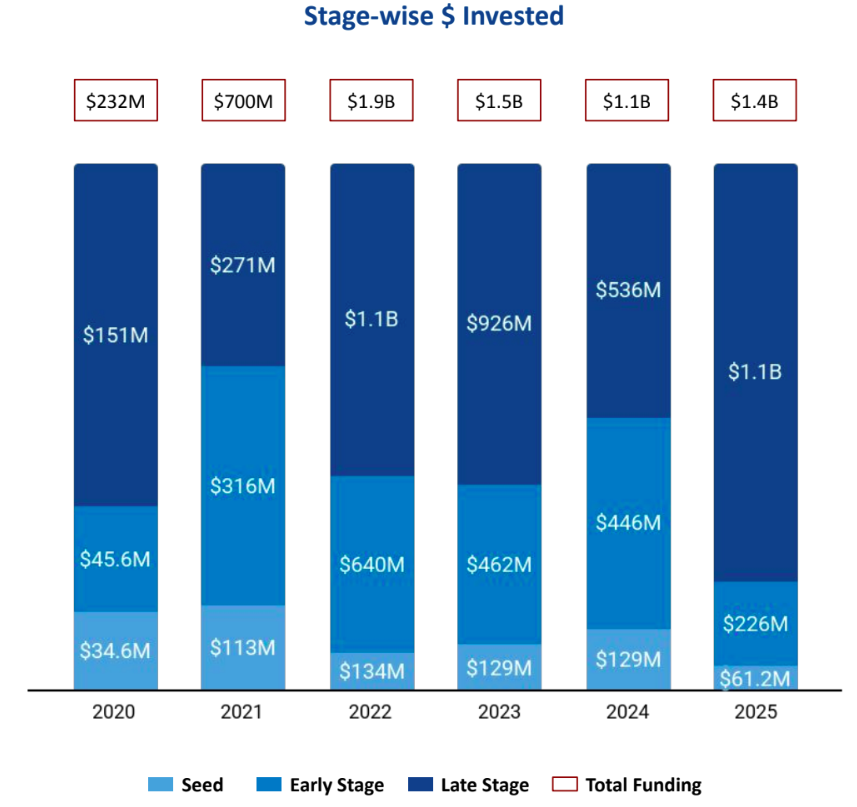

Late-Stage Funding surged by 105% YoY, rising from $536M in 2024 to $1.1B in 2025 YTD, reflecting renewed confidence in scale-ready, selective and mature startups. This indicates a transition towards performance-led capital deployment with sector maturity. Early-Stage Funding experienced a sharp contraction, dropping 49.3% YoY, from $446M in 2024 to $226M in 2025 YTD. Seed-Stage Funding also dropped sharply to $61.2M over 32 rounds in 2025 YTD, down from $129M over 77 rounds in 2024, reflecting reduced early-stage capital flow.

Commenting on the findings, Neha Singh, Co-Founder of Tracxn, said, “The strong surge in late-stage capital, driven by a billion-dollar round supporting manufacturing and charging infrastructure, signifies India’s EV ecosystem has moved beyond early experimentation to embrace a phase of measurable, scaled maturity. It’s a clear signal that global and domestic investors now see EVs not just as a climate bet, but as a commercially viable, long-horizon opportunity ”

Funding was heavily concentrated, with the top cities leading the charge in 2025 YTD. Delhi emerged as the top-funded city, raising $1.1B. Pune followed with $120M while Bengaluru secured $105M in funding.

The total number of investors declined from 150 in 2024 to 70 in 2025 YTD. First-time investors dropped from 63 in 2024 to just 32 as of November 2025 YTD. This highlights a growing reliance on existing investors. Acquisitions rose to 3 in 2025 YTD from 1 in 2024. Notable acquisitions included Astro Motors by Remsons and Grinntech Motors & Services by Yuma Energy.

The sector recorded 4 IPOs in 2025 YTD, matching the number in 2024. Ather Energy's $1.4B IPO in May 2025 being the largest.