Tracxn has released its insights on the France Tech ecosystem for 2025, outlining funding activity, sector performance, deal trends, and investor participation during the year. France emerged as the 6th highest funded country globally in 2025, ahead of Canada and Singapore at positions 7th and 8th respectively, while the United States, United Kingdom, India, China and Germany remained the only countries to record higher funding. The data highlights shifts across funding stages, sector-level investments, acquisition activity, and city-wise concentration within the French tech ecosystem.

N8

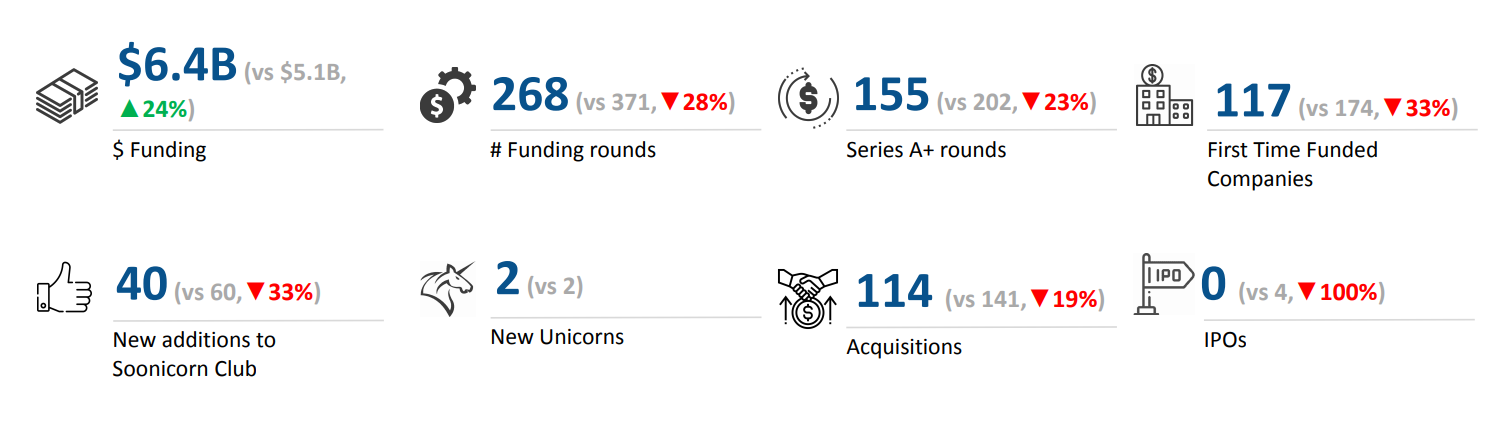

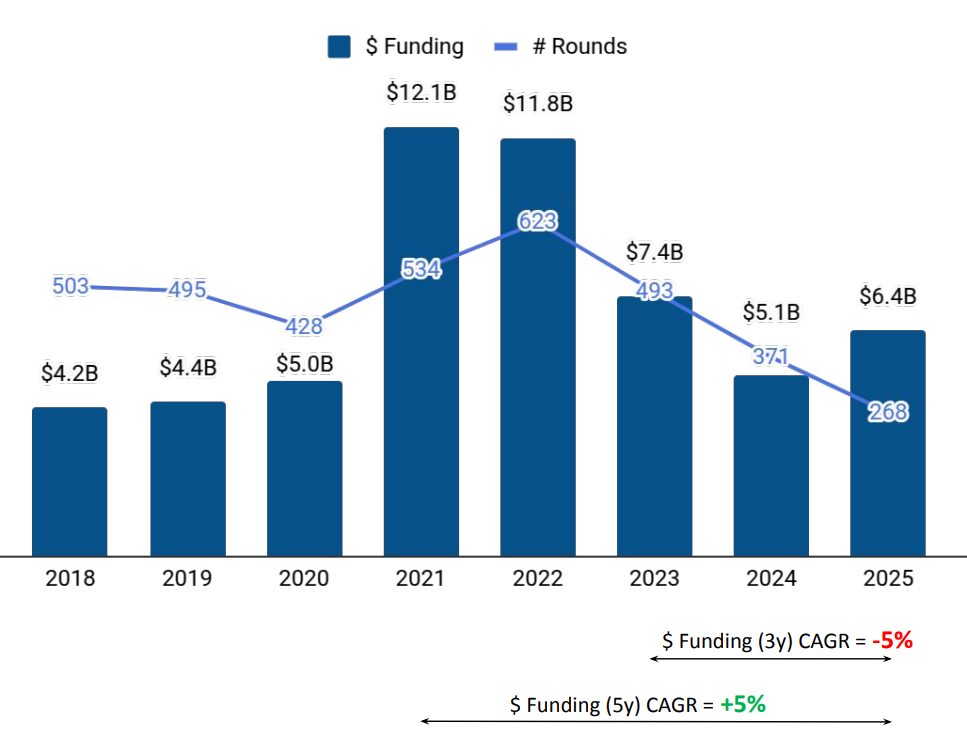

Tech companies in France raised a total of $6.4B in 2025, representing a 24% increase from the $5.1B raised in 2024. Funding levels, however, were 14% lower than the $7.4B recorded in 2023. Investment activity during the year varied across stages, with late-stage rounds accounting for a substantial share of the total capital raised.

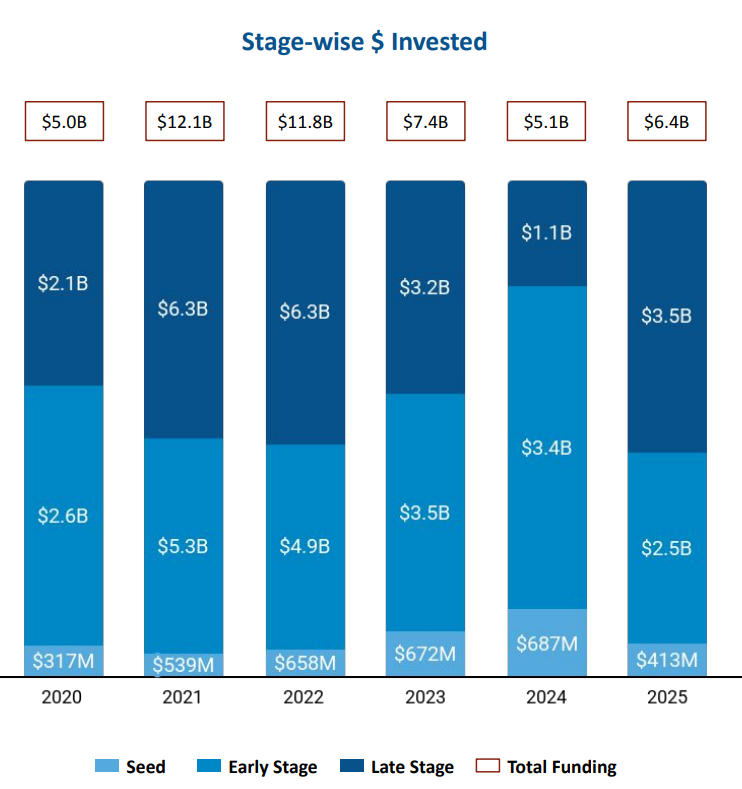

Seed Stage funding in France stood at $413M in 2025, representing a drop of 40% compared to $687M raised in 2024 and a drop of 39% compared to $672M raised in 2023. Early Stage funding totaled $2.5B in 2025, a decrease of 27% compared to $3.4B raised in 2024 and a decrease of 30% compared to $3.5B raised in 2023. In contrast, Late Stage funding reached $3.5B in 2025, registering a rise of 218% compared to $1.1B raised in 2024 and a rise of 10% compared to $3.2B raised in 2023.

Enterprise Applications, Life Sciences and FinTech were the top-performing sectors in 2025 within the France tech ecosystem. The Enterprise Applications sector recorded total funding of $4.3B in 2025, which is an increase of 47% when compared to $2.9B raised in 2024 and 2023 each. Life Sciences saw total funding of $714M in 2025, reflecting an increase of 56% compared to $459M raised in 2024, and a decrease of 14% compared to $829M raised in 2023. The FinTech sector attracted $597M in funding in 2025, which is a decrease of 43% compared to $1B raised in 2024 and a decrease of 28% compared to $824M raised in 2023.

France recorded 5 $100M+ funding rounds in 2025, compared to 8 such rounds in 2024 and 14 such rounds in 2023. Companies such as Mistral AI, Brevo, and Adcytherix raised funding above $100M during the period. Mistral AI raised a total of $2B through a Series C round, Brevo raised a total of $583M through a Series C round, and Adcytherix raised a total of $122M through a Series A round. A major part of these $100M+ funding rounds came from Enterprise Applications, Life Sciences, and Auto Tech.

France Tech recorded no IPOs in 2025, compared to 4 IPOs in 2024 and 2 IPOs in 2023. There were 2 unicorns created in 2025, in line with 2024 and 2023.

Tech companies in France saw 114 acquisitions in 2025, marking a drop of 19% compared to 141 acquisitions in 2024 and a drop of 30% compared to 162 acquisitions in 2023. La Centrale was acquired by Olx Group at a price of $1.3B, making it the highest valued acquisition in 2025. This was followed by the acquisition of Sonepar by Solar Norge AS at a price of $49M.

Paris-based tech firms accounted for 78% of all funding raised by tech companies across France in 2025. Marseille followed as the next major hub, contributing 2% of the total funding during the year.

Investor participation remained active across funding stages in 2025. Kima Ventures, Speedinvest, and Newfund led seed-stage investments within the France tech ecosystem. At the early stage, Daphni, Supernova Invest, and Kurma Partners emerged as the most active investors. Late-stage funding activity was dominated by DST Global, Woven Capital, and CapitalG, which stood out as the leading late-stage investors in France during the year.

The France tech ecosystem recorded $6.4B in funding in 2025, supported by a strong rise in late-stage investments and continued dominance of Enterprise Applications, Life Sciences, and FinTech. While seed and early-stage funding declined compared to previous years, large late-stage rounds and sustained acquisition activity shaped overall investment dynamics. France maintained its global standing as the 6th highest funded country, with Paris continuing to account for the majority of capital deployed across the ecosystem.