Tracxn has released its France Tech 9M 2025 Funding Report, showcasing major shifts in the country’s technology investment landscape. France secured its position as the world’s fifth most-funded tech market in 9M 2025, surpassing Canada and China, which ranked sixth and seventh, respectively. The United States, United Kingdom, India, and Germany were the only countries to record higher funding volumes. The report highlights renewed investor confidence in France’s tech ecosystem, driven by a surge in late-stage deals and strong activity across Enterprise Applications, FinTech, and Life Sciences sectors.

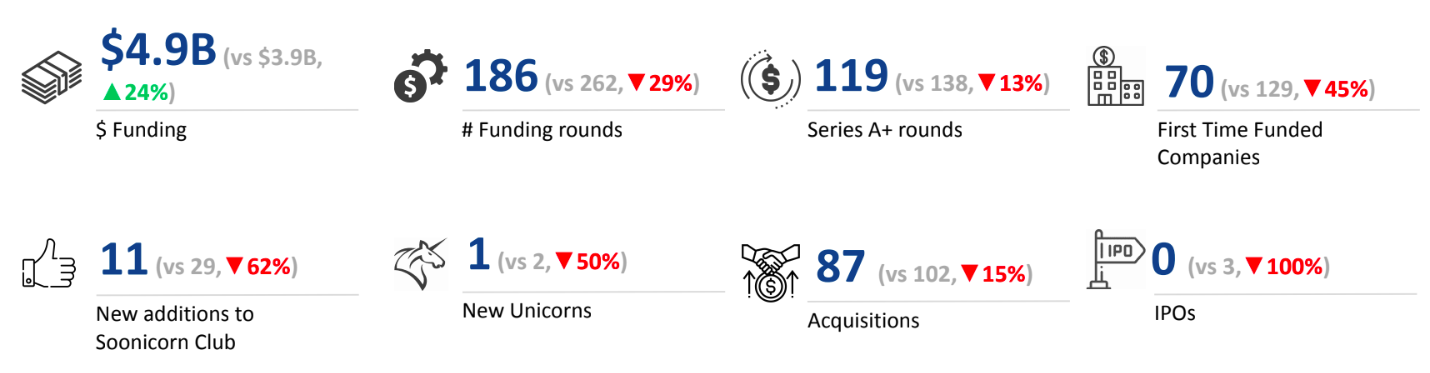

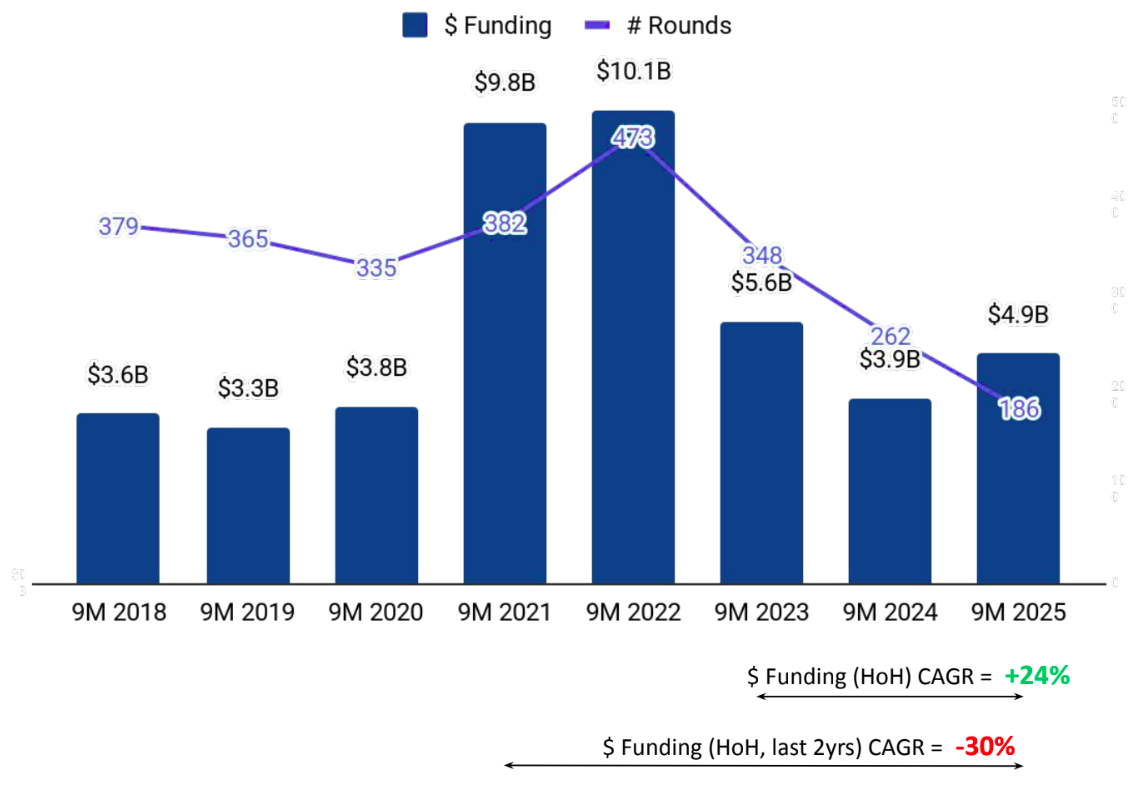

France’s tech sector raised a total of $4.9B in 9M 2025, marking a 24% increase compared to $3.9B in 9M 2024, and a 13% decline from $5.6B in 9M 2023. Despite the mixed trend, the strong rebound in late-stage investments contributed significantly to sustaining France’s overall funding momentum.

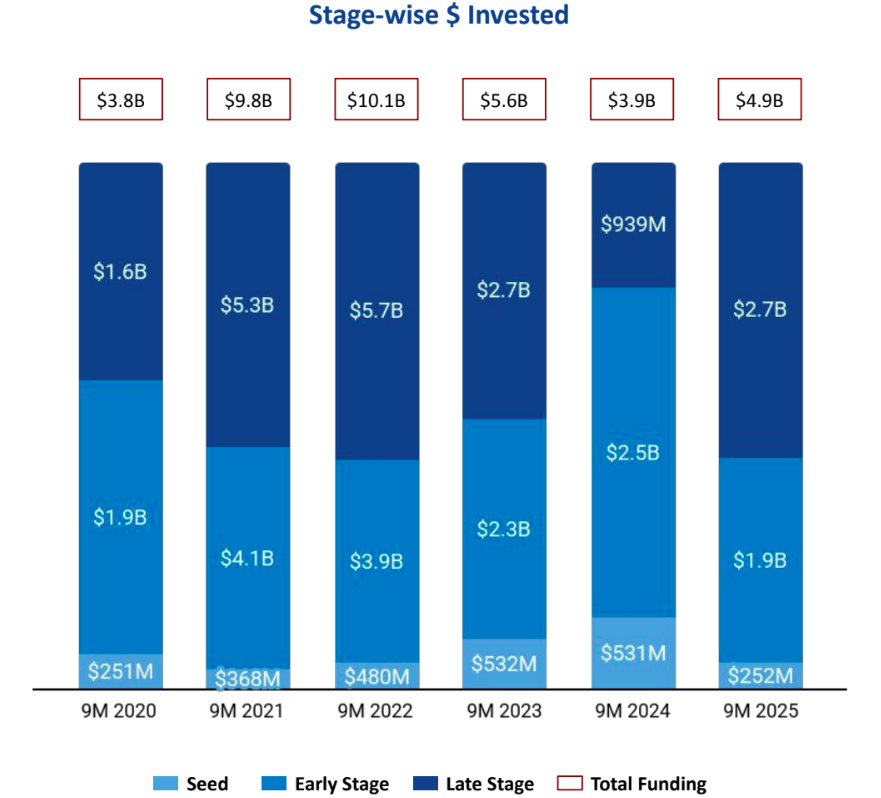

Funding activity across stages in France reflected contrasting trends in 9M 2025. Seed-stage funding totaled $252M in 9M 2025, down roughly 53% from $531M and $532M recorded in the same period of 2024 and 2023, respectively. Early-stage funding reached $1.9B, representing a 24% decrease from $2.5B in 9M 2024 and a 19% fall from $2.3B in 9M 2023. In contrast, late-stage funding showed strong momentum, climbing to $2.7B in 9M 2025, a sharp 193% rise from $939M in 9M 2024 and maintaining the same level as in 9M 2023, underscoring robust investor appetite for mature ventures.

Enterprise Applications, FinTech, and Life Sciences emerged as the top-performing sectors in France during 9M 2025. The Enterprise Applications sector recorded total funding of $3.3B, marking a 63% rise compared to $2.0B raised in both 9M 2024 and 9M 2023. The FinTech sector saw total funding of $542M, down 37% from $863M in 9M 2024 and 14% from $632M in 9M 2023. Life Sciences attracted $474M in funding, reflecting a 32% increase compared to $361M in 9M 2024 but a 29% drop relative to $672M in 9M 2023.

Three $100M+ funding rounds were recorded in France in 9M 2025, compared to seven in 9M 2024 and thirteen in 9M 2023. Mistral AI raised $2.0B in a Series C round, WAAT secured $118M in a PE round, and Alice&Bob raised $105M in a Series B round. The $100M+ deals were primarily driven by the Enterprise Applications and Energy Tech sectors.

France’s IPO environment remained subdued, with no public listings recorded in 9M 2025, down from three in 9M 2024 and two in 9M 2023. One new unicorn emerged during the period, a 50% drop from two in 9M 2024 but consistent with the same level as in 9M 2023.

France’s M&A landscape remained active in 9M 2025, with 87 acquisitions recorded during the period. This represented a 15% decline from 102 acquisitions in 9M 2024 and a 34% drop compared to 132 in 9M 2023. Despite the moderation in deal volume, notable high-value transactions underscored continued strategic activity in the market. The largest deal was Ad Creative AI’s $38.7M acquisition by Appier Technologies, followed by Perion’s $27.5M acquisition of Greenbids.

Paris-based tech firms accounted for 81% of all funding raised by French tech companies in 9M 2025, underscoring the city’s dominance as the nation’s primary innovation hub. Cherbourg en Cotentin followed distantly, contributing 2% of the total funding during the same period.

Investor participation in France’s tech ecosystem remained broad-based across stages in 9M 2025. Kima Ventures, Speedinvest, and Better Angle emerged as the most active investors at the seed stage, supporting early innovation and startup formation. At the early stage, Daphni, Supernova Invest, and Cathay Innovation played a leading role in driving growth-oriented investments. Meanwhile, DST Global Partners, CapitalG, and Woven Capital stood out as the top late-stage investors, backing mature companies with strong expansion potential.

The France tech ecosystem demonstrated mixed trends in 9M 2025, with overall funding rising 24% year-over-year to $4.9B, largely driven by a sharp increase in late-stage investments. Enterprise Applications, FinTech, and Life Sciences continued to anchor the funding landscape, with Enterprise Applications showing notable growth. Despite declines in seed and early-stage investments, and a muted IPO environment, major funding rounds such as Mistral AI’s $2.0B Series C underscored continued investor confidence in high-value opportunities within France’s technology sector.