N8

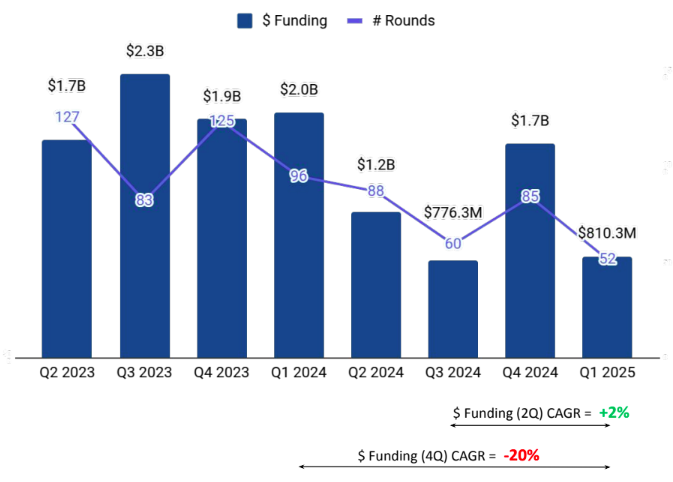

Tracxn has released its France Tech Q1 2025 Funding Report, providing a comprehensive view of the country's tech ecosystem. The report highlights a sharp decline in overall investment activity compared to previous quarters and the same period last year. While total funding dropped significantly, sectors like FinTech and Life Sciences displayed notable growth. Investor activity remained concentrated in early stages, and Paris continued to dominate as the top-funded city.

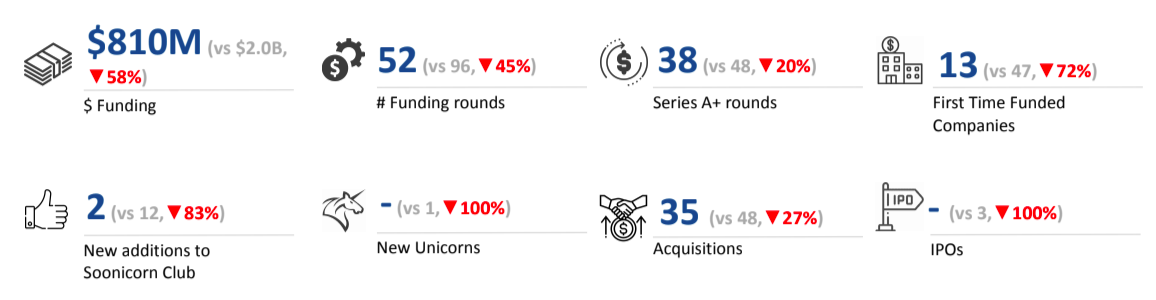

A total of $810M was raised in Q1 2025, a drop of 52% compared to $1.7B raised in Q4 2024, and a drop of 58% compared to $2.0B raised in Q1 2024. The decline reflects a broad pullback across most funding stages and sectors, with only a few segments registering gains.

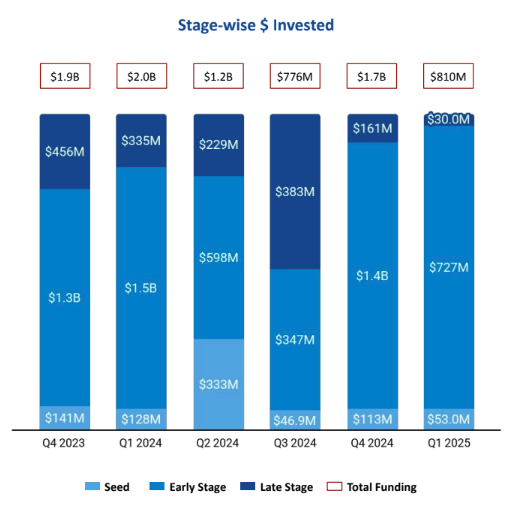

Seed Stage saw a total funding of $53M in Q1 2025, a drop of 53% compared to $113M raised in Q4 2024, and a drop of 59% compared to $128M raised in Q1 2024. Early Stage saw a total funding of $727M in Q1 2025, a drop of 48% compared to $1.4B raised in Q4 2024, and a drop of 52% compared to $1.5B raised in Q1 2024. Late Stage witnessed a total funding of $30M in Q1 2025, a drop of 81% compared to $161M raised in Q4 2024, and a drop of 91% compared to $335M raised in Q1 2024.

Enterprise Applications, FinTech and Life Sciences were the top-performing sectors in Q1 2025 in this space. Enterprise Applications sector saw a total funding of $240M in Q1 2025 which is a drop of 77% when compared to $1.1B raised in Q4 2024 and a drop of 72% when compared to $843M raised in Q1 2024. FinTech saw a total funding of $236M in Q1 2025 which is an increase of 67% when compared to $141M raised in Q4 2024 and an increase of 105% when compared to $115M raised in Q1 2024. Life Sciences saw a total funding of $211M in Q1 2025 which is an increase of 134% when compared to $90.0M in Q4 2024 and an increase of 52% when compared to $139M raised in Q1 2024.

In Q1 2025, France saw 1 100M+ round, when compared to 3 such rounds in Q4 2024 and 2 in Q1 2024. Companies like Alice&Bob have managed to raise funds above $100M in this quarter. Alice&Bob has raised a total of $105M in a Series B round. A major part of these $100M+ funding rounds are from Quantum Computing. No companies went public in Q1 2025. No unicorns were created in Q1 2025, compared to one each in Q4 2024 and Q1 2024.

Tech companies in France saw 35 acquisitions in Q1 2025, which is a 9% increase as compared to 32 acquisitions in Q4 2024 and a drop of 27% compared to 48 acquisitions in Q1 2024. Amplitude Surgical was acquired by Zydus Lifesciences at a price of $280M. This became the highest valued acquisition in Q1 2025 followed by the acquisition of AdCreative.ai by Appier at a price of $38.7M.

Paris based tech firms accounted for 79% of all funding seen by tech companies across France. This was followed by Ivry sur Seine at a distant second.

Bpifrance, Kima Ventures and Idinvest Partners were the overall top investors in France Tech ecosystem. Founders Future, Techstars and LocalGlobe were the top Seed stage investors in France Tech ecosystem for Q1 2025. Daphni, Cathay Innovation and Kurma Partners were the top Early stage investors in France Tech ecosystem for Q1 2025. Woven Capital emerged as the top Late stage investor in France Tech ecosystem for Q1 2025. Among VCs, France based Daphni led the most number of investments in Q1 2025 with 5 rounds, while United States based fund Cathay Innovation added 2 new companies to its portfolio. Late stage VC investments saw Japan based Woven Capital add 1 company to their portfolio.

The France tech ecosystem experienced a significant funding downturn in Q1 2025, with overall investments falling across most stages and sectors. Despite this, FinTech and Life Sciences emerged as strong performers, registering substantial growth. The lack of IPOs and unicorns, coupled with a reduction in $100M+ rounds, reflects a cautious investment climate. Paris maintained its lead as the dominant hub, and major acquisitions like Amplitude Surgical’s $280M deal added momentum to the M&A landscape.