Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: France Tech Q3 2024. The report, based on Tracxn’s extensive database, provides insights into the French Tech space.

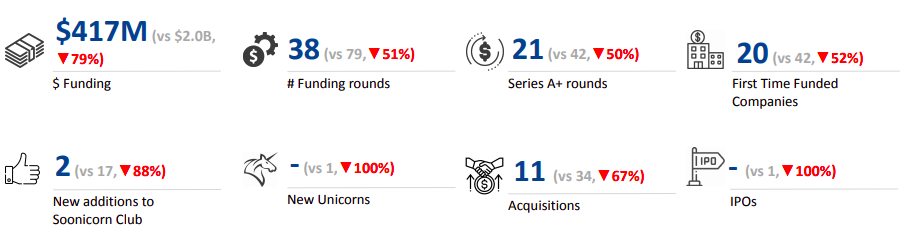

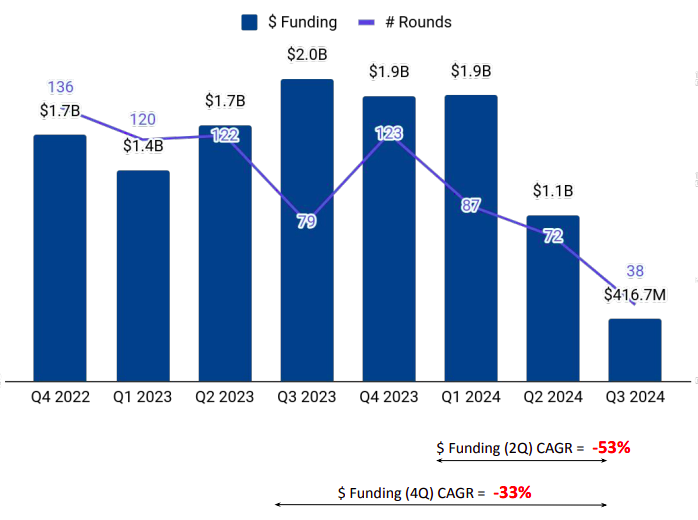

France ranked ninth globally in terms of startup funding in Q3 2024. French tech startups secured total funding of $417 million in Q3 2024, a massive decline of 79.45% from the $2.03 billion raised in the corresponding quarter last year (Q3 2023). This is also a significant drop of 62.62% compared with the $1.11 billion raised in Q2 2024.

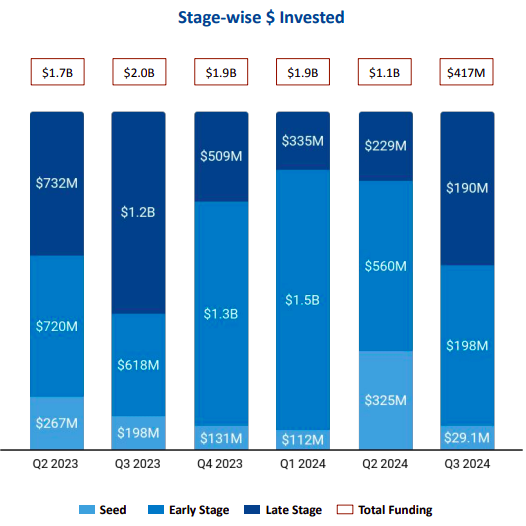

The French tech startup ecosystem witnessed late-stage funding of $190 million in Q3 2024, a sharp decline of 84.35% compared with the $1.21 billion raised in Q3 2023. Seed-stage investments fell 85.3% to $325 million in Q3 2024 from $198 million In Q3 2023. Early-stage funding, too, declined 67.97% to $198 million in Q3 2024 from $618 million raised in Q3 2023.

Akur8 raised $120 million in a Series C round led by One Peak, making it the only company to raise more than $100 million in the third quarter of this year. The quarter was uneventful in terms of activity, with an absence of new unicorns and IPOs.

High Tech, FinTech, and Enterprise Applications were the top-performing sectors in Q3 2024. Funding raised by the High Tech sector dropped 59% when compared with the previous quarter. The FinTech and Enterprise Applications sectors, too, witnessed funding declines of 20.03% and 67% respectively.

Paris dominated the funding landscape, with funding worth $261.1 million. This was followed by tech startups based in Bonneuil sur Marne and Bordeaux, which raised $35 million and $33.2 million respectively.

Kima Ventures, Idinvest Partners, and Alven were the overall top investors in the France Tech ecosystem. b2venture, JamJar Investments, and Draper Dragon were the top seed-stage investors in the France Tech ecosystem for Q3 2024, while Leadblock Bitpanda Ventures emerged as the top late-stage investor. Supernova Invest, ENGIE New Ventures, and Ring Capital were the top early-stage investors in French tech startups during the same period.

(Data for Q3 2024 has been taken from Jul 1, 2024 - Sep 16, 2024)