Tracxn has released its France Tech H1 2025 Funding Report, offering a detailed view of the country's tech investment trends in the first half of the year. France ranked as the 8th highest funded country globally in H1 2025, ahead of Singapore and Switzerland at the 9th and 10th positions respectively. Despite maintaining a place among the top 10, the overall funding landscape showed a notable decline across stages and sectors.

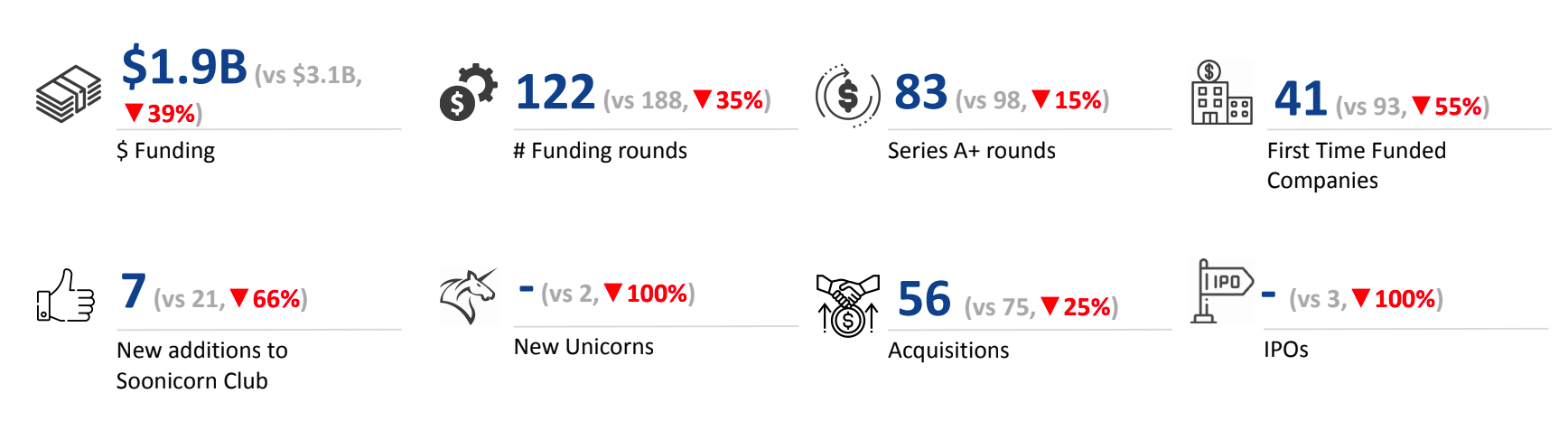

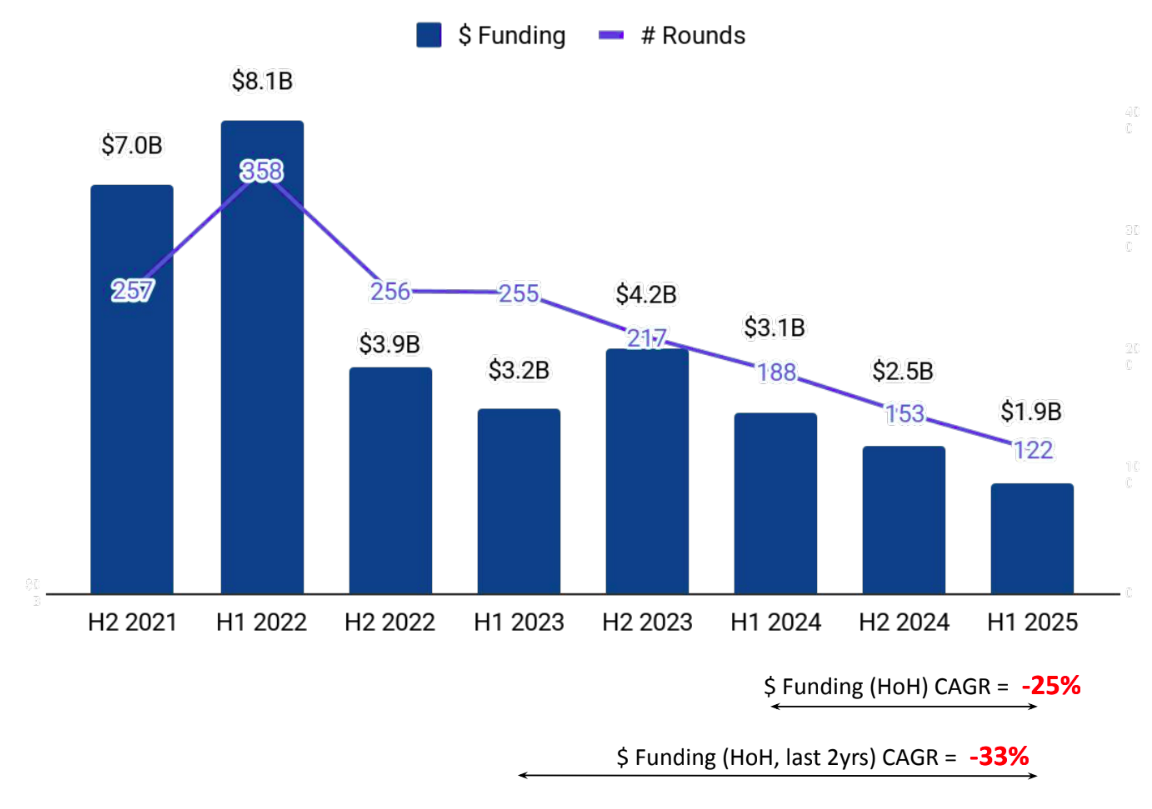

A total of $1.83B was raised in H1 2025, marking a 24% decline compared to $2.53B raised in H2 2024 and a 39% drop from $3.10B raised in H1 2024. The sharp decrease indicates a significant contraction in capital flow into the French tech ecosystem over the past year.

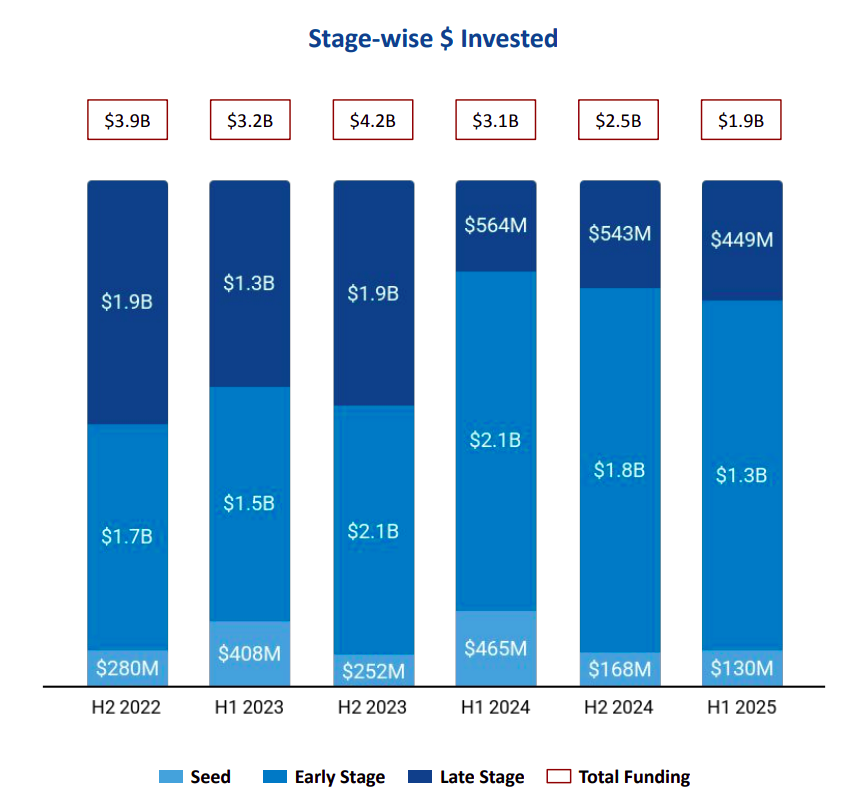

Seed Stage funding totaled $130M in H1 2025, reflecting a 23% drop from $168M raised in H2 2024 and a significant 72% decrease from $465M in H1 2024. Early Stage investments amounted to $1.3B in H1 2025, a 31% decline from $1.8B in H2 2024 and down 40% compared to $2.1B in H1 2024. Late Stage funding stood at $449M in H1 2025, which represents a 17% drop from $543M in H2 2024 and a 20% decrease from $564M in H1 2024.

Enterprise Applications, Life Sciences, and FinTech emerged as the top-performing sectors in H1 2025. The Enterprise Applications sector saw $969M in funding during H1 2025, down 30% from $1.4B in H2 2024 and 42% lower than $1.7B in H1 2024. Life Sciences experienced a funding surge, raising $393M in H1 2025, up 188% from $136M in H2 2024 and a 33% increase from $295M in H1 2024. FinTech, on the other hand, saw a decline with $368M raised in H1 2025, marking a 43% drop from $643M in H2 2024 and a 7% decrease from $395M in H1 2024.

In H1 2025, France recorded only one $100M+ funding round, compared to five such rounds in both H2 2024 and H1 2024. Alice&Bob managed to raise funds above $100M in this period. No unicorns were created in H1 2025, in contrast to two unicorns in H1 2024 and one in H2 2024. Additionally, no companies went public in H1 2025.

Tech companies in France saw 56 acquisitions in H1 2025, representing a 7% decrease from 60 acquisitions in H2 2024 and a 25% decline compared to 75 acquisitions in H1 2024. AdCreative.ai was acquired by Appier at a price of $38.7M, making it the highest valued acquisition in H1 2025. This was followed by the acquisition of QuantHouse by Baha Holdings at a price of $20.2M.

Paris-based tech firms accounted for 79% of all funding seen by tech companies across France in H1 2025. Bordeaux followed at a distant second in terms of funding concentration.

Bpifrance, Kima Ventures, and Idinvest Partners were the overall top investors in the France Tech ecosystem in H1 2025. Kima Ventures, Better Angle, and Founders Future led seed-stage investments during the same period. Daphni, Supernova Invest, and Cathay Innovation emerged as the top early-stage investors. At the late stage, DST Global Partners, CapitalG, and Vesalius Biocapital were the most active. Notably, United States-based DST Global Partners and CapitalG added one and six companies, respectively, to their portfolios through late-stage VC investments.

The France tech ecosystem experienced a downturn in H1 2025, with notable declines in funding across all stages and no unicorn or IPO activity during the period. Despite the overall slowdown, sectors like Life Sciences showed resilience with strong growth. Paris continued to dominate in funding share, while international and domestic investors remained active across investment stages.