Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: France Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the French Tech space.

The French tech startup ecosystem ranks seventh in terms of country-wise funding. The United States tops the list, followed by the United Kingdom, China and India.

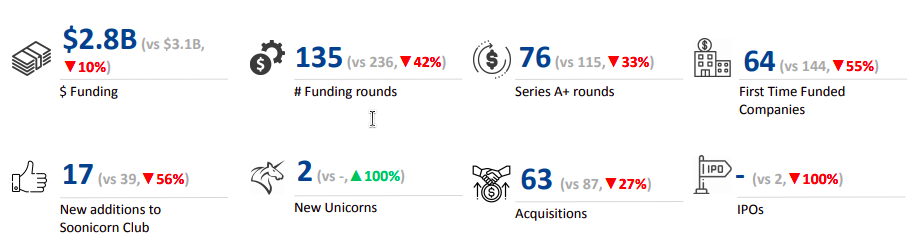

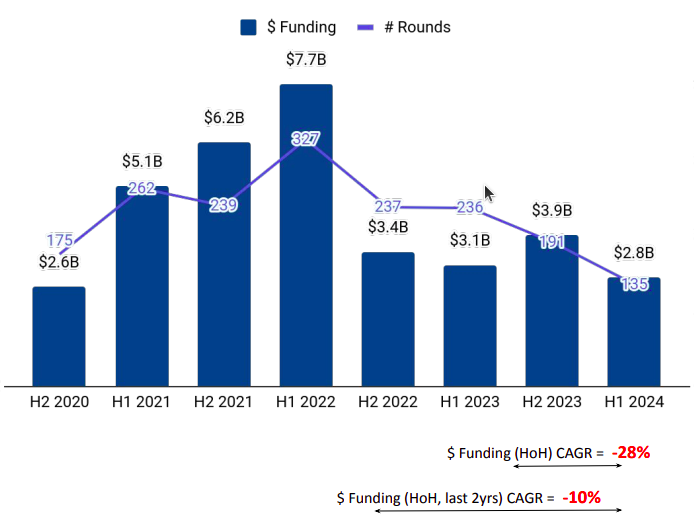

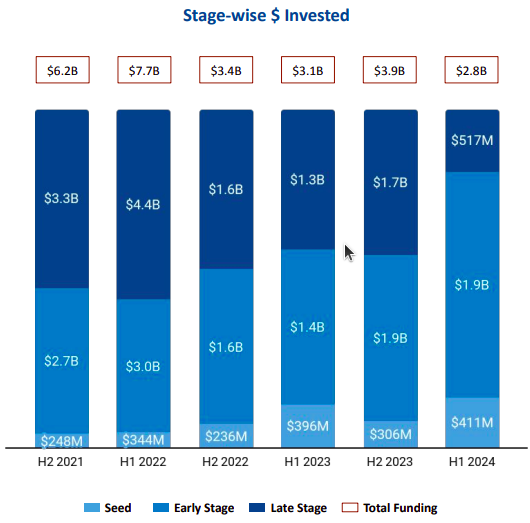

Funding into French tech startups fell 10% to $2.8 billion In the first half of 2024, from $3.1 billion in H1 2023. This is also a 28% decline from the $3.9 billion raised in H2 2023. The decline is largely driven by a decrease in late-stage funding, which plunged 60% to $517 million in H1 2024 from $1.3 billion in H1 2023.

However, resilience was observed across other funding stages. Seed-stage investments stood at $411 million, 3.8% higher than the $396 million raised in the first six months of 2023. This space secured early-stage funding worth $1.9 billion in H1 2024, a 32% increase from the $1.4 billion raised in H1 2023.

Mistral AI, Electra, H Company, Pigment and Stonal are top companies to raise funds above $100M in this half year. Mistral AI raised $503 million in a Series B round led by General Catalyst, valuing the company at over $6.23 billion. Electra raised $333 million in a Series B round led by PGGM at a valuation of $305 million.

Only two new unicorns emerged in the first half of 2024 - Pigment and Pennylane, an improvement from H1 2023 which did not witness any new unicorns. The number of acquisitions saw a significant decline, to 63 in H1 2024 from 87 in H1 2023. Amolyt Pharma was acquired by Astrazeneca for $1.1 billion, becoming the highest-valued acquisition in H1 2024, followed by the acquisition of Sonio by Samsung Medison for $93 million.

High Tech, Enterprise Applications and Environment Tech were the top-performing sectors in H1 2024. Each of these segments witnessed growth in investments. Funding in the High Tech space rose 36% to $1.51 billion in the first half of 2024 from $1.11 billion in H1 2023. Companies in the Enterprise Applications segment secured funding worth $1.48 billion in H1 2024, a 56% spike from the $948 million raised in H1 2023. The Environment Tech sector witnessed an 8% increase in funding from %508 million in H1 2023 to $548 million in H1 2024.

Paris dominated the funding landscape, accounting for 78% of the overall funding raised by tech startups across France. Companies based in Paris raised $2.2 billion in H1 2024, while those based in Rennes and Grenoble raised $94 million and $71.9 million respectively.

Kima Ventures, Idinvest Partners and Alven are the all-time top investors in the France Tech ecosystem. Kima Ventures, Elaia and Karista are the overall top investors in France Tech ecosystem in the first half 2024.

Headline, Cathay Innovation and BNP Paribas Developpement were the top early-stage investors in France Tech ecosystem in H1 2024, while DST Global, ICONIQ Growth and Sandberg Bernthal Venture Partners were the top investors in late-stage rounds.

Despite the decline in funding, the French tech startup ecosystem has strong support from a diverse range of investors. It is well-positioned to navigate the challenges and capitalize on emerging opportunities.