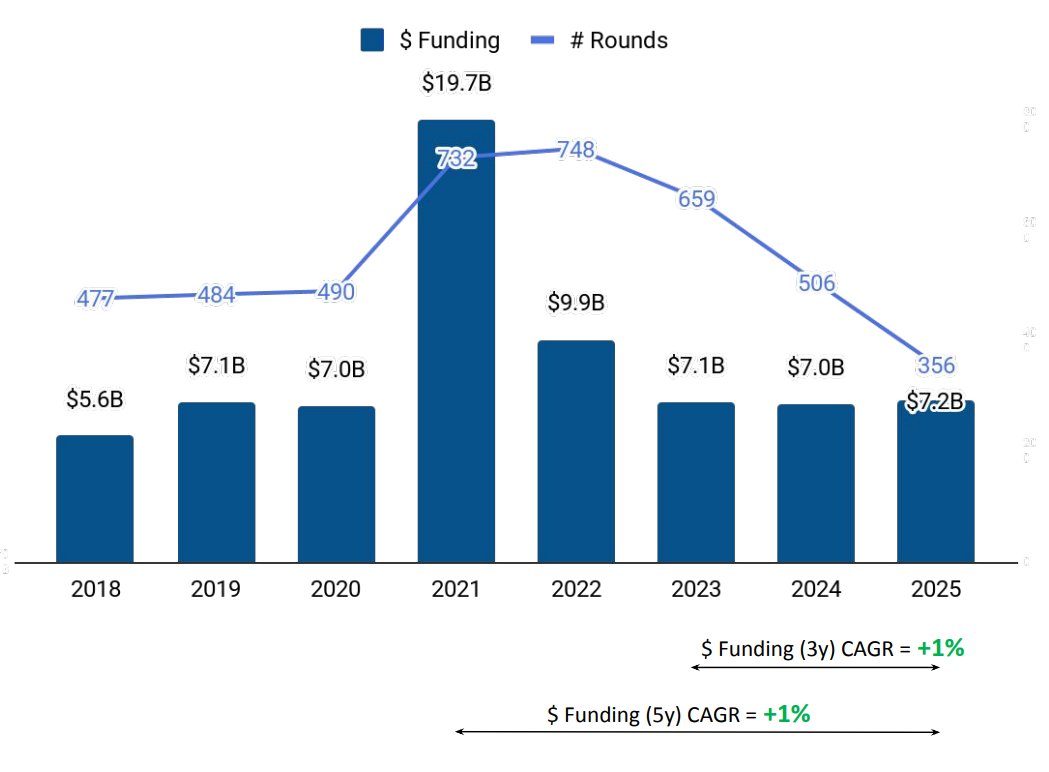

Tracxn has released its Germany Tech Annual Funding Report for 2025, highlighting key trends across funding activity, sector performance, exits, and investor participation. The 2025 period reflects a year of moderate overall funding growth, supported by a strong rebound in late-stage investments and sustained activity across select high-performing sectors. Germany maintained its position as one of the leading global tech ecosystems, ranking fifth worldwide in total funding raised during the year.

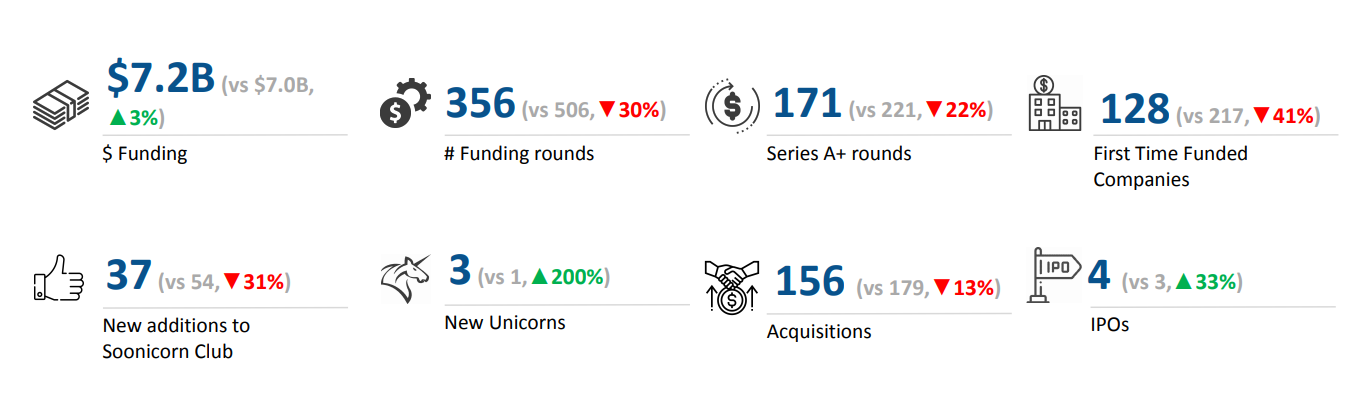

A total of $7.2B was raised by tech companies in Germany in 2025, reflecting a 3% increase from the $7B raised in 2024 and a 2% rise compared to $7.1B raised in 2023. Alongside this growth, Germany ranked as the fifth highest funded country globally during the year, placing it ahead of France and Canada, while only the United States, United Kingdom, India, and China recorded higher funding levels.

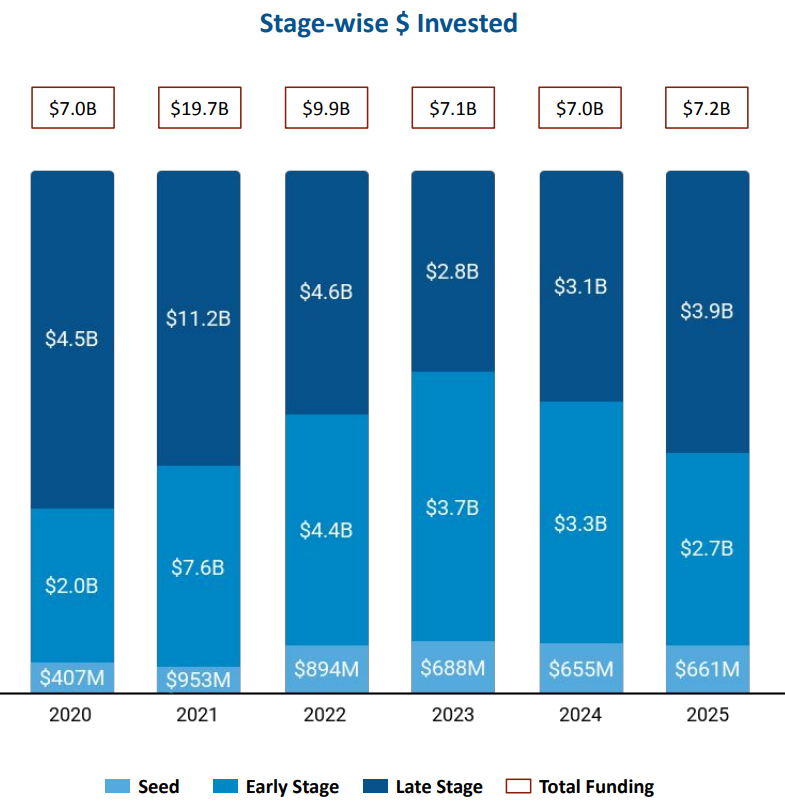

Seed-stage funding in Germany totaled $661M in 2025, representing a 1% increase compared to $655M raised in 2024, while declining 4% from $688M raised in 2023. Early-stage funding reached $2.7B in 2025, reflecting an 18% drop compared to $3.3B raised in 2024 and a 27% decline from $3.7B raised in 2023. Late-stage funding saw a significant rebound, with $3.9B raised in 2025, marking a 27% increase over $3.1B in 2024 and a 42% rise compared to $2.8B raised in 2023.

Enterprise Applications, Aerospace, Maritime and Defense Tech, and Energy Tech emerged as the top-performing sectors in 2025. The Enterprise Applications sector recorded $2.9B in total funding, reflecting a 30% increase compared to $2.2B raised in 2024 and a 14% rise from $2.6B raised in 2023. The Aerospace, Maritime and Defense Tech sector raised $1.6B in 2025, marking a 74% increase from $899M in 2024 and a 153% increase from $618M in 2023. The Energy Tech sector attracted $1.2B in funding, up 34% from $903M in 2024 and 8% higher than $1.1B raised in 2023.

Germany witnessed 15 $100M+ funding rounds in 2025, compared to 20 such rounds in 2024 and 16 in 2023. Companies such as Helsing, green flexibility, and Tubulis Technologies raised funding above $100M during the period. Helsing raised a total of $694M through a Series D round, green flexibility raised $412M through a Series D round, and Tubulis Technologies raised $401M through a Series C round. A major part of the $100M+ funding rounds during the year came from Aerospace, Maritime and Defense Tech, Enterprise Applications, and Energy Tech.

Germany recorded three unicorns in 2025, a 200% increase compared to one unicorn in 2024, and in line with 2023. The German tech ecosystem also saw four IPOs in 2025, up 33% from three IPOs in 2024 and up 300% from one IPO in 2023, with Otto Bock, TIN INN, and WF International EWIV among the companies that went public.

Tech companies in Germany recorded 156 acquisitions in 2025, reflecting a 13% decline compared to 179 acquisitions in 2024 and a 29% drop from 220 acquisitions in 2023. The acquisition of CureVac by BioNTech for $1.3B emerged as the highest-valued acquisition of 2025, followed by NICE’s acquisition of Cognigy for $955M.

Munich-based tech firms accounted for 33% of the total funding raised by tech companies across Germany in 2025. Berlin followed with 28% of the total funding, making it the second most funded city in the country during the year.

Investor participation remained active across stages in 2025. HTGF, Y Combinator, and Speedinvest were the top seed-stage investors in the German tech ecosystem. At the early stage, Balderton Capital, Partech Partners, and eCAPITAL emerged as the most active investors. Late-stage funding was led by Durable Capital Partners, M&G, and Sofina, which were the top late-stage investors in Germany during 2025.

The German tech ecosystem recorded steady growth in 2025, with total funding reaching $7.2B and the country ranking fifth globally in capital raised. A strong rebound in late-stage funding, alongside robust performance from Enterprise Applications, Aerospace, Maritime and Defense Tech, and Energy Tech, shaped the investment landscape. While early-stage funding and acquisition activity declined compared to previous years, large $100M+ deals, increased IPO activity, and continued unicorn creation defined Germany’s tech funding environment in 2025.