Tracxn, a leading global SaaS-based market intelligence platform, has released its Annual Report: Germany Tech Annual Report 2024. Based on Tracxn’s extensive database, the report provides insights into the Germany Tech space.

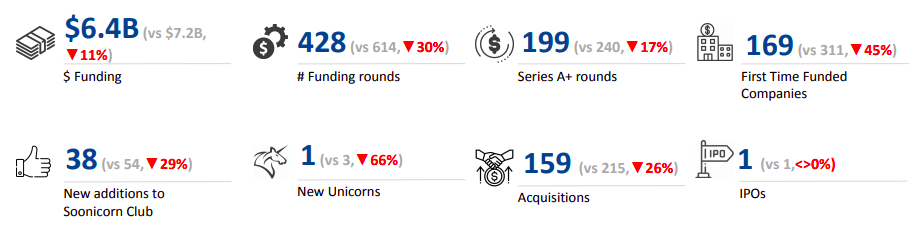

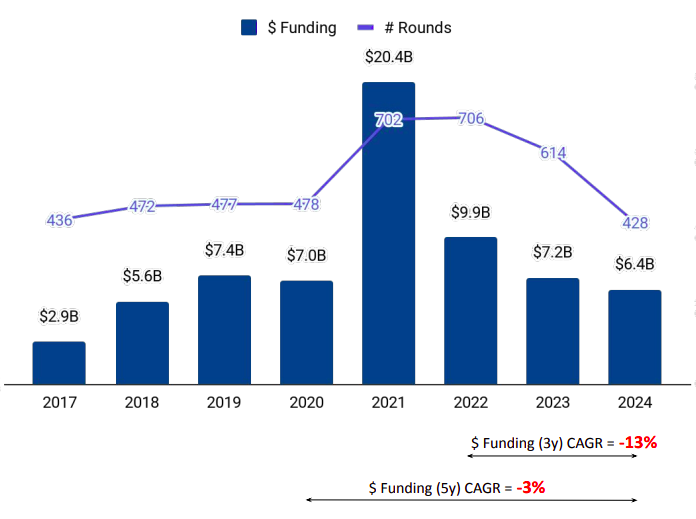

In 2024, the German tech startups raised $6.4 billion, reflecting an 11% decline from 2023 ($7.2B) and a 35.28% decrease from 2022 ($9.9B).

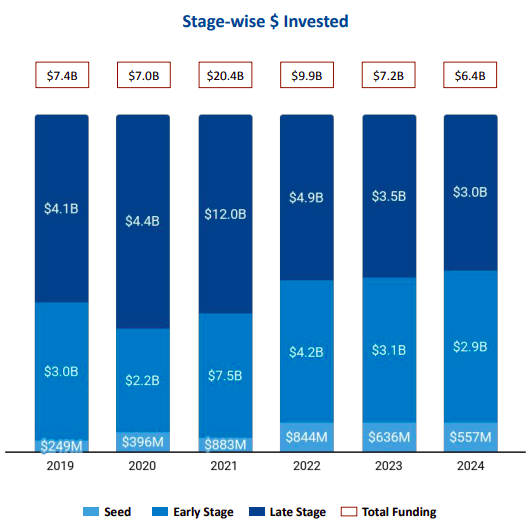

Stage-wise Investment Trends

● Late-Stage Funding: Late-stage startups raised $3 billion in 2024, witnessing a 15.04% decrease from 2023 ($3.5B) and a steeper 39.33% drop from 2022 ($4.9B).

● Seed-Stage Funding: Seed-stage investments totaled $557 million, falling by 12.4% compared to 2023 ($636M) and 34% from 2022 ($844M).

● Early-Stage Funding: Early-stage companies secured $2.9 billion, marking a 6.24% drop from 2023 ($3.1B) and a 30.77% decline from 2022 ($4.2B).

Sectoral Performance

Top-performing sectors in 2024 included High Tech, Enterprise Applications, and Environment Tech:

● High Tech: With a total funding of $3.1 billion in 2024, this sector saw a drop of 10% when compared to $3.5B raised in 2023 and a rise of 11% when compared to $2.8B raised in 2022.

● Enterprise Applications: Funding reached $2.6 billion in 2024, a decrease of 8% when compared to $2.8B raised in 2023 and a drop of 40% when compared to $4.3B raised in 2022.

● Environment Tech: Funding in this sector totaled $1 billion in 2024, this sector saw a drop of 33% when compared to $1.5B in 2023 and a drop of 26% when compared to $1.4B raised in 2022.

Top cities leading the landscape

● Germany’s funding ecosystem was largely driven by Munich and Berlin, accounting for 28.35% and 27.73% of the total funding, respectively.

Leading Investors

HTGF, HV Capital, and Bayern Kapital emerged as the top investors in the German tech ecosystem, actively supporting startups across various stages.

Mergers & Acquisitions:

There were a total of 159 acquisitions in 2024, including:

● MorphoSys’s acquisition by Novartis for $2.9 billion, was the largest deal of the year.

● ABOUT YOU was acquired by Zalando for $1.3 billion.

This data underscores the evolving dynamics of the German tech ecosystem, reflecting both growth opportunities and challenges across different funding stages, sectors, and regions.