Tracxn has released its Germany Tech - 9M 2025 Report, highlighting key funding, investment, and acquisition trends in the country’s tech ecosystem. Germany ranked as the 4th highest funded country globally in 9M 2025, ahead of Canada and France at 5th and 6th positions, respectively. The United States, United Kingdom, and India were the only countries to record higher funding totals.

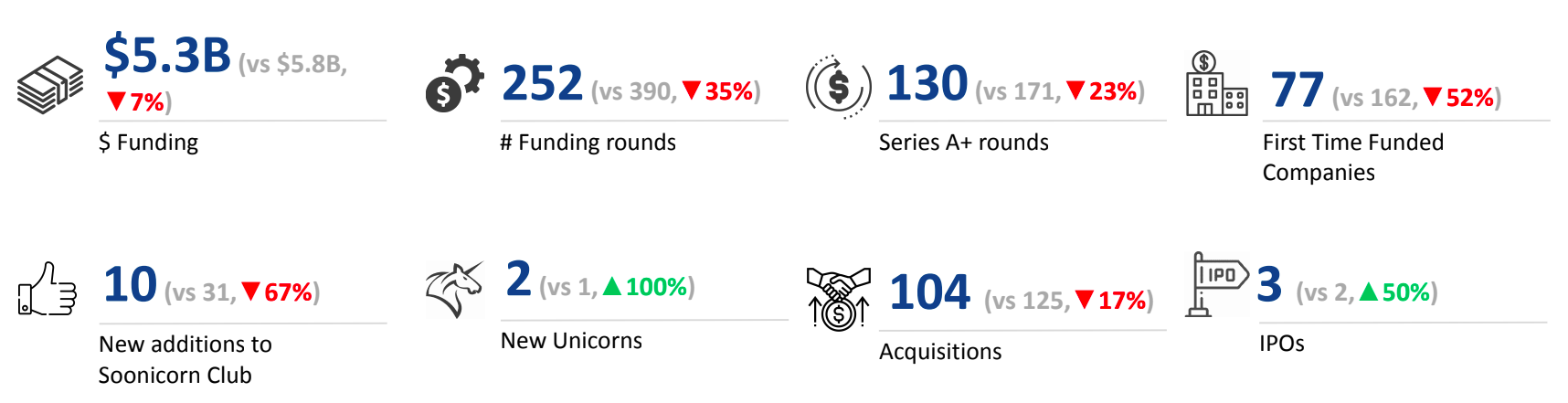

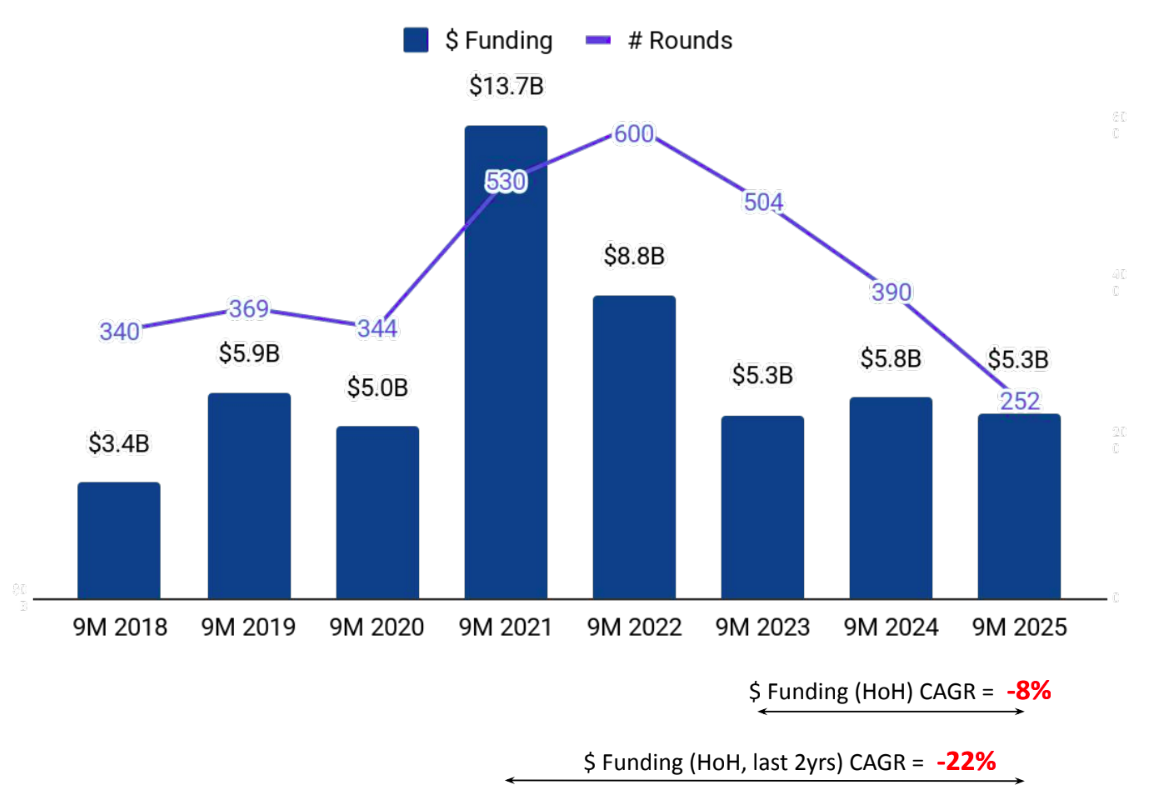

Germany’s tech sector raised a total of $5.3B in 9M 2025, marking a 7% decline compared to $5.8B in 9M 2024, and the same level as in 9M 2023. Despite the overall dip, certain sectors like Enterprise Applications and Defense Tech posted strong growth, contributing to the resilience of Germany’s tech funding landscape. N8

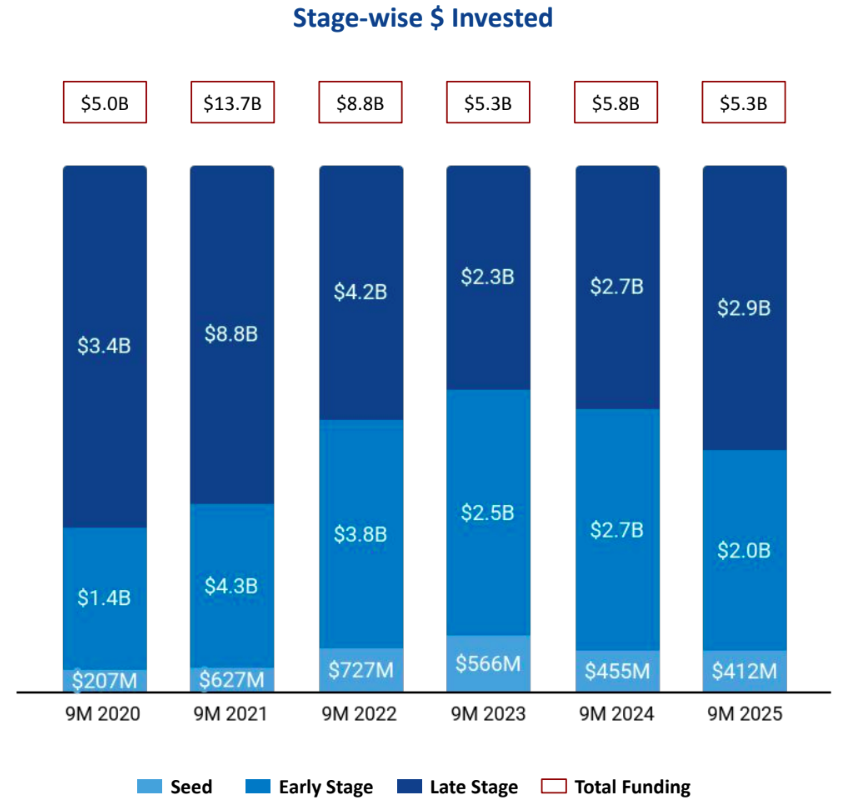

Funding activity across stages in Germany reflected mixed trends in 9M 2025. Seed Stage funding stood at $412M, registering a 9% decline from $455M in 9M 2024 and a 27% drop compared to $566M in 9M 2023. Early Stage funding reached $2.0B, marking a 25% decrease from $2.7B in 9M 2024 and a 20% fall from $2.5B in 9M 2023. In contrast, Late Stage funding showed strong momentum, climbing to $2.9B in 9M 2025, an 8% rise from $2.7B in 9M 2024 and a 28% increase compared to $2.3B in 9M 2023, indicating steady investor confidence in mature ventures.

The top-performing sectors in Germany during 9M 2025 were Enterprise Applications, Aerospace, Maritime and Defense Tech, and Energy Tech. Enterprise Applications led with $2.2B in funding, a 31% increase from $1.7B in 9M 2024, and a 47% rise compared to $1.5B in 9M 2023. Aerospace, Maritime and Defense Tech followed with $1.2B raised, marking a 79% increase from $687M in 9M 2024 and a 124% rise from $550M in 9M 2023. Energy Tech also performed well with $1.1B raised, up 41% from $804M in 9M 2024, and 67% higher than $678M in 9M 2023.

Germany recorded 12 $100M+ funding rounds in 9M 2025, compared to 17 such rounds in 9M 2024 and the same number as 9M 2023. Notable large rounds included Helsing ($694M, Series D), green flexibility ($412M, Series D), and AMBOSS ($259M, Series C). Most of these $100M+ rounds were concentrated in the Aerospace, Maritime and Defense Tech, Energy Tech, and Enterprise Applications sectors.

The country also witnessed 3 IPOs in 9M 2025, up 50% from 2 in 9M 2024 and 200% higher than 1 in 9M 2023. The companies that went public were TIN INN, WF International EWIV, and Anbio. Germany also saw the creation of 2 unicorns in 9M 2025, representing a 100% rise compared to 1 in 9M 2024, but a 33% decline from 3 in 9M 2023.

Germany’s M&A landscape remained active in 9M 2025, with 104 acquisitions recorded during the period. This represented a 17% decline from 125 acquisitions in 9M 2024 and a 36% decrease compared to 162 in 9M 2023. Despite the moderation in deal volume, several high-value transactions highlighted continued strategic activity in the market. The largest deal was BioNTech’s $1.3B acquisition of CureVac, followed by NICE’s $955M acquisition of Cognigy, underscoring strong investor confidence and sustained consolidation across key technology sectors.

Munich accounted for 33% of all funding raised by German tech companies in 9M 2025, making it the leading city in terms of capital inflow. Berlin followed closely, contributing 30% of the total funding raised in the country.

Investor participation in Germany’s tech ecosystem remained diverse across stages in 9M 2025. HTGF, Y Combinator, and IFB Innovationsstarter emerged as the most active investors at the seed stage, supporting early innovation and startup formation. At the early stage, Partech Partners, Balderton Capital, and EQT Ventures played a leading role in driving growth-focused investments. Meanwhile, Sofina, Durable Capital Partners, and M&G stood out as the top late-stage investors, backing mature companies with substantial growth potential.

The Germany tech ecosystem in 9M 2025 maintained stability despite a slight decline in total funding. Strong performances from Enterprise Applications, Aerospace, Maritime and Defense Tech, and Energy Tech sectors offset the slowdown in early and seed-stage investments. The rise in late-stage funding, multiple IPOs, and major acquisitions underlines the maturity of Germany’s startup ecosystem, while Munich and Berlin continued to dominate as the country’s primary innovation hubs.