Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: Germany Tech Q1 2024. The report, based on Tracxn’s extensive database, provides insights into the Germany Tech space.

The German Tech startup landscape is the fifth-highest funded in the first quarter of 2024 to date, and ranks second within the European Tech ecosystem, after the UK.

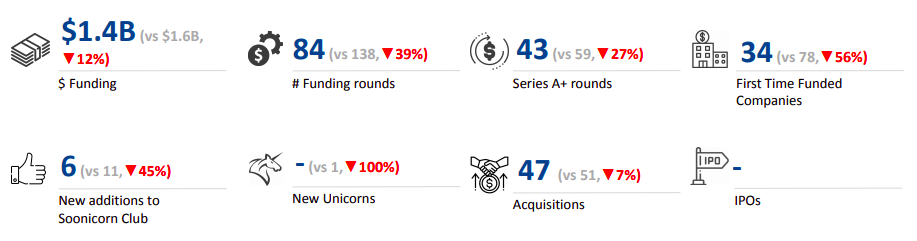

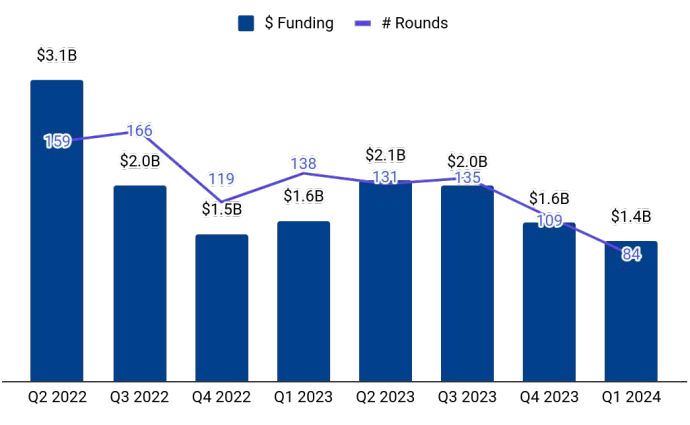

In Q1 2024 to date till (March 15, 2024), the German tech startup ecosystem secured a total funding of $1.4 billion, 8% lower than the $1.5 billion raised in the same period in Q4 2023 (till December 15, 2023). However, it is a 32% increase from the $1.06 billion raised in the same period in Q1 2023 (till March 15, 2023).

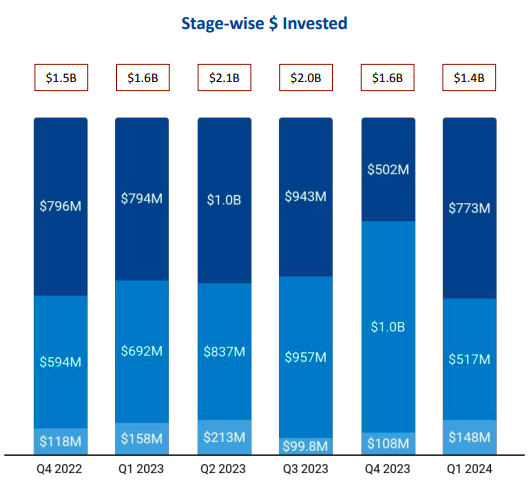

Late-stage investments stood at $773 million in the first quarter of 2024 which is 55% of the total funding in the quarter. Late-stage funding rose 73% compared with $447 million funding in the same period in Q4 2023, and a 24% uptick compared with $622 million raised in the same period in Q1 2023.

Companies in this space attracted early-stage investments worth $517 million in Q1 2024 to date, a growth of 55% as against the same period in Q1 2023. However, it declined 44% when compared with the same period in Q4 2023. Seed-stage funding in Q1 2024 to date was $148 million, a 65% increase compared with the $89.5 million raised in the same period in Q4 2023 which, is a 37% increase from $108 million raised in the same period in Q1 2023.

The German Tech sector recorded six funding rounds in Q1 2024 to date that crossed the $100M mark. Companies like Tubulis Technologies, Razor Group, and Sunfire were some of the companies which raised more than $100 million.

Energy Tech, Enterprise Applications, and Environment Tech emerged as top-performing segments in Q1 2024 to date. The Energy Tech sector attracted total funding of $506 million funding in Q1 2024 to date, a 95% spike compared with $259 million raised in the same period in Q4 2023, and an increase of 65% when compared with $306 million raised in the same period in Q1 2023.

The Enterprise Applications space, which is the constant second-highest funded space in the overall German tech sector, raised $333 million funding in Q1 2024 till date, 58% lower than $797 million raised in the same period in Q4 2023. The Environment Tech sector emerged as the third highest-funded sector in the first quarter of 2024 to date, securing funding worth $313 million.

In the first quarter of 2024 to date, the German tech startup ecosystem saw 47 acquisitions, similar to 46 and 47 reported in the same period in Q4 2023 and Q1 2023 respectively. No IPOs from this space took place in Q1 2024 to date, similar to both Q4 2023 and Q1 2023.

N8

Berlin, Dresden and Stuttgart were the cities that attracted the maximum investment in the first quarter of 2024. Tech startups headquartered in Berlin raised $416 million, while those based in Dresden and Stuttgart raised $247 million and $233 million respectively.

HTGF, German Accelerator and HV Capital are the all-time most active investors in German Tech startup ecosystem. HTGF, Bayern Kapital, and Techstars were the top investors in Q1 2024 in terms of seed-stage funding, while Molten Ventures, Lightspeed Venture Partners & Spark Capital were the most active early-stage investors.

The government of Germany has been keen on improving its startup landscape, and has framed a 10-point plan strategy. Such measures will likely help the country’s startup ecosystem thrive in the coming years.