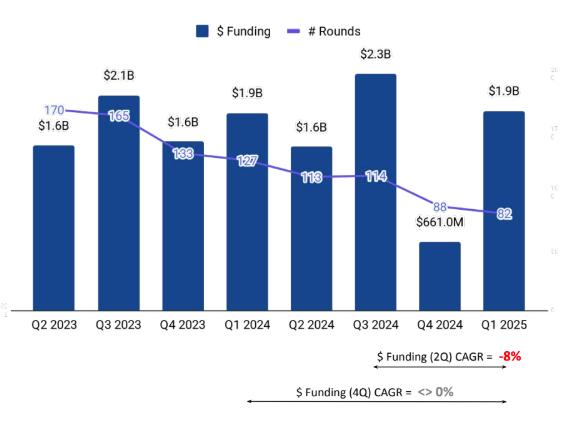

Tracxn has released its Germany Tech Funding Report for Q1 2025, offering a comprehensive look at the investment landscape across the country’s tech ecosystem. The data reveals a sharp rebound in funding activity, with Germany emerging as the 4th highest funded country globally, ahead of Canada and China at the 5th and 6th positions respectively. The United States, United Kingdom, and India retained the top three spots. Notably, Germany experienced a significant uptick in funding rounds and deal sizes this quarter, marking a substantial shift from the subdued activity in Q4 2024.

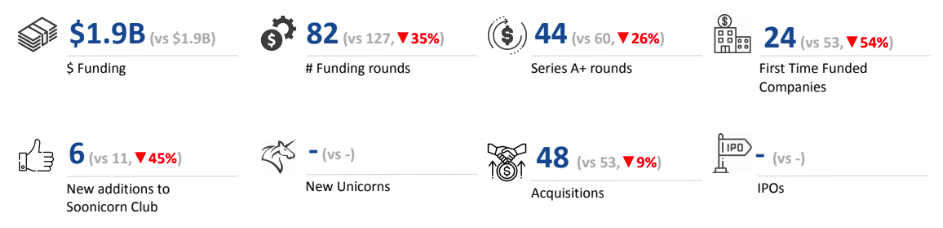

A total of $1.9B was raised in Q1 2025, reflecting a 191% surge from the $661M raised in Q4 2024. The funding level this quarter was also on par with the $1.9B recorded in Q1 2024.

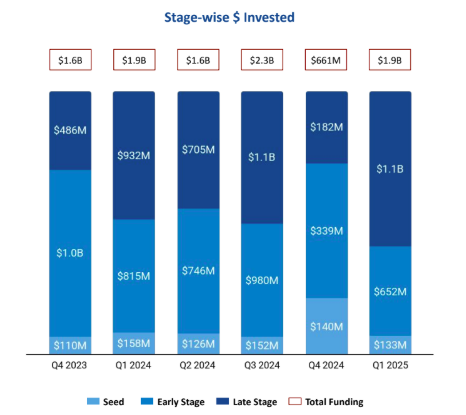

Seed Stage saw a total funding of $133M in Q1 2025, a drop of 5% compared to $140M raised in Q4 2024, and a drop of 16% compared to $158M raised in Q1 2024. Early Stage saw a total funding of $652M in Q1 2025, an increase of 92% compared to $339M raised in Q4 2024, and a drop of 20% compared to $815M raised in Q1 2024. Late Stage witnessed a total funding of $1.1B in Q1 2025, an increase of 525% compared to $182M raised in Q4 2024, and an increase of 22% compared to $932M raised in Q1 2024.

Enterprise Applications, Energy Tech, and HealthTech were the top-performing sectors in Q1 2025 in this space. Enterprise Applications sector saw a total fundUwining of $763M in Q1 2025 which is an increase of 105% when compared to $372M raised in Q4 2024 and an increase of 67% when compared to $456M raised in Q1 2024.

Energy Tech saw a total funding of $733M in Q1 2025 which is an increase of 828% when compared to $79.0M raised in Q4 2024 and an increase of 19% when compared to $614M raised in Q1 2024. HealthTech saw a total funding of $370M in Q1 2025 which is an increase of 295% when compared to $93.6M in Q4 2024 and an increase of 692% when compared to $46.7M raised in Q1 2024. A major part of these $100M+ funding rounds are from Energy Tech, Enterprise Applications, and HealthTech.

In Q1 2025, Germany saw 5 $100M+ rounds, when compared to no rounds in Q4 2024 and 7 in Q1 2024. Companies like green flexibility, AMBOSS, Sunfire, Solaris, Neura Robotics have managed to raise funds above $100M in this quarter. Green flexibility has raised a total of $412M in a Series D round. AMBOSS has raised a total of $259M in a Series C round. Sunfire has raised a total of $206M in a Series E round. The $2.0B funding round from Binance from Malta has become one of the notable and highest funding rounds witnessed in the Tech space last quarter. However, this region did not receive any other funding rounds in this period. No companies went public in Q1 2025. No unicorns were created in Q1 2025 and Q1 2024.

Tech companies in Germany saw 48 acquisitions in Q1 2025, which is a 17% increase as compared to 41 acquisitions in Q4 2024 and a drop of 9% compared to 53 acquisitions in Q1 2024. IDnow was acquired by Corsair Capital at a price of $295M. This became the highest valued acquisition in Q1 2025 followed by the acquisition of Burster by Discoverie at a price of $32.3M.

Berlin based tech firms accounted for 36% of all funding seen by tech companies across Germany. This was followed by Kempten at a close second at 21%.

HTGF, HV Capital, and Bayern Kapital emerged as the overall top investors in the Germany tech ecosystem. HTGF, Y Combinator, and IFB Innovationsstarter were the most active seed-stage investors in Germany. Capnamic Ventures, Creandum, and Sequoia Capital were dominant in early-stage funding, while M&G led late-stage investments in the country.

The Germany tech ecosystem showed strong momentum in Q1 2025, with a sharp rebound in funding and a rise in acquisition activity. The dominance of Enterprise Applications, Energy Tech, and HealthTech reflects growing investor focus on scalable and impact-driven sectors. While seed-stage funding declined, the surge in late-stage investments played a crucial role in driving overall capital inflow.