Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Quarterly Report: Germany Tech Q3 2024. The report, based on Tracxn’s extensive database, provides insights into the German Tech space.

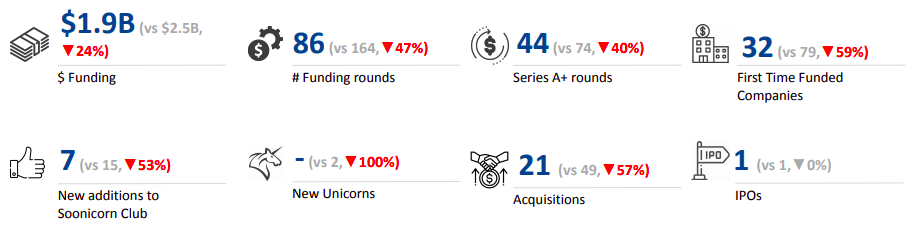

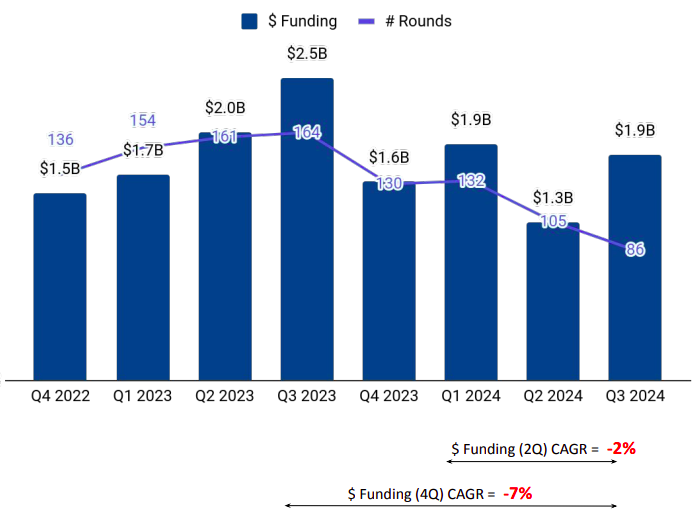

Germany's tech startup ecosystem secured total funding of $1.9 billion in Q3 2024, a 46.2% surge from $1.3 billion raised in Q2 2024, but a 24% decline from the $2.5 billion raised in Q3 2023. However, the country still ranked fourth globally, in terms of startup funding in Q3 2024, after the US, India, and the UK.

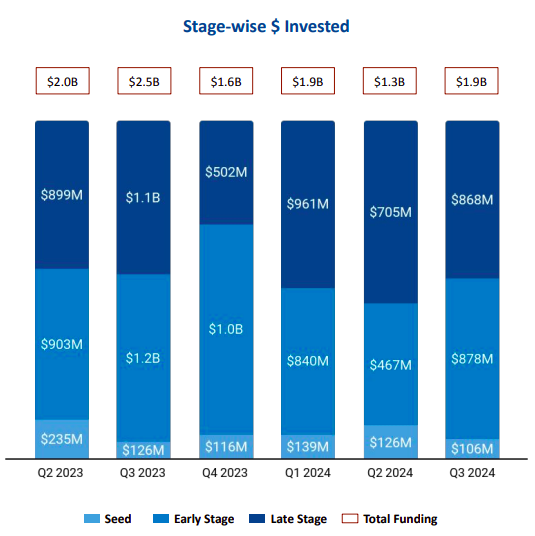

German tech startups attracted late-stage investments worth $868 million in the third quarter of 2024, an increase of 23.06% compared to Q2 2024, and a 23.49% decrease compared to the corresponding quarter last year (Q3 2023). Seed-stage funding stood at $106 million, a 15.87% decrease from Q2 2024, and a similar drop compared with Q3 2023. Early-stage funding saw a total of $878 million, an increase of 87.94% from the previous quarter (Q2 2024), and a 28.26% decrease compared with Q3 2023.

A total of five startups raised $100M+ rounds. Helsing raised a total of $486.97 million in a Series C round led by General Catalyst. CatalYm raised $150 million in a Series D round led by Canaan. Osapiens raised $120 million in a Series B round led by Goldman Sachs Asset Management, while Flink raised $115 million in a Series C round led by Bond Capital. Quantum-Systems raised $111.29 million in a Series B round led by Notion.

No new unicorns emerged in the third quarter of this year. There was also a sharp decline in the number of acquisitions, which fell to 21 in Q3 2024 from 43 and 49 in Q2 2024 and Q3 2023, respectively. Further, BigRep was the only company to go public in Q3 2024.

High Tech, Enterprise Applications, and Aerospace, Maritime & Defense Tech were the top-performing sectors in Q3 2024. Funding raised by companies in the High Tech space rose 40% in Q3 2024, compared with the previous quarter. The Enterprise Applications segment witnessed a 31% increase in Q3 2024 compared with Q2 2024. Funding raised by Aerospace, Maritime & Defense Tech companies surged 701% in Q3 2024 compared with Q2 2024.

Startups based in Munich accounted for the majority of the funding in Q3, raising $864.8 million. Tech startups based in Berlin raised $368.4 million, while those based in Mannheim raised $120 million.

HTGF, HV Capital, and EIC Fund are the all-time top investors in the Germany Tech ecosystem. HTGF, EIC Fund and IBB Ventures were the top seed-stage investors in this space in Q3 2024, while Bond Capital emerged as the top late-stage investor. Grazia Equity, Winning Mindset Ventures, and Wellington Partners Venture Capital were the top early-stage investors during the same period.

(Data for Q3 2024 has been taken from Jul 1, 2024 - Sep 25, 2024)