Tracxn has released its Germany Tech H1 2025 Funding Report, highlighting the investment activity across Germany’s tech sector for the first half of 2025. Germany secured the 4th position globally in tech funding during this period, surpassing Israel and Canada, which ranked 5th and 6th respectively. The United States, United Kingdom, and India retained the top three spots. The report outlines funding activity, sector performance, major deals, and investor participation across this half-year.

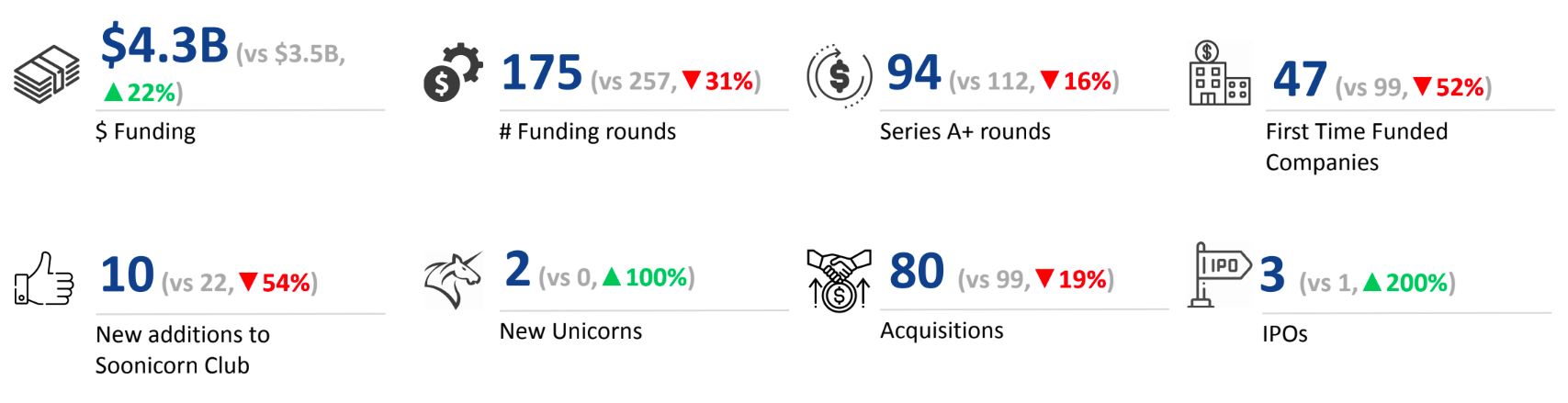

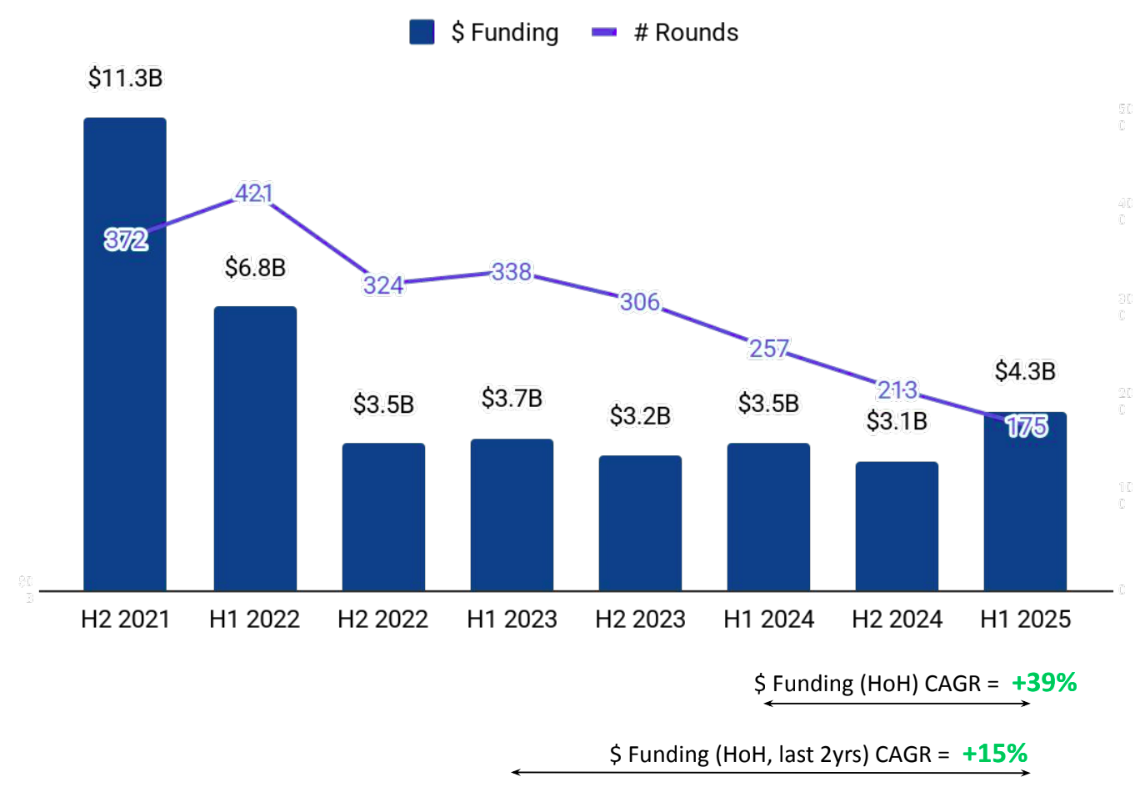

Germany’s tech sector raised a total of $4.3B in H1 2025, reflecting a 39% increase compared to $3.1B in H2 2024, and a 22% rise from $3.5B in H1 2024. This funding growth signals a steady upward trend across consecutive halves, positioning Germany as a strong player in the global tech funding ecosystem.

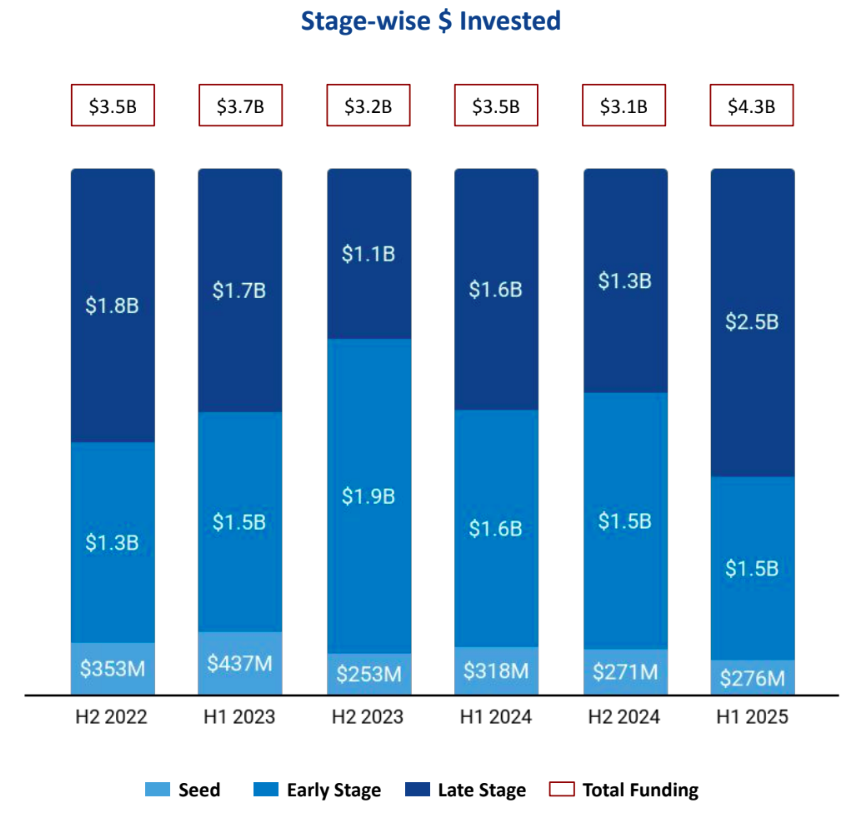

Seed-stage funding totaled $276M in H1 2025, reflecting a 2% increase over the $271M raised in H2 2024, but a 13% decline from the $317M in H1 2024. Early-stage investments reached $1.51B, nearly unchanged from $1.5B in H2 2024 and slightly down from $1.6B in H1 2024. The most notable growth was seen in Late-stage funding, which surged to $2.5B in H1 2025, up 89% from $1.3B in H2 2024 and 54% from $1.6B in H1 2024.

Enterprise Applications, Energy Tech, and Aerospace, Maritime and Defense Tech emerged as the top-performing sectors during H1 2025. Enterprise Applications saw funding of $2.4B, a 64% rise from $1.5B in H2 2024 and an 80% increase from $1.3B in H1 2024. Energy Tech recorded a total of $1.1B, growing 270% from $292M in H2 2024 and 55% from $697M in H1 2024. The Aerospace, Maritime and Defense Tech sector experienced a dramatic surge to $990M, up 53% from $646M in H2 2024 and 1072% from just $84.5M in H1 2024.

H1 2025 saw 10 funding rounds of $100M+ when compared to 7 such rounds in H2 2024 and 11 such rounds in H1 2024. Companies such as Helsing, green flexibility, AMBOSS, Sunfire, and Quantum Systems each raised more than $100M during this period. Notably, Helsing secured $694M in a Series D round, green flexibility raised $412M in a Series D round, and AMBOSS raised $259M in a Series C round. A large portion of these rounds came from the Enterprise Applications, Aerospace, Maritime and Defense Tech, and Energy Tech sectors. On the public markets front, TIN INN, WF International EWIV, and Anbio were the companies that went public during H1 2025. In terms of unicorn creation, two new unicorns emerged in H1 2025, double the one created in H2 2024, while none were recorded in H1 2024.

Germany recorded 80 acquisitions in H1 2025, an 18% rise from the 68 in H2 2024, but a 19% decline from 99 in H1 2024. CureVac’s $1.3B acquisition by BioNTech was the largest deal of the half-year, followed by the acquisition of Elatec RFID by Allegion for $378M.

Munich-based tech companies attracted 32% of the total funding in H1 2025, making it the top city for tech investment in Germany. Berlin followed closely, accounting for 29% of the total capital raised by German tech firms.

HTGF, HV Capital, and Bayern Kapital were the top overall investors in the Germany tech ecosystem during H1 2025. Y Combinator, HTGF, and Earlybird led seed-stage investments. Capnamic Ventures, Balderton Capital, and Partech Partners were the most active in early-stage investments. Durable Capital Partners, M&G, and RPT Capital led late-stage funding. Among venture firms, Germany-based HTGF led the most number of investments in H1 2025, participating in five rounds. Another Germany-based fund, HV Capital, added seven new companies to its portfolio. In the late-stage category, US-based Durable Capital Partners and UK-based M&G added one and two companies respectively to their portfolios.

The Germany tech ecosystem gained strong momentum in H1 2025, with a 39% rise in funding compared to the previous half and increased M&A activity. The growth was largely driven by a significant surge in late-stage funding and strong performances from sectors like Enterprise Applications, Energy Tech, and Aerospace, Maritime and Defense Tech. While seed and early-stage investments remained steady or saw slight declines, the increase in $100M+ deals and unicorn creation underscores continued investor confidence in Germany’s tech landscape.