Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: Germany Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the German Tech space.

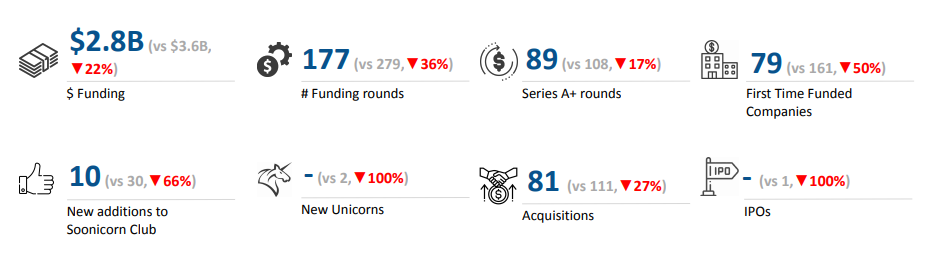

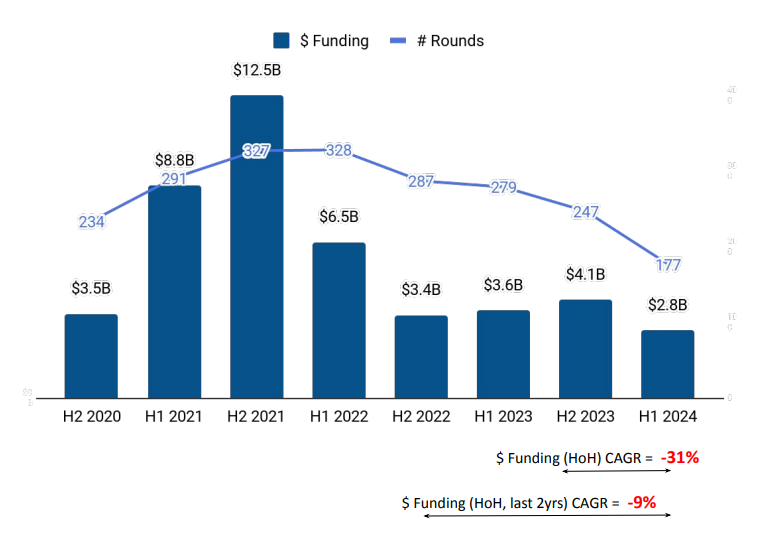

Germany has solidified its position as a leading hub for tech startups, ranking as the sixth highest-funded country globally in H1 2024. Despite facing a challenging investment climate, The German tech startup ecosystem raised a total of $2.8 billion in H1 2024. This is a 30.5% decline in funding compared with $4.1 billion raised in H2 2023 and a 22% drop from the $3.6 billion raised in H1 2023.

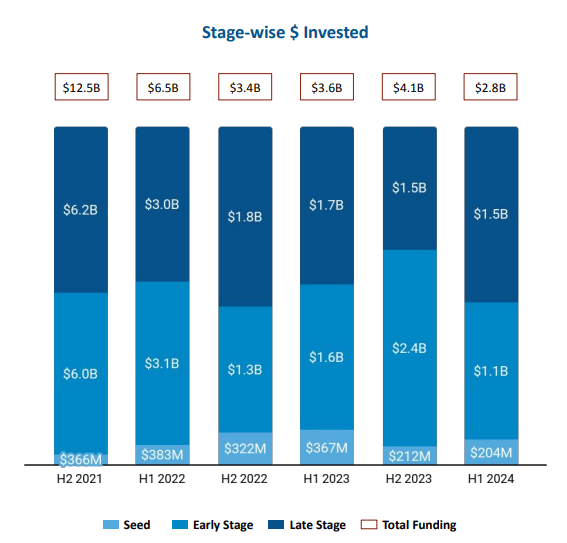

Seed-stage funding stood at $204 million in H1 2024, a decline of 3.7% from $212 million raised in H2 2023 and a 44% decrease from the $367 million raised in the first half of 2023. Early-stage funding reached $1.1 billion, marking a 54% decrease from the $2.4 billion raised in H2 2023 and a 31% drop from the $1.6 billion raised in H1 2023. Late-stage funding remained relatively stable at $1.5 billion, similar to H2 2023, but 12% lower than H1 2023.

H1 2024 has witnessed nine 100M+ funding rounds. Companies like INERATEC, ITM, DeepL, Solaris, Tubulis Technologies, Sunfire, Razor Group, FINN, Impulse Dynamics were some of the companies that raised funds above $100M in the first half of this year. DeepL raised $300 million in a Series C round led by Index Ventures at a valuation of $2 billion. Sunfire raised $233M in Series E round led by Index Ventures, Ahren and Carbon Equity. ITM has raised a total of $204 million in a Series E round led by Temasek.

Enterprise Applications, High Tech and Energy Tech were the top-performing sectors in H1 2024 in this space. Funding in the Enterprise Applications Space rose 15%, from $818 million in H1 2023 to $942 million in H1 2024. Companies in the High Tech segment saw funding decline 15% to $720 million in H1 2024 from $852 million in H1 2023. Funding in the Energy Tech space stood at $624 million in H1 2024, a sharp 40% drop from $1.04 billion raised in the first half of 2023.

While no new unicorns were created in H1 2024, compared to two in H1 2023, the acquisition landscape remained active with 81 companies acquired, a 27% decline from 111 acquisitions in H1 2023.

The biggest acquisition in H1 2024 was Novartis’ purchase of MorphoSys for $2.9 billion, followed by the acquisition of Kyon Energy by TotalEnergies at $98 million.

Among German cities, Berlin took a significant lead in terms of funding, followed by Munch and Cologne. Tech startups headquartered in Berlin raised $914 million in the first six months of 2024, while those based in Munich and Cologne raised $482 million and $385 million, respectively.

HTGF, HV Capital and Robin Capital were the overall top investors in the German tech ecosystem in the first half of 2024. Earlybird, Coparion and Lightspeed Venture Partners were the top investors in early-stage rounds, while We Founder Circle, Z Nation Lab and Y Combinator were the top seed-stage investors in H1 2024.

Despite the funding challenges, Germany's tech startup ecosystem continues to show resilience and adaptability, driven by significant investments in key sectors and regions. The ecosystem's ability to attract substantial funding and maintain a dynamic acquisition environment underscores its ongoing potential and growth.