Tracxn, a leading market intelligence platform, has released its 2024 Geo Annual Funding Report on India’s Direct-to-Consumer (D2C) sector. The report provides a detailed view of funding trends, top-funded segments, and key developments in the D2C sector.

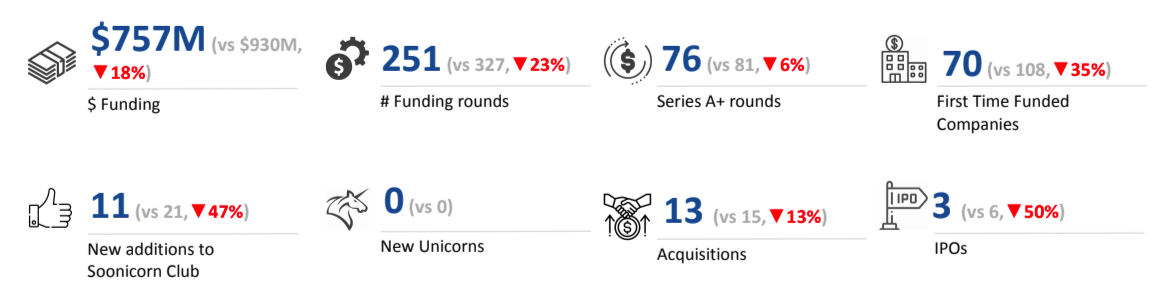

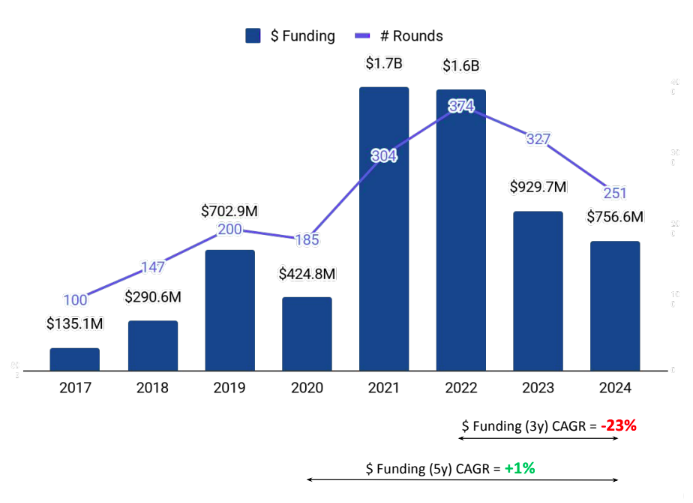

As per the report, India secured the second position globally in terms of funding raised for the D2C sector in 2024, following the United States and ahead of China, UK and Italy. The sector raised a total funding of $757M in 2024, a significant decline of 18% from $930M raised in 2023 and a 54% drop compared to $1.6B raised in 2022.

With over 11,000 companies, India is home to some of the largest D2C brands. However, only around 800 of these have secured funding so far. The D2C space witnessed its peak funding in 2021 and 2022, after which the funds started to decline steadily, and 2024 became the least funded year since 2021.

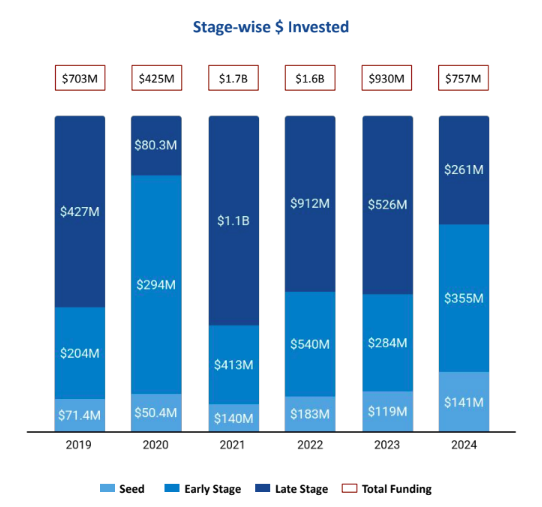

Early-stage witnessed a total funding of $355M in 2024, reflecting a 25% increase from the $284M raised in 2023, albeit a 34% decline compared to the $540M raised in 2022. Seed-stage funding reached $141M in 2024, marking an 18% increase from the $119M raised in 2023, but a 23% decline compared to the $183M raised in 2022. Late-stage funding stood at $261M in 2024, reflecting a decline of 50% and 71% compared to the $526M and $912M raised in 2023 and 2022, respectively. This was the highest drop witnessed in both total funding and the number of funding rounds in 2024 compared to the previous two years.

The decline in funding can be attributed to increased investor caution amid a global economic slowdown, the oversaturation of similar brands, and fluctuating unit economics driven by high customer acquisition costs. Additionally, D2C brands are facing challenges such as expensive offline expansion and pressure to be profitable, leading many to seek acquisitions as viable exit strategies.

To help overcome some of these challenges, the Indian government has launched several initiatives such as Digital India, Startup India, and the Open Network for Digital Commerce (ONDC) to strengthen digital infrastructure, streamline regulations, and reduce platform dependency. Additionally, programs like the Export Promotion Mission, Government e-Marketplace (GEM), and the Green Credit Programme are also helping D2C brands expand globally, access new markets, and adopt more sustainable practices.

Speaking at the launch of their report, Neha Singh, Co-Founder Tracxn, said, "India’s D2C sector is evolving with investors prioritizing profitability and sustainable growth. While overall funding has declined due to investor caution and broader economic tailwinds, the rise in early-stage investments signals continued confidence in the long-term potential of India’s D2C sector. Government support through initiatives like ONDC and Startup India is also helping create a more resilient and scalable ecosystem.”

The top-funded segments in the D2C sector in 2024 were D2C Organic Beauty Brands, Online Jewellery Brands, and D2C Beauty Brands.

D2C Organic Beauty Brands raised $105M in 2024, marking a 79% increase compared to $58.5M in 2023. Online Jewellery Brands secured $94.8M in 2024, reflecting a 15% decline from the $112M raised in 2023. D2C Beauty Brands received $56.1M in funding, a 7% rise compared to $52.4M in 2023.

Despite these gains, 2024 did not witness any $100M+ funding rounds, unlike 2023 and 2022, which saw 1 and 3 such rounds, respectively.

BlueStone, an online brand offering subscription-based precious jewellery, secured $71M in its Series D funding round at a valuation of $964M, making it the largest funding round in the Indian D2C space in 2024. Bella Vita Organic, a multi-category beauty products brand, raised $48.5M in its angel funding round, while WoodenStreet, an Internet-first brand for customized furniture for homes, raised $43M in a series C funding round.

There were no Unicorns created in 2024 and 2023, compared to 1 in 2022. Notably, India’s D2C space has created only 4 Unicorns so far. These are Lenskart, MyGlamm, boAT and Licious.

2024 witnessed 13 acquisitions, reflecting a 13% and 58% decline compared to that of 15 and 31 acquisitions in 2023 and 2022, respectively. The largest deal was the acquisition of VCare Products, an Internet-first brand offering multi-category organic beauty products, by Creador for $60M. Max Protein, a brand offering energy bars, was acquired by Zydus Wellness for $46.4M. Earth Rhythm, an Internet-first brand offering multi-category organic beauty products, was acquired by Nykaa for $5.3M. Tagz Foods, an online convenience food brand, was acquired by Reliance Consumer Products for $3.3M.

Three companies went public in 2024 compared to 6 companies in 2023. The companies that attained IPO status in 2024 were Interiors & More, Signoria, and KIZI Apparels.

Bengaluru led the Indian D2C funding sector in 2024 with a total funding of $253M, followed by Gurugram with $164M and Mumbai with $99.8M. Bengaluru and Gurugram accounted for 55% of the total funds raised in this space.

Fireside Ventures, Angel List, and DSG Consumer Partners were the overall top Investors in 2024. Thapar Vision, Fireside Ventures, and Z Nation Lab were the top seed-stage investors. Saama Capital, Unilever Ventures, and Alteria Capital were the top early-stage investors, while Think Investments was one of the top late-stage investors.

India is experiencing a temporary slowdown in the D2C funding space. However, ongoing efforts such as government initiatives and programs, along with continued investor interest in the sector’s potential, are contributing to the sector's continued growth.