Tracxn has released its report on India’s defence technology ecosystem, outlining a transition from fragmented innovation toward an execution-driven capability infrastructure. Defence technology in India is no longer defined by individual platforms, but by integrated systems spanning AI, autonomy, ISR, secure communications, and manufacturing depth. Policy reforms, rising defence budgets, and geopolitical imperatives are positioning defence technology as national infrastructure, linking military readiness, industrial capacity, and long-term economic value.

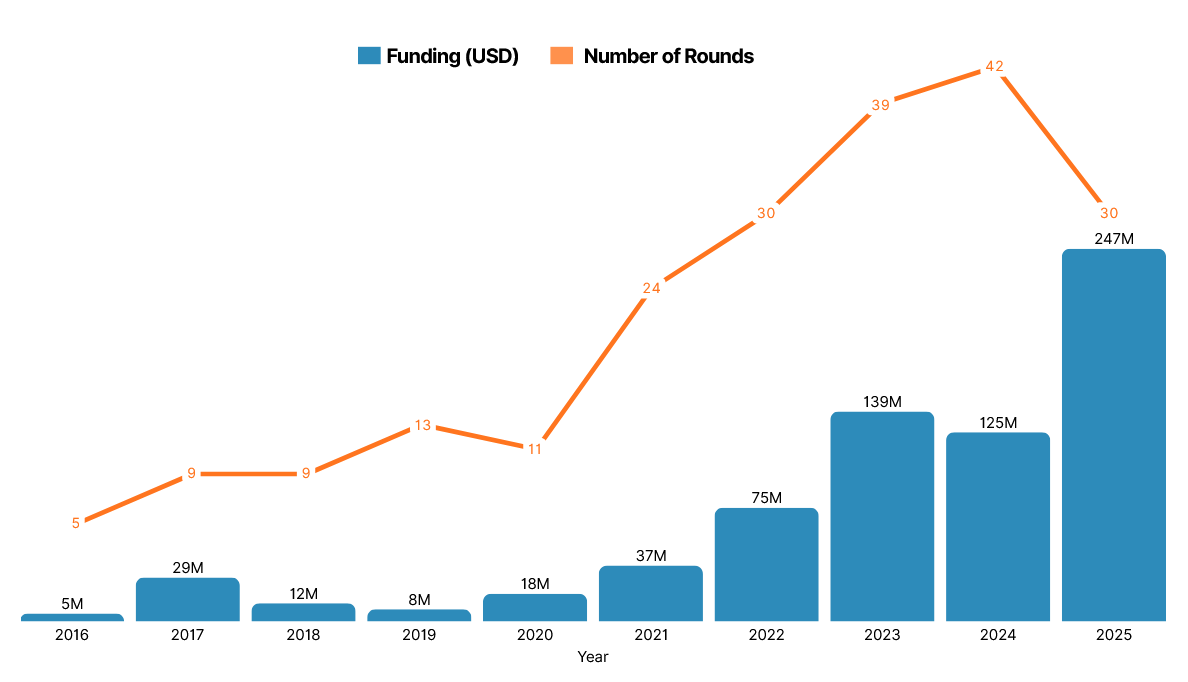

India’s defence tech sector has attracted $711M in all-time equity funding across 232 rounds. Annual funding has risen from $5.0M in 2016 to a peak of $247M in 2025 YTD. Funding increased from $37M in 2021 to $75M in 2022, followed by $139M in 2023, and $125M across 42 rounds in 2024. Despite a lower number of rounds in 2025 YTD (30 rounds), total funding nearly doubled year-over-year, largely driven by Raphe mPhibr’s $100M Series B round. The number of annual funding rounds increased from 5 in 2016 to 42 in 2024, before moderating in 2025 YTD.

As of 2025 YTD, defence tech funding in India remains heavily front-loaded. Seed-stage companies raised approximately $118M across 174 rounds, early-stage companies absorbed $527M across 56 rounds, and late-stage funding totaled $66.0M across just 5 rounds.

Capital distribution across the defence tech value chain shows a strong skew toward infrastructure-oriented segments. Non-Combat Systems attracted $551M, followed by Combat Weapon Systems at $106M, Defence Support and Enablement Systems at $27M, and Training and Simulation Solutions at $27M. Market concentration data shows Non-Combat Systems account for 74% of startups, while Combat Weapon Systems represent 15%, Defence Support and Enablement Systems 6%, and Training and Simulation Solutions 5%.

Exit activity in India’s defence tech ecosystem has remained limited in volume but meaningful in signal, with 5 IPOs since 2010 and 3 acquisitions recorded to date.

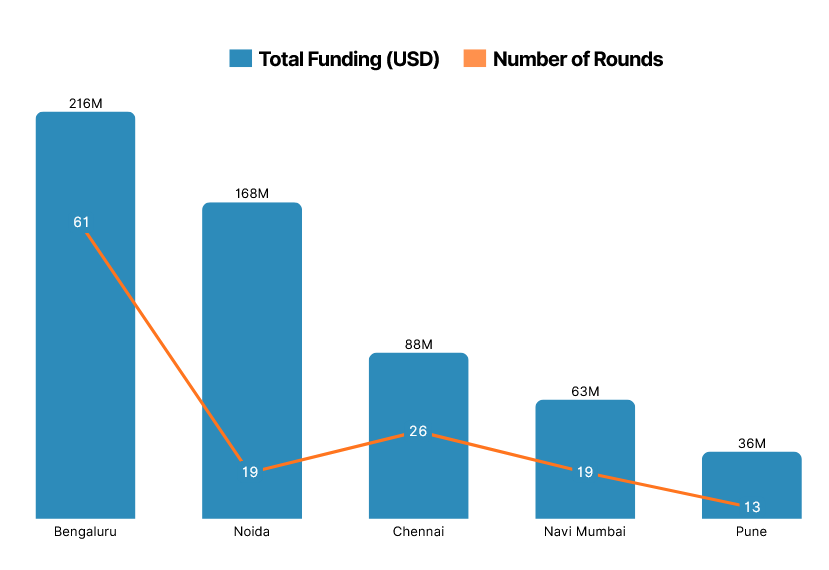

Bengaluru emerged as the most funded city with $216M raised across 61 rounds, followed by Noida with $168M across 19 rounds, and Chennai with $88M across 26 rounds.

Around 116 VC firms have participated in India’s defence tech funding to date. Venture Catalysts emerged as the most active investor with 6 rounds, followed by HDA Tech Growth, Inflection Point Ventures, and Accel with 5 rounds each.

India’s defence tech ecosystem recorded $247M in funding in 2025 YTD, marking its highest annual inflow to date despite a lower number of deals. The dominance of Non-Combat Systems, the emergence of a $100M mega round, and capital concentration among a small set of companies highlight a selective funding landscape. While seed-stage activity remains broad, late-stage funding continues to be limited, reinforcing the ecosystem’s progression toward execution-focused and platform-led defence capabilities.