Tracxn, a leading market intelligence platform, has released its India Tech Annual Funding Report 2025. The proprietary report provides comprehensive insights into the Indian tech ecosystem, highlighting funding activity, sector performance, IPOs, acquisitions, investor participation, major players, and the key trends shaping the sector’s landscape in 2025.

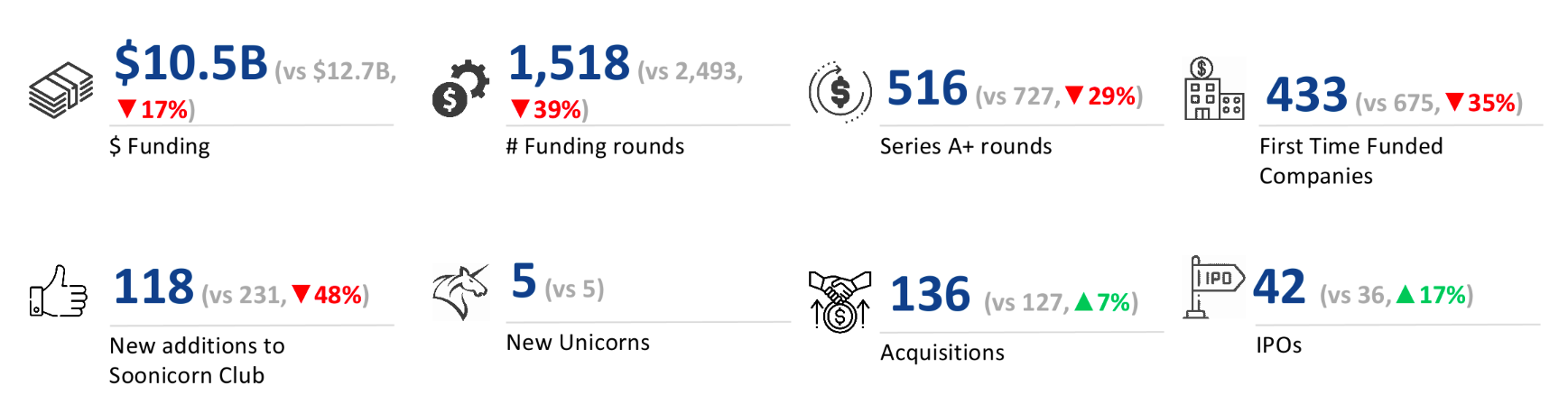

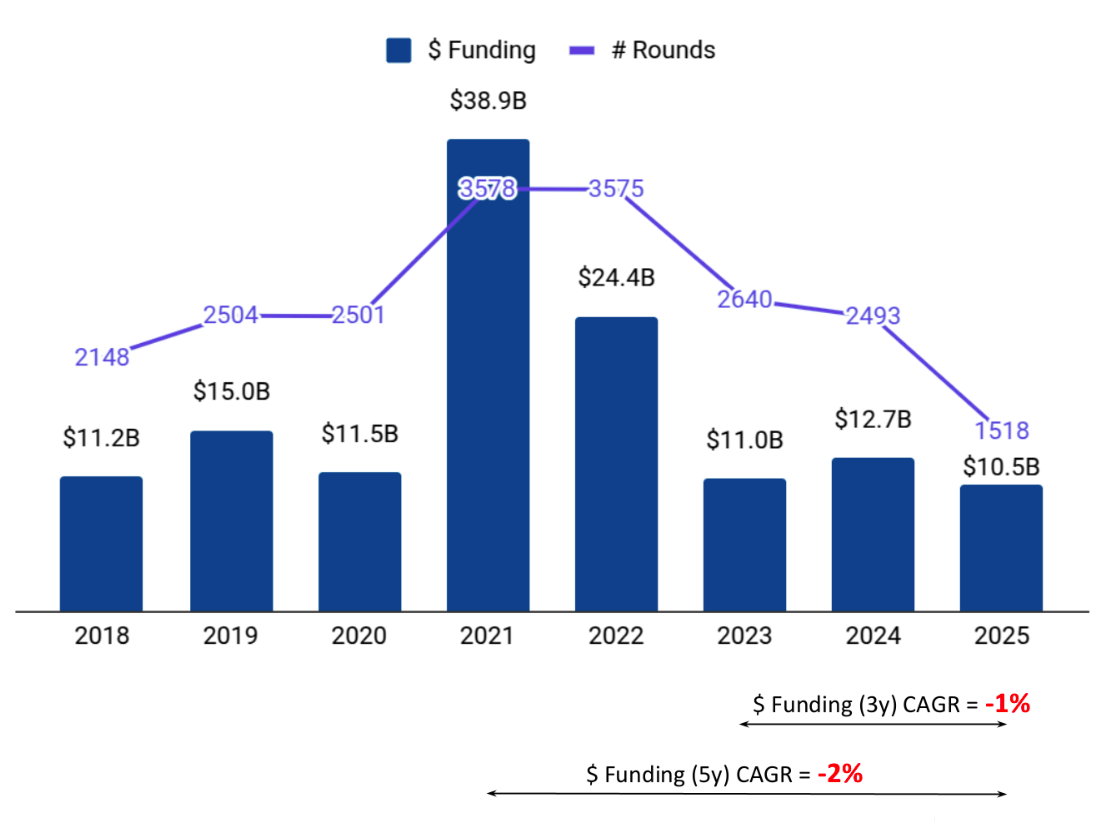

According to the report, India’s tech startups raised $10.5B in 2025, marking a 17% decline from $12.7B in 2024 and a 4% drop compared to $11.0B raised in 2023. Despite the slowdown, India continued to rank as the third-highest funded tech ecosystem globally, behind only the United States and the United Kingdom, and ahead of China and Germany.

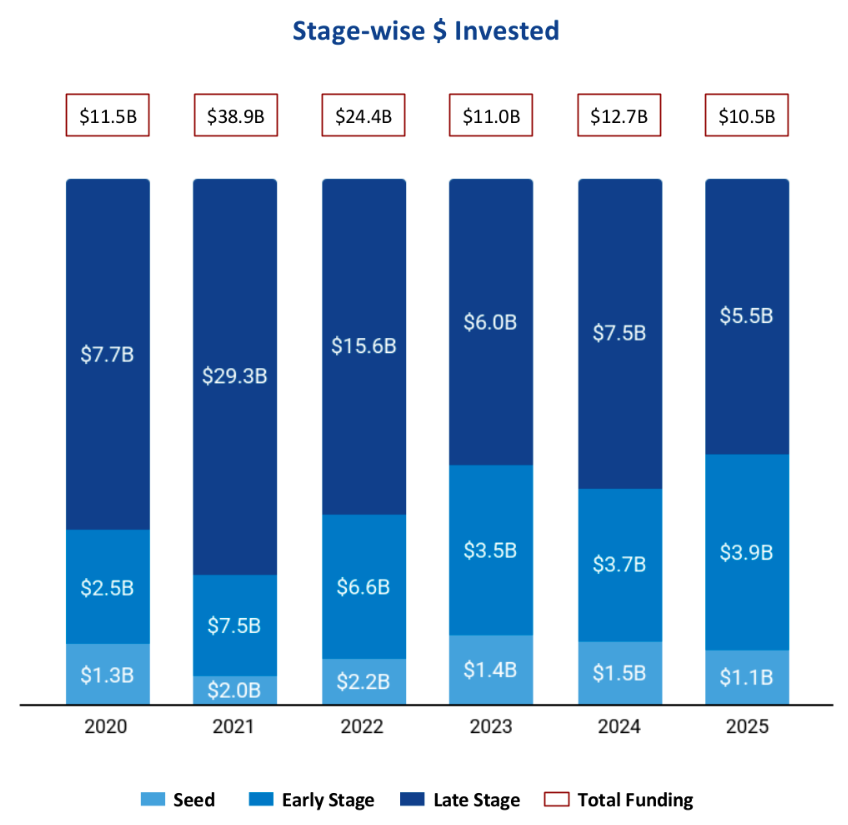

Funding trends varied across stages. Seed-stage witnessed a total funding of $1.1B in 2025, marking a 30% drop from $1.5B raised in 2024 and a 25% decline compared to $1.4B in 2023. Early-stage funding, however, showed resilience, rising to $3.9B in 2025, a 7% increase from $3.7B in 2024 and an 11% rise over $3.5B raised in 2023, indicating sustained investor confidence in scalable, growth-ready startups. Late-stage raised funding of $5.5B, a 26% decline from $7.5B in 2024 and an 8% drop compared to $6.0B in 2023.

Commenting on the insights, Neha Singh, Co-Founder of Tracxn, said, “India’s tech ecosystem continues to demonstrate strong fundamentals and global relevance. While capital deployment has become more disciplined, the sustained momentum in early-stage funding, rising IPO activity, and steady unicorn creation highlight a maturing ecosystem that is increasingly focused on building scalable, high-quality businesses. The growth in exits and continued investor interest across core sectors such as enterprise applications, retail, and fintech reinforce India’s position as one of the world’s most resilient and attractive startup markets.”

Uwin

In 2025, India witnessed 14 funding rounds of $100M+, compared to 19 such rounds in 2024 and 16 in 2023. Large deals were driven primarily by the Transportation & Logistics Tech, Environment Tech, and Auto Tech sectors, with companies raising notable capital including Erisha E Mobility’s $1.0B Series D round, Zepto’s $300M Series H round, and GreenLine’s $275M Series A funding.

Women co-founded tech startups in India, attracted $1.0B in funding in 2025 with notable rounds such as GIVA’s $62M Series C and AMNEX’s $52M Series A. Retail and Enterprise Applications emerged as the top-funded sectors, driven by brand-led execution, strong consumer demand, and enterprise adoption. 33 acquisitions completed during the year. Bengaluru, Mumbai, and Delhi continued to lead women-led startup activity.

The report highlights that Enterprise Applications, Retail, and FinTech emerged as the top-performing sectors in 2025. Enterprise Applications received $2.6B in funding, reflecting a 17% decline compared to $3.2B raised in 2024 and a 12% decrease from $3.0B raised in 2023. Retail secured $2.4B in funding, marking a 17% drop from $2.9B in 2024 and a 21% decline compared to $3.1B raised in 2023. FinTech raised $2.2B in 2025, registering a 5% decline from $2. B in 2024 and a 9% decrease compared to $2.4B in 2023.

In 2025, India Tech recorded 136 acquisitions, marking a 7% increase compared to 127 acquisitions in 2024, though an 11% decline from 153 acquisitions in 2023. The largest deal was Resulticks’ $2.0B acquisition by Diginex, making it the highest-valued acquisition of the year, followed by Magma General Insurance’s $516M acquisition by DS Group and Patanjali Ayurved.

On the exit front, India Tech recorded 42 IPOs in 2025, marking a 17% increase over 36 IPOs in 2024 and a 62% rise compared to 26 IPOs in 2023. Major IPOs during the year included Meesho, Aequs, and Ravel.

There were 5 unicorns created in 2025, same as compared to 2024, and a rise of 150% compared to 2 in 2023.

City-wise, Bengaluru accounted for 32% of total funding, maintaining its position as India’s leading startup hub, followed by Mumbai with 18% of total funding.

Inflection Point Ventures, Venture Catalysts, and Antler emerged as the top seed-stage investors in 2025. Peak XV Partners, Accel, and Elevation Capital led early-stage investments, while Sofina, SoftBank Vision Fund, and Mars Growth Capital were the most active investors at the late stage.

Data from 01-Jan-2025 to 15N8-Dec-2025 is considered in report