Tracxn, a leading market intelligence platform, has released its Geo Quarterly India Tech Report. The report provides key insights into India's technology ecosystem, highlighting notable trends and developments in the first quarter of 2025.

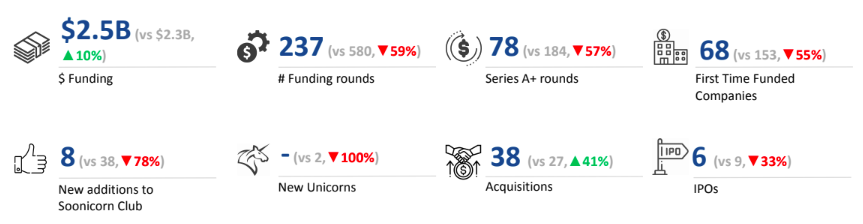

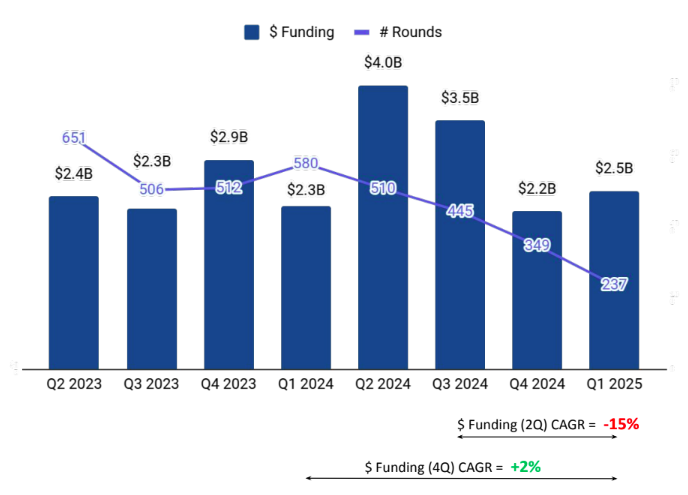

In Q1 2025, India's tech startups raised $2.5B, marking a 13.64% increase from the previous quarter and an 8.7% rise from the same period last year, making it the third most-funded country globally ahead of Malta and Germany and behind the US and UK.

Out of the $2.5B in funding, three startups Erisha E Mobility, Darwinbox and Infra Market received funding of over $100M each as compared to three such rounds in Q4 2024 and 2 in Q1 2024.

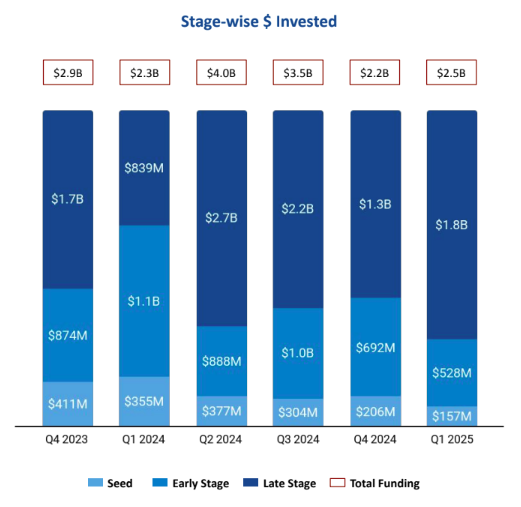

This quarter saw shifting funding dynamics in the tech ecosystem, with varied trends emerging across different stages of investment. Late Stage witnessed a total funding of $1.8B in Q1 2025, an increase of 38.46% compared to $1.3B raised in Q4 2024, and an increase of 114.54% compared to $839M raised in Q1 2024. Seed Stage saw a total funding of $157M in Q1 2025, a drop of 23.79% compared to $206M raised in Q4 2024, and a drop of 55.77% compared to $355M raised in Q1 2024. Early Stage saw a total funding of $528M in Q1 2025, a drop of 23.70% compared to $692M raised in Q4 2024, and a drop of 52% compared to $1.1B raised in Q1 2024.

Speaking at the launch of their report, Neha Singh, Co-Founder of Tracxn, said, "While the funding environment remains dynamic, India’s startup ecosystem continues to demonstrate adaptability and growth. Key sectors like Auto Tech, Enterprise Applications, and Retail are attracting investor interest, and the rise in acquisitions signals a maturing market. Innovation and entrepreneurship remain at the core of this ecosystem, positioning India for long-term success.”

The report highlights that Auto Tech, Enterprise Applications and Retail were the top-performing sectors in Q1 2025. Auto Tech received funding of $1.1B, which was an increase of 403.35% compared to $214.6M raised in Q4 2024 and an increase of 339.71% compared to $245.7M raised in Q1 2024. Enterprise Applications received $650.7M, a growth of 21.94% compared to $533.6M raised in the previous quarter and a drop of 8.12% compared to $708.2M raised in Q1 2024. and Retail received $481.5M in funding, marking a 21.67% increase from the last quarter’s $395.8M and a drop of 2.30% when compared to $492.9M raised in Q1 2024.

There were 6 companies that went IPO in Q1 2025, Nukleus, Maxvolt Energy, Volercars, and Harshil Agrotech were among the companies that went public. There were no unicorns created in Q1 2025 as against 2 created in Q1 2024.

A total of 38 acquisitions took place this quarter, marking a 15.15% increase from the previous quarter and a 40.74% rise from 27 acquisitions in Q1 2024. The largest deal was Magma General’s $516M acquisition by DS Group and Patanjali Ayurved, making it the highest-valued acquisition of Q1 2025, surpassing Minimalist’s $350M acquisition by HUL.

Delhi-based tech firms accounted for 40% of all funding seen by tech companies across India. This was followed by Bengaluru accounting for 21.64%.

Accel, Blume Ventures and Peak XV Partners were the overall all-time top investors for Q1 2025. Venture Catalysts, Unicorn India Ventures and YourNest were the top seed-stage investors, while Avataar Ventures and Sofina were the top late-stage investors. Accel, Peak XV Partners and Vertex Ventures were the top early-stage investors this quarter.

The Indian tech startup ecosystem demonstrated resilience and adaptability in Q1 2025, with a notable increase in funding and acquisitions. The growth of key sectors like Auto Tech, Enterprise Applications, and Retail underscores the ecosystem's potential for long-term success. As the ecosystem continues to evolve, it will be important to monitor trends and developments in the coming quarters.