Tracxn, a leading market intelligence platform, has unveiled its India Tech Semi-Annual Funding Report H1 2024. The report provides valuable information on funding trends, sector performances, and notable developments in the Indian technology sector for the half of 2024.

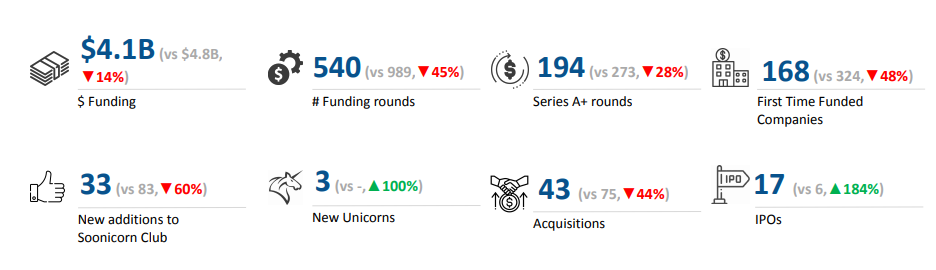

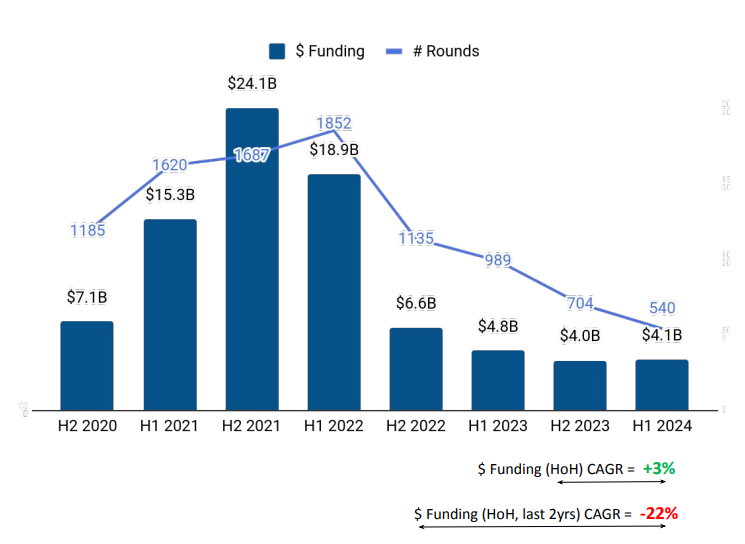

According to the report, Indian tech startups raised $4.1 billion in H1 2024, a 4% increase from $3.96 billion in H2 2023. Though there was a 13% decrease compared to $4.8 billion raised in H1 2023, India still remains the fourth-highest funded country globally in the tech startup landscape. The United States led in overall funding volumes, followed by the UK and China.

Commenting on the findings of their report, Neha Singh, Co-Founder, Tracxn, said, “Despite four consecutive half-year periods of declining funding since H1 2022, we are now showing signs of stabilization, going upward. India’s robust performance as the fourth-highest funded country in the tech startup ecosystem is encouraging. From emerging developments in Retail and Enterprise Applications to pioneering advancements in fintech, Indian startups are transforming industries and driving economic growth.”

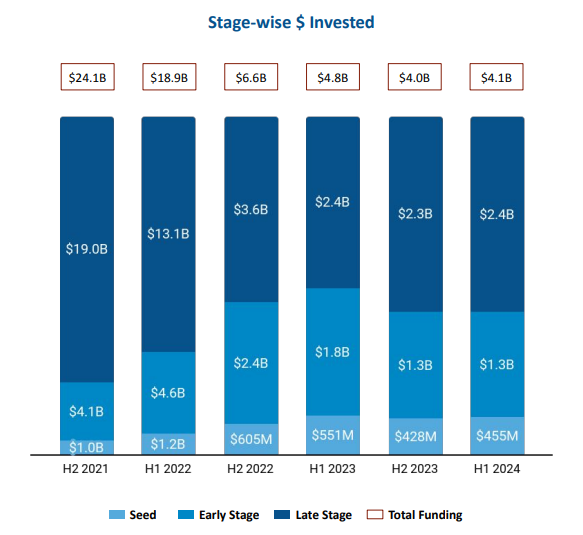

The funding landscape across different stages showcased varied trends: Seed-stage funding increased to $455 million, up by 6.5% from H2 2023 but down 17.3% from H1 2023. Early-stage startups maintained a steady funding amount of $1.3 billion, consistent with H2 2023 but 28% lower than H1 2023. Late-stage funding rose to $2.4 billion, marking a 3.8% increase from H2 2023, although it saw a slight 1.3% drop compared to H1 2023.

Despite these challenges, the first half of 2024 witnessed 8 funding rounds surpassing $100 million such as Flipkart’s $350 million Series J round led by Google, Apollo 24|7’s $297 million PE round, and Meesho’s $275 million Series F round.

The leading sectors in terms of performance in H1 2024 were Retail, Enterprise Applications, and FinTech. Funding in the Retail sector increased by 32%, reaching $1.63 billion in H1 2024 compared to $1.23 billion in H1 2023. The Enterprise Application sector raised $933 million in H1 2024, a 10% decrease from the $1.04 billion raised in H1 2023. In the FinTech space, funding dropped by 50%, from $1.45 billion in H1 2023 to $726 million in H1 2024.

In H1 2024, 3 unicorns emerged, a notable rise from none in H1 2023, alongside 33 new additions to the Soonicorn club. The number of IPOs also rose to 17 in H1 2024, from 6 in H1 2023 and 12 in H2 2023. Some of the top companies that went public were TBO, TGIF Agribusiness, Radiowalla and Trust Systems & S/w. Acquisitions in the Indian startup ecosystem saw a decline, with 43 acquisitions in H1 2024, compared to 75 acquisitions in H1 2023. Notable acquisitions included PingSafe, being acquired by SentinelOne for $100M, marking the highest valued acquisition in H1 2024, followed by PureSoftware acquired by Happiest Minds for $94.5M.

Bangalore emerged as the leader in total funds raised during this period, followed by Delhi and Mumbai.

The overall top investors in H1 2024 were Accel, Blume Ventures and Peak XV Partners. In the seed stage, Venture Catalyst, Z Nation Lab and We Founder Circle were the top investors. Peak XV Partners, Alpha Wave Global and Saama Capital are the most active early stage investors in H1 2024. DST Global, Epiq Capital Advisors and UC-RNT Fund are the leading investors actively involved in late-stage investments in H1 2024.