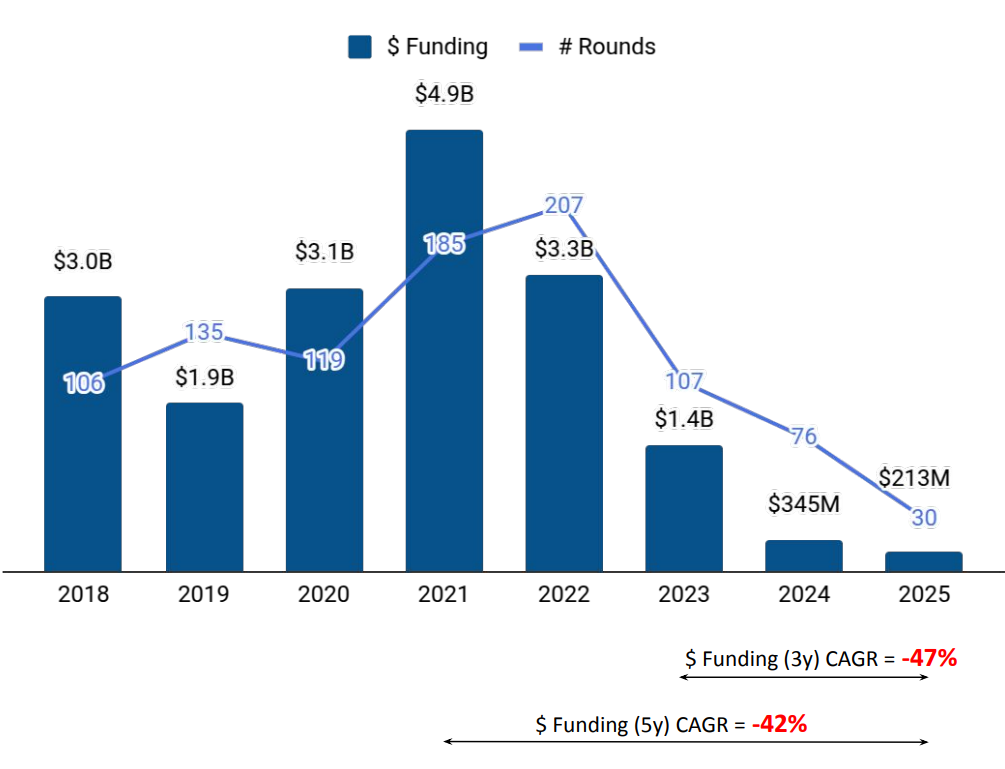

Tracxn has released its insights on the Indonesia Tech ecosystem for the year 2025, highlighting funding activity, sectoral performance, exits, acquisitions, and investor participation during the period. The data indicate a notable contraction in overall capital inflows into Indonesia’s tech ecosystem, with funding levels declining sharply compared to both 2024 and 2023, alongside reduced activity across most stages and deal types.

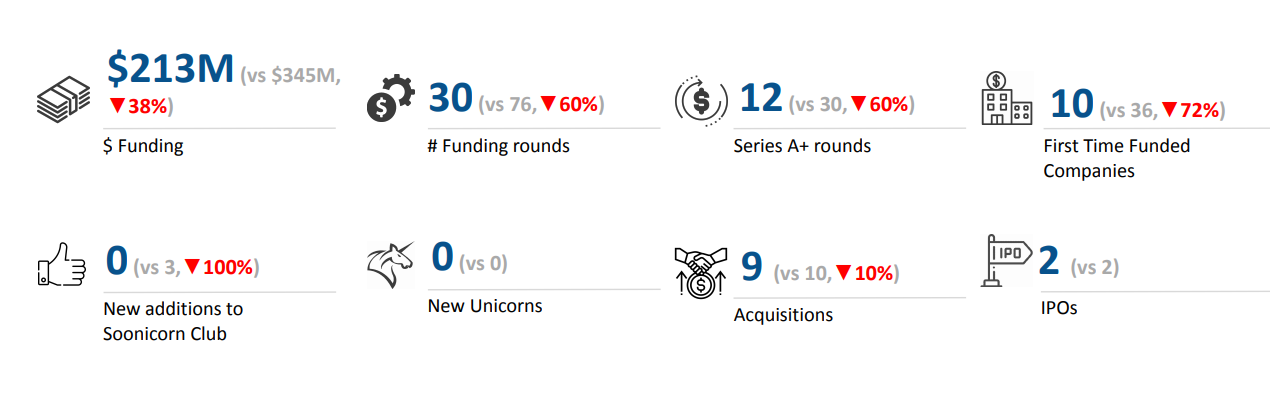

A total of $213M was raised by tech companies in Indonesia in 2025, representing a 38% drop compared to the $345M raised in 2024 and an 85% decline from the $1.4B raised in 2023. This reflects a year marked by lower aggregate funding levels across the ecosystem when compared to the previous two years.

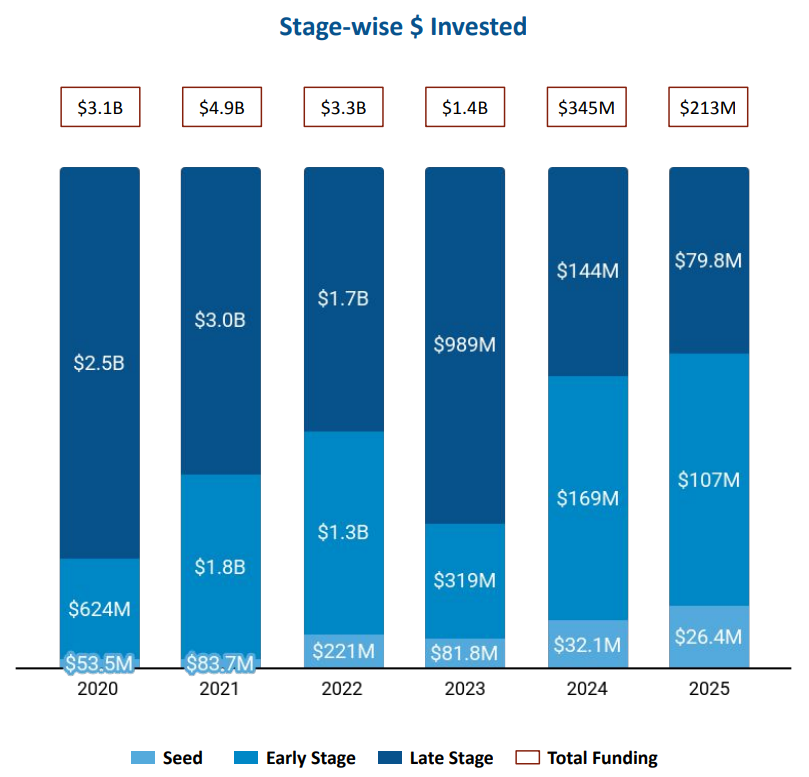

Seed-Stage funding in Indonesian tech stood at $26.4M in 2025, reflecting an 18% decrease compared to the $32.1M raised in 2024 and a 68% decline from the $81.8M raised in 2023. Early-stage funding totaled $107M in 2025, marking a 37% drop from $169M in 2024 and a 67% decline compared to $319M in 2023. Late-stage funding amounted to $79.8M in 2025, which was 45% lower than the $144M raised in 2024 and 92% lower than the $989M raised in 2023.

Food and Agriculture Tech, Retail, and Energy Tech emerged as the top-performing sectors in Indonesia Tech during 2025. The Food and Agriculture Tech sector raised $70.6M in 2025, representing a 72% increase compared to $41M raised in 2024, while still recording a 75% decrease compared to the $280M raised in 2023. The Retail sector attracted $49M in 2025, an increase of 207% from the $16M raised in 2024, and a 70% decline compared to the $163M raised in 2023. Energy Tech recorded $44.8M in funding in 2025, which was a 51% decrease compared to the $90.8M raised in 2023, with no funding activity recorded in 2024.

Indonesia Tech recorded 2 IPOs in 2025, the same number as in 2024 and a 60% decline from the 5 IPOs recorded in 2023. Superbank and Nusatrip were the companies that went public during the year. Indonesia-Tech in 2025 saw no $100M+ funding rounds and no new unicorns created during the period.

Tech companies in Indonesia recorded 9 acquisitions in 2025, reflecting a 10% drop compared to the 10 acquisitions in 2024 and a 36% decline from the 14 acquisitions completed in 2023. Among the disclosed transactions, Gaji Gesa was acquired by Kredivo for $12M.

Jakarta-based tech firms captured almost all of the funding raised by tech companies across Indonesia in 2025, underscoring the city’s dominant position in attracting investment within the country’s tech ecosystem.

Iterative, East Ventures, and Antler emerged as the top seed-stage investors in the Indonesian tech ecosystem in 2025. At the early stage, Acrew Capital, Genting Ventures, and Altos Ventures Management were the most active investors. DST Global led late-stage investments in Indonesia Tech during the year.

The Indonesian Tech ecosystem in 2025 recorded a significant reduction in overall funding, with capital deployment declining across seed, early, and late stages compared to both 2024 and 2023. Food and Agriculture Tech, Retail, and Energy Tech stood out as the leading sectors by funding, while Jakarta continued to dominate as the primary hub for investment activity. Exit activity remained steady year-over-year in terms of IPO count, even as acquisitions declined, and investor participation remained concentrated among a defined set of active firms across stages.