Tracxn, a leading global SaaS-based market intelligence platform, has released its Geo Semi-Annual Report: Indonesia Tech H1 2024. The report, based on Tracxn’s extensive database, provides insights into the Indonesia Tech space.

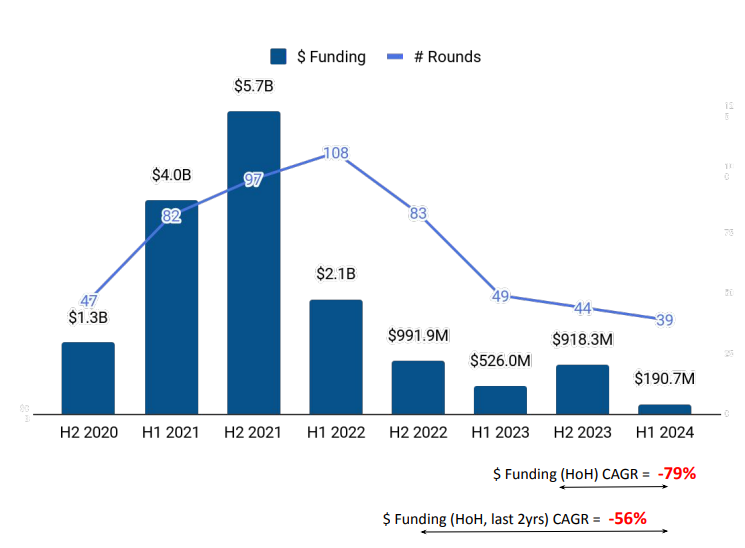

In the dynamic landscape of Indonesia's tech startup ecosystem, H1 2024 has been marked by notable shifts in funding and market activities, according to Tracxn’s recent in-depth analysis.

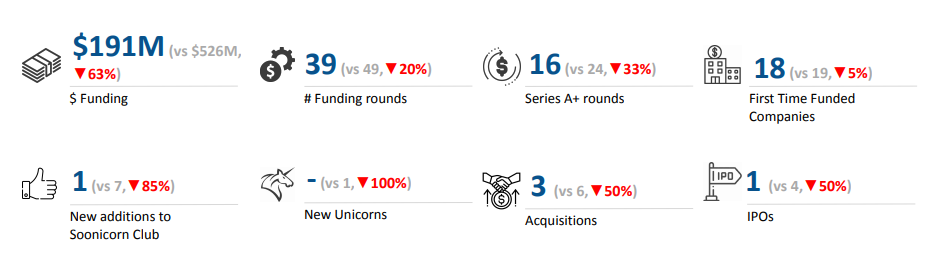

Indonesia, ranking 29th globally in funding as of H1 2024, has demonstrated resilience amidst global economic challenges. The total funding raised by the Indonesia Tech startup ecosystem amounted to $191 million in the first half of 2024. This reflects a 79% decline compared to the $918.3 million raised in H2 2023 and a 64% decrease from $526 million in H1 2023, underscoring the evolving investment climate.

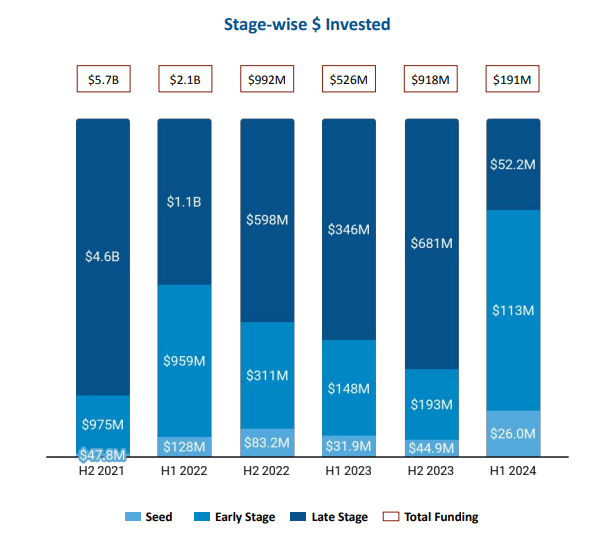

Funding at various stages showed distinct patterns. Seed-stage funding reached $26 million, experiencing a 42% decline from $45 million in H2 2023 and a 27% decrease from the $32 million raised in H1 2023. Early-stage funding witnessed $113 million, marking a 42% drop from $148 million raised in H1 2023, while late-stage investments stood at $52.2 million, showing a significant 92% decrease from the $681 million raised in the latter half of 2023, highlighting a cautious investor sentiment in later-stage ventures.

Sector-wise, FinTech, InsurTech and Enterprise Applications emerged as the top-performing sectors in H1 2024, indicating strategic growth areas within the industry. Despite these sector successes, the ecosystem saw no new unicorns in H1 2024, in contrast to the creation of one unicorn in the same period last year.

Fintech startups in Indonesia raised $128 million in the first half of 2024, a 61% plunge from $329 million raised in H1 2023. The Enterprise Applications witnessed a 56% decline in funding, to $45.1 million in H1 2024 from $104 million in H1 2023. However, the Insurtech space saw a huge surge in funding, from $7.5 million in H1 2023 to $47 million in H1 2024.

H1 2024 saw a decline in acquisitions and IPO activity compared to the previous year. Three acquisitions took place, including DycodeX, AyoPajak, and Lifepal, down from six each in H1 2023 and H2 2023. Topindoku was the only company to go public in H1 2024, showcasing a subdued IPO market during this period. This is lower than the four IPOs that took place in H1 2023.

Jakarta took the lead in terms of city-wise funding in the first half of 2024, followed by Yogyakarta and Bandung, demonstrating the diverse regional growth within the Indonesian startup ecosystem. Tech startups based in Jakarta raised $185 million, far ahead of those based in Yogyakarta ($3.5 million) and Bandung ($2.5 million).

East Ventures, AC Ventures, and Alpha JWC Ventures maintained their status as the top investors in the overall Indonesia Tech ecosystem, while East Ventures, Insignia Ventures Partners, and Beenext emerged as the top investors specifically for H1 2024. In the early-stage investments, Peak XV Partners, Vertex Ventures, and Shunwei Capital led the funding activities, with MUFG Innovation Partners emerging as the top investor in late-stage startups.

Sports

Despite challenges, Indonesia's tech startup ecosystem remains vibrant and adaptive, supported by strategic investments and sectoral diversification.