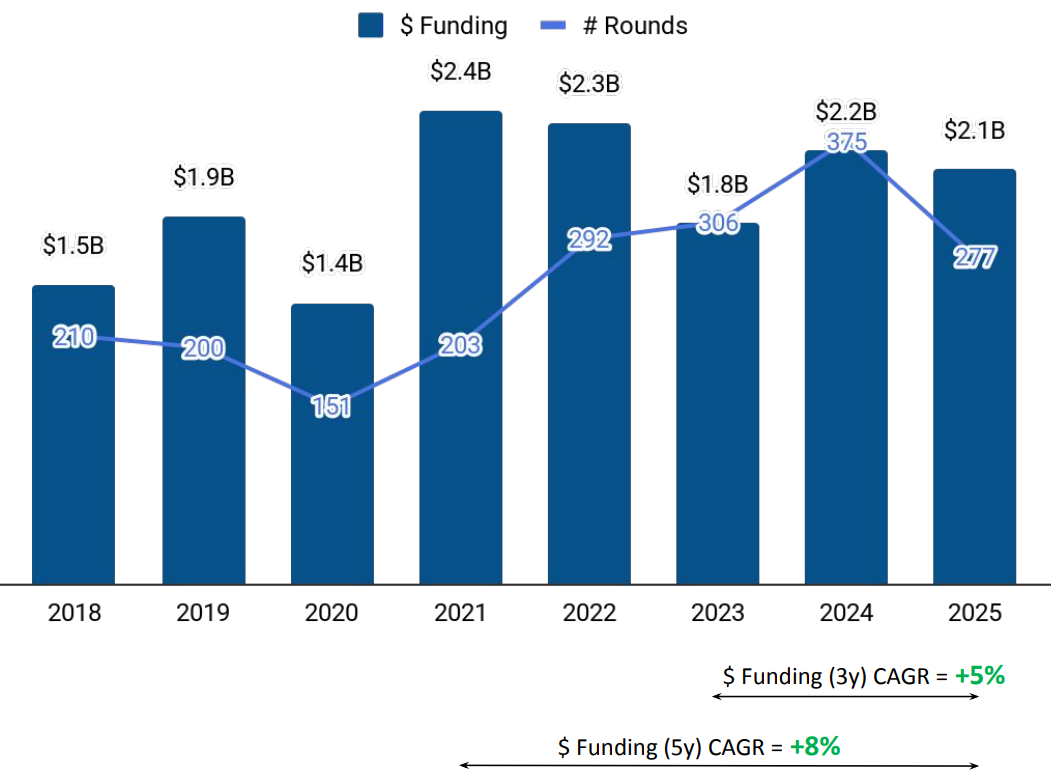

Tracxn has released its insights on the Japan Tech ecosystem for the year 2025, outlining funding activity, sector performance, deal trends, and investor participation. The data highlights how Japan’s tech funding landscape evolved during 2025, capturing shifts across stages, sectors, cities, and exits. While overall funding moderated compared to the previous year, activity remained above 2023 levels, supported by growth in early-stage investments and an increase in large funding rounds.

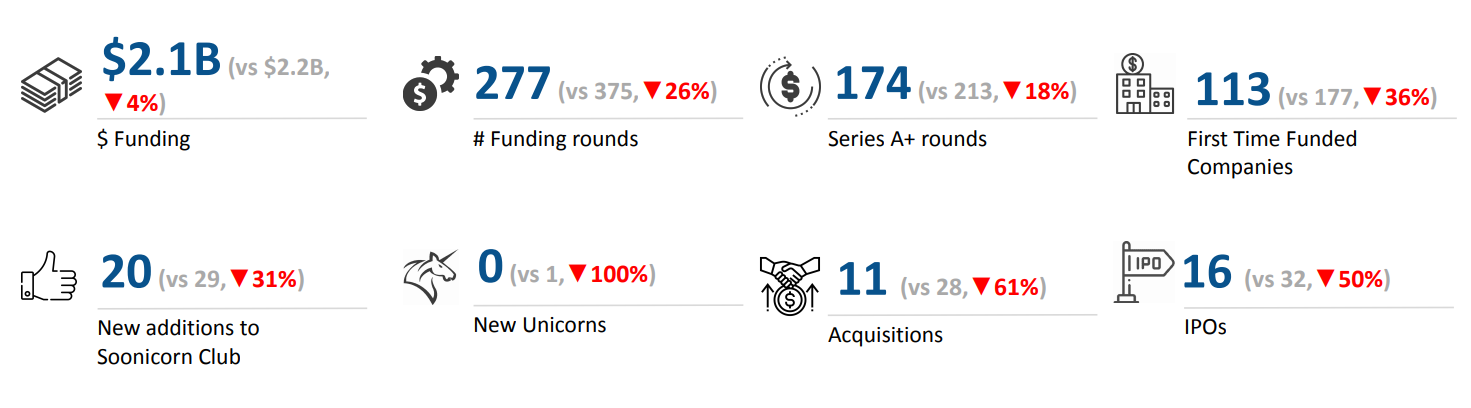

A total of $2.1B was raised by tech companies in Japan in 2025. This represents a drop of 4% compared to the $2.2B raised in 2024, while marking a rise of 15% compared to the $1.8B raised in 2023. The funding data reflects year-on-year variation, with capital deployment remaining higher than 2023 despite a marginal decline from 2024 levels.

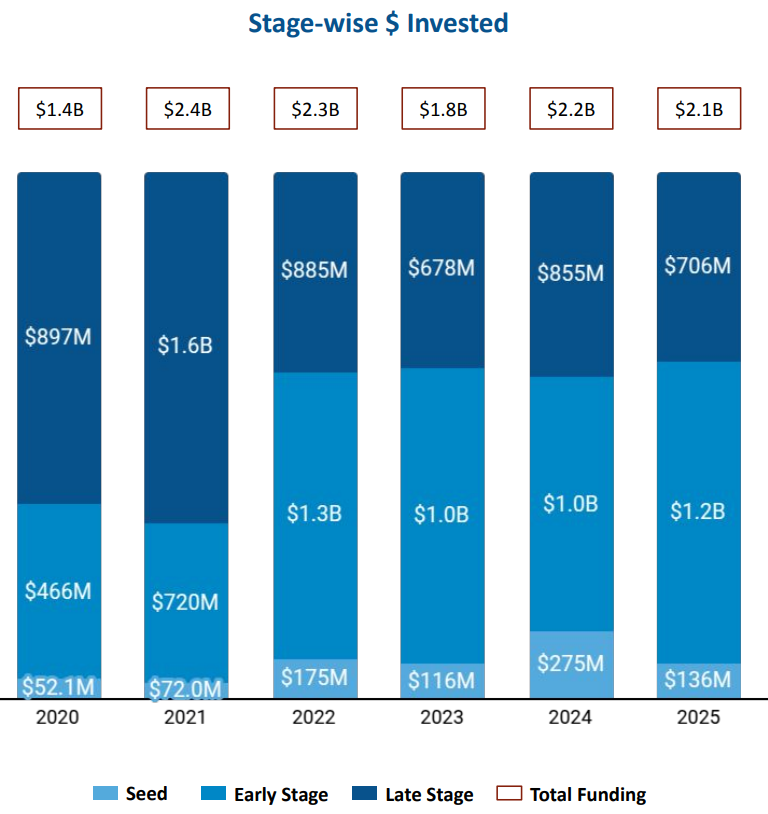

Seed Stage saw a total funding of $136M in 2025, a drop of 50% compared to $275M raised in 2024, and a rise of 17% compared to $116M raised in 2023. Early Stage recorded a total funding of $1.2B in 2025, a rise of 20% compared to $1B raised in 2024 and in 2023 each. Late Stage funding stood at $706M in 2025, a drop of 18% compared to $855M raised in 2024, and a rise of 4% compared to $678M raised in 2023.

Enterprise Applications, Industrial Goods and Manufacturing, & Aerospace, Maritime and Defense Tech emerged as the top-performing sectors in 2025. The Enterprise Applications sector recorded $988M in total funding in 2025, reflecting a marginal decline of less than 1% from the $991M raised in 2024, while posting a 56% increase over the $635M raised in 2023. The Industrial Goods and Manufacturing sector recorded total funding of $255M in 2025, an increase of 323% compared to $60.3M raised in 2024 and an increase of 97% compared to $129M raised in 2023. Aerospace, Maritime, and Defense Tech saw total funding of $223M in 2025, which is an increase of 91% compared to $117M raised in 2024 and a decrease of 3% compared to $231M raised in 2023.

The year 2025 witnessed 4 $100M+ funding rounds, compared to 3 such rounds in 2024 and 2 such rounds in 2023. Companies such as Sakana, Mujin, and EdgeCortix raised funding above $100M during this period. Sakana raised a total of $135M through a Series B round, Mujin raised a total of $133M through a Series D round, and EdgeCortix raised a total of $110M through a Series B round. A major part of the $100M+ funding rounds came from Enterprise Applications, Industrial Goods and Manufacturing, & Semiconductors.

Unicorn formation remained subdued in 2025, with zero new unicorns, following one in 2024 and none in 2023. Japan Tech recorded 16 IPOs in 2025, down 50% from 32 in 2024 and down 27% from 22 in 2023. Hutzper, PRONI, and PowerX were among the companies that went public in 2025.

Japan Tech saw 11 acquisitions in 2025, which is a drop of 61% compared to 28 acquisitions in 2024 and a drop of 45% compared to 20 acquisitions in 2023. Shibaura Electronics was acquired by Yageogroup at a price of $742M, making it the highest-valued acquisition in 2025. This was followed by the acquisition of IndyGo by NCSoft at a price of $104M.

Tokyo-based tech firms accounted for 39% of all funding received by tech companies across Japan in 2025. Chuo City followed with 14% of the total funding. These cities represented the largest share of capital inflow within the Japan Tech ecosystem during the year.

Global Brain, East Ventures, and Incubate Fund emerged as the top seed-stage investors in the Japan Tech ecosystem for 2025. Mitsubishi UFJ Capital, SMBC Venture Capital, and Keio Innovation Initiative were the most active early-stage investors during the year. Daiwa House Ventures led late-stage investments in the Japan Tech ecosystem in 2025.

The Japan Tech ecosystem recorded $2.1B in funding during 2025, reflecting a slight year-on-year decline while remaining above 2023 levels. Early-stage funding growth and an increase in $100M+ rounds supported overall activity, alongside strong performance from Enterprise Applications, Industrial Goods and Manufacturing, & Aerospace, Maritime and Defense Tech sectors. Although IPO and acquisition activity declined and no new unicorns were created, large funding rounds, sectoral momentum, and sustained investor participation continued to shape the ecosystem in 2025.