Tracxn, a leading global SaaS-based market intelligence platform, has released its Annual Report: Japan Tech Annual Report 2024. Based on Tracxn’s extensive database, the report provides insights into the Japanese Tech space.

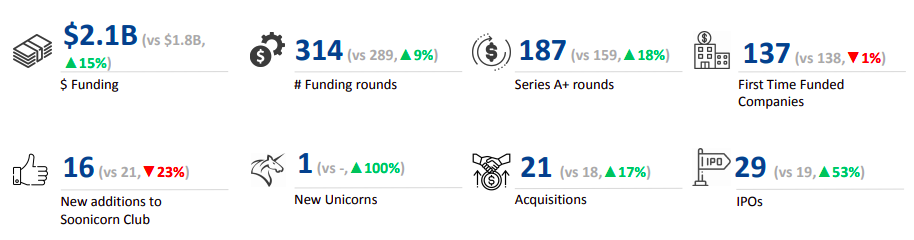

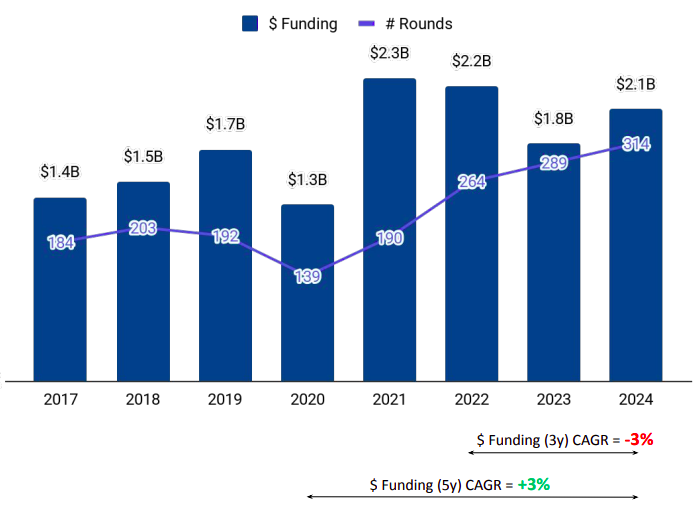

N8In 2024, Japanese tech startups raised $2.1 billion in funding, representing a 15% increase from the $1.8 billion secured in 2023 and a marginal 5% drop compared to the $2.2 billion raised in 2022.

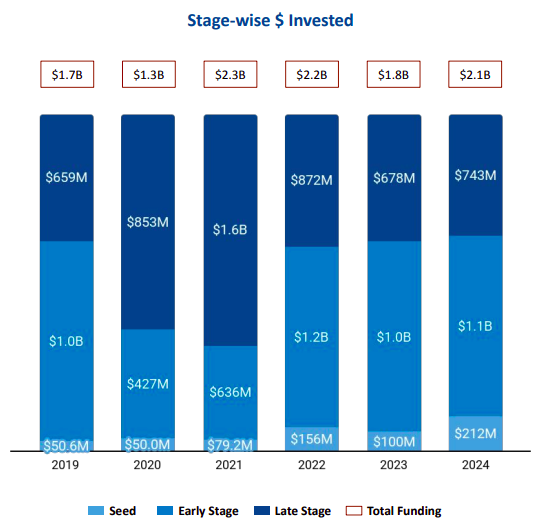

Stage-wise Investment Trends

● Late-Stage Funding: Late-stage investments surged to $743 million in 2024, marking a 10% increase compared to $678 million in 2023.

● Seed-Stage Funding: Seed-stage investments increased by 112%, growed to $212 million in 2024 from $100 million in 2023.

● Early-Stage Funding: Early-stage funding experienced a 10% increase, totaling $1.1 billion in 2024, compared to $1 billion in 2023.

Sectoral Performance

Top-performing sectors in 2024 included Enterprise Applications, Environment Tech, and Auto Tech:

● Enterprise Applications: Funding increased by 77% compared to 2023 and 30% compared to 2022.

● Environment Tech: Funding rose by 51% compared to 2023, similar growth of 52% was observed compared to 2022.

● Auto Tech: Funding increased by 115% in 2024 relative to 2023, and a marginal growth of 6% compared to 2022.

Top cities leading the landscape

● Tokyo-based tech firms accounted for 28% of all funding raised by Japanese tech companies, leading the continent.

● Minato City followed closely, contributing 18% of the total funding.

Leading Investors

Mitsubishi UFJ Capital, SMBC Venture Capital, and Global Brain emerged as the top investors in the Japanese tech ecosystem, actively supporting startups across various stages.

Mergers & Acquisitions

The Japanese tech ecosystem recorded 21 acquisitions in 2024, up from 18 in 2023. Notable deals include:

● Coin Master’s acquisition by Gate.io, KADOKAWA’s acquisition by Sony and Mikai’s acquisition by 17LIVE are some of the acquisitions that occurred in 2024.

This data underscores the evolving dynamics of the Japanese tech ecosystem, reflecting both growth opportunities and challenges across different funding stages, sectors, and regions.