Tracxn has released its Japan Tech - 9M 2025 Funding Report, detailing funding activity across Japan’s technology ecosystem. The report highlights a slowdown in overall investment activity compared to previous years, with notable declines across most stages and fewer large-ticket deals. Despite the overall contraction, select sectors such as FinTech and Aerospace, Maritime & Defense Tech experienced growth in funding volumes.

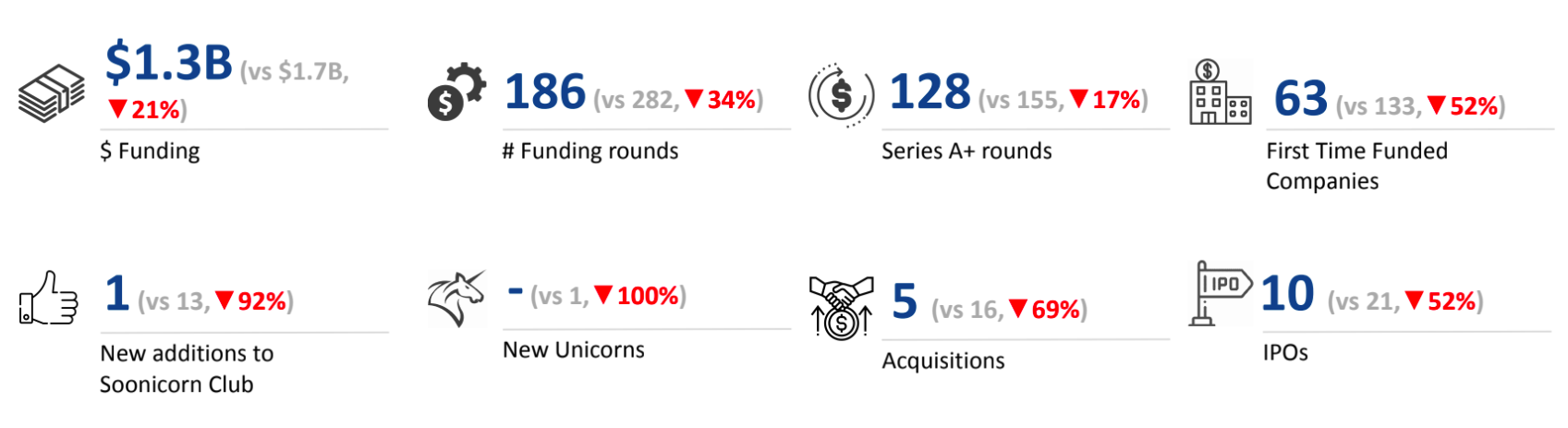

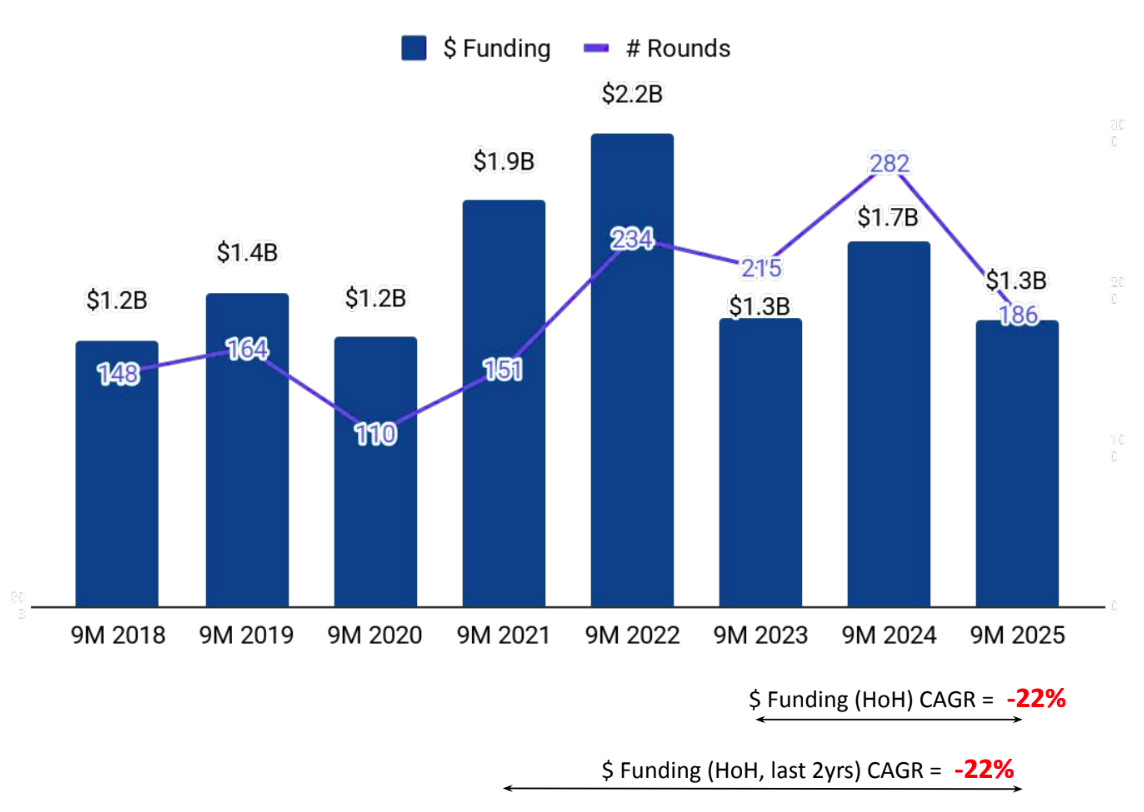

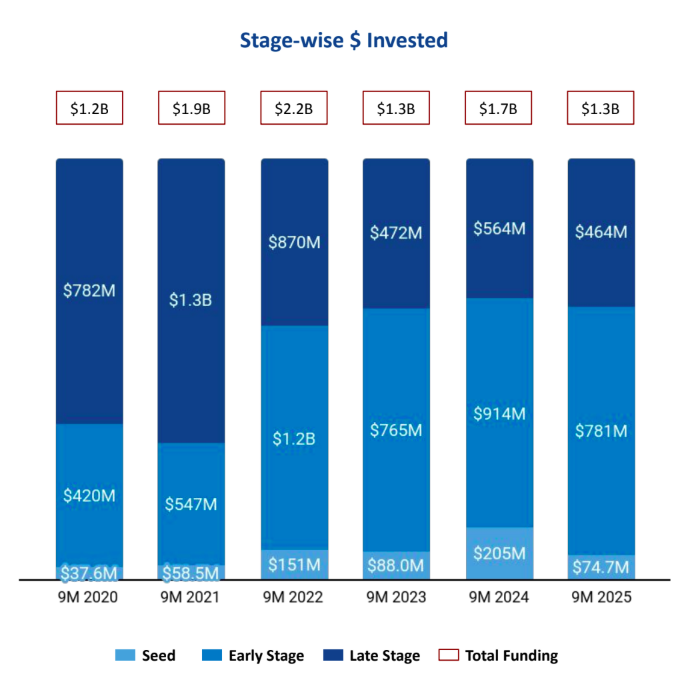

Japan’s tech sector raised a total of $1.3B in 9M 2025, marking a 21% decline compared to $1.7B in 9M 2024, and remaining at the same level as in 9M 2023. Despite the overall drop, the ecosystem maintained stability, supported by consistent activity across key sectors that helped sustain investor engagement through the period.

Sports

The top-performing sectors in Japan during 9M 2025 were Enterprise Applications, FinTech, and Aerospace, Maritime & Defense Tech. Enterprise Applications led with $477M in funding, marking a 49% decline from $931M in 9M 2024 and a 5% drop compared to $500M in 9M 2023. FinTech followed with $198M raised, registering a sharp 135% increase from $84.2M in 9M 2024 and a 33% rise compared to $149M in 9M 2023. The Aerospace, Maritime & Defense Tech sector also saw notable growth, attracting $195M in 9M 2025 up 137% from $82.3M in 9M 2024 and 11% higher than $175M in 9M 2023.

Japan recorded only one $100M+ funding round in 9M 2025, compared to three such rounds in 9M 2024 and the same number as in 9M 2023. LayerX was the sole company to secure funding above the $100M mark during this period, raising $100M in a Series B round.

Japan Tech recorded 10 IPOs in 9M 2025, down 52% from 21 in 9M 2024 and 33% from 15 in 9M 2023. Companies such as Axelspace, Fuller, Digital Grid, and Dynamic Map Platform went public during the period. There were no new unicorns created in 9M 2025, compared to one in 9M 2024 and none in 9M 2023.

Tech companies in Japan recorded five acquisitions in 9M 2025, representing a 69% drop compared to 16 in 9M 2024 and a 64% drop compared to 14 in 9M 2023. Strainer was acquired by Ateam Entertainment Inc. at a price of $1.7M, making it the highest-valued acquisition during the period. Other notable deals included the acquisitions of Mitsubishi Electric Insurance Service, KYODAI REMITTANCE, Coinbook, and Polarify.

Tokyo-based tech firms accounted for 22% of all funding raised by tech companies in Japan, followed by Chuo City with 14% of the total funding. These two cities together represented a significant share of Japan’s total tech investment activity during the period.

Investor participation in Japan’s tech ecosystem spanned multiple stages in 9M 2025. Global Brain, East Ventures, and UTokyo Innovation Platform were the most active investors at the seed stage, supporting early innovation and startup formation. At the early stage, Mitsubishi UFJ Capital, SMBC Venture Capital, and Keio Innovation Initiative led growth-oriented investments. Meanwhile, Daiwa House Ventures emerged as the key late-stage investor, backing mature companies during the period.

The Japan tech ecosystem experienced a contraction in 9M 2025, with a 21% drop in overall funding and fewer large-ticket deals compared to 2024. While funding declined across stages, FinTech and Aerospace, Maritime & Defense Tech sectors recorded notable growth, offsetting part of the slowdown in Enterprise Applications. Tokyo and Chuo City remained the leading hubs for funding, while a sharp decline in IPOs and acquisitions marked a more selective investment landscape. Despite subdued momentum, activity from top investors such as Global Brain, East Ventures, and Mitsubishi UFJ Capital continued to support early-stage innovation in Japan’s tech ecosystem.